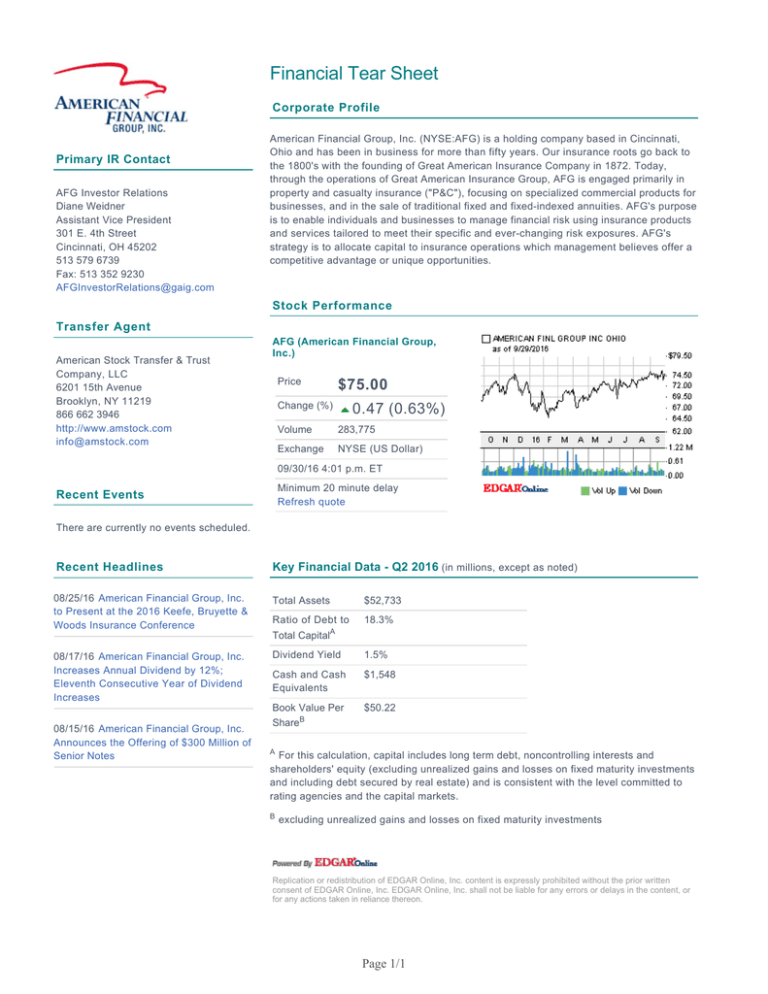

Financial Tear Sheet - American Financial Group, Inc.

advertisement

Financial Tear Sheet Corporate Profile Primary IR Contact AFG Investor Relations Diane Weidner Assistant Vice President 301 E. 4th Street Cincinnati, OH 45202 513 579 6739 Fax: 513 352 9230 AFGInvestorRelations@gaig.com American Financial Group, Inc. (NYSE:AFG) is a holding company based in Cincinnati, Ohio and has been in business for more than fifty years. Our insurance roots go back to the 1800's with the founding of Great American Insurance Company in 1872. Today, through the operations of Great American Insurance Group, AFG is engaged primarily in property and casualty insurance ("P&C"), focusing on specialized commercial products for businesses, and in the sale of traditional fixed and fixed-indexed annuities. AFG's purpose is to enable individuals and businesses to manage financial risk using insurance products and services tailored to meet their specific and ever-changing risk exposures. AFG's strategy is to allocate capital to insurance operations which management believes offer a competitive advantage or unique opportunities. Stock Performance Transfer Agent American Stock Transfer & Trust Company, LLC 6201 15th Avenue Brooklyn, NY 11219 866 662 3946 http://www.amstock.com info@amstock.com AFG (American Financial Group, Inc.) Price $75.00 Change (%) 0.47 (0.63%) Volume 283,775 Exchange NYSE (US Dollar) 09/30/16 4:01 p.m. ET Minimum 20 minute delay Refresh quote Recent Events There are currently no events scheduled. Recent Headlines Key Financial Data - Q2 2016 (in millions, except as noted) 08/25/16 American Financial Group, Inc. to Present at the 2016 Keefe, Bruyette & Woods Insurance Conference Total Assets $52,733 Ratio of Debt to 18.3% 08/17/16 American Financial Group, Inc. Increases Annual Dividend by 12%; Eleventh Consecutive Year of Dividend Increases Dividend Yield 1.5% Cash and Cash Equivalents $1,548 Book Value Per $50.22 08/15/16 American Financial Group, Inc. Announces the Offering of $300 Million of Senior Notes Total CapitalA ShareB A For this calculation, capital includes long term debt, noncontrolling interests and shareholders' equity (excluding unrealized gains and losses on fixed maturity investments and including debt secured by real estate) and is consistent with the level committed to rating agencies and the capital markets. B excluding unrealized gains and losses on fixed maturity investments Replication or redistribution of EDGAR Online, Inc. content is expressly prohibited without the prior written consent of EDGAR Online, Inc. EDGAR Online, Inc. shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon. Page 1/1