ESES triparty service

advertisement

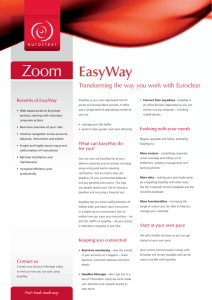

TRIPARTY ZOOM ESES triparty service Clients of the ESES platform can now benefit from triparty collateral management services in central bank money. The introduction of triparty services in ESES comes at a timely moment as repo activity has come back to pre-crisis levels and there is an increasing trend toward using CCPs to mitigate risk. Make optimal use of your securities with our triparty collateral management services. Manage your collateral easily This facility is built on the proven collateral ESES triparty collateral management services management systems and expertise remove the whole operational burden developed in Euroclear Bank. involved in managing the collateral aspect of your settlement transactions – whether By linking these to the settlement process these are executed directly with your in the ESES platform, we are able to offer counterparty or via a trading platform. you an efficient triparty collateral solution in three key business areas: As your neutral triparty agent, we provide you with an efficient automated solution • Eurosystem credit operations, where which covers: triparty services are used to collateralise • your central bank credit operations • Deal matching Interbank OTC triparty transactions • Automatic screening and selection of collateral settling DVP on the ESES platform (launching in February 2012) • • a CCP in order to reduce risk (set for launch in 2012) Post-trade made easy substitutions Centrally cleared triparty services – for market players dealing through Settlement (DVP), margin calls and • Valuation through daily mark-to-market • Comprehensive reporting Benefits to you • • Use one single access point to Reduce risk – triparty greatly reduces • Optimise your collateral through manage collateral allocated to central counterparty and market risk by the re-use facility – you can re-use bank credit operations and centrally collateralising your exposures at all times the collateral you receive as a collateral cleared and bilateral OTC transactions. according to tailored risk-related criteria. taker in onward triparty transactions. Your operational risk is mitigated by • Enhanced efficiency – AutoSelect, our using automated rather than manual powerful automated collateral allocation processes. • Highly secure – your business is managed in the safe legal environment of the ESES CSDs, using the highly- and monitoring tool, relieves the manual • Reduce cost – current manual resilient collateral management systems securities, enabling you to use all your processes and multiple transactions are of the Euroclear group. available assets efficiently. replaced by automation which reduces burden of selecting and substituting your back-office costs. A unique solution to access 3 market segments CCP-cleared GC baskets Automatic Trading System Bilateral OTC A ATS Eurosystem credit operations B A NCB CCP Securities Settlement System CMS (AutoSelect) CMS (AutoSelect) A CCP B A CMS (AutoSelect) B A NCB T2 Contact us To find out more about triparty collateral management, contact your Account Manager or use the following contact details: Euroclear Belgium: +32 (0)2 337 5930 Euroclear France: +33 (0)1 5534 5544 Euroclear Nederland: +31 (0)20 552 1530 eses.accountmanagement@euroclear.com ©2012 – This document is sent on behalf of Euroclear Belgium I Euroclear France I Euroclear Nederland – Euroclear is the marketing name for the Euroclear System, Euroclear plc, Euroclear SA/NV and their affiliates. www.euroclear.com MA0997 Collateral Management System