UZ) rw - Foundation Center

advertisement

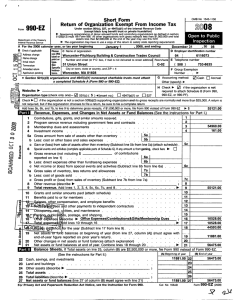

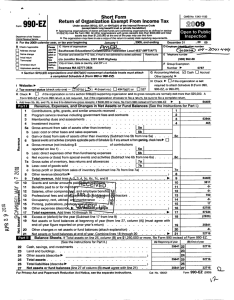

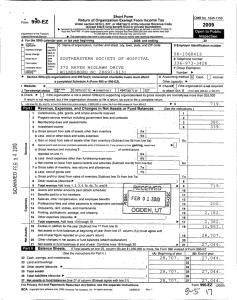

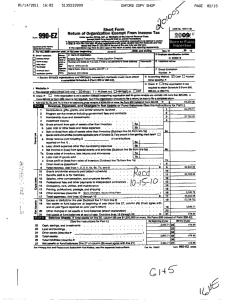

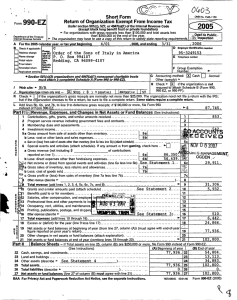

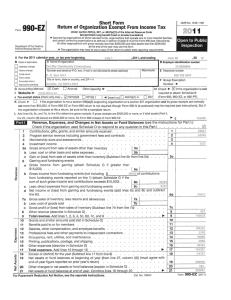

'f Form 990 Short Form Return of Organization Exempt From Income Tax -EZ At Department of the Treasury Internal Revenue service Under section 501(c), 527, or 4947( a)(1) of the Internal Revenue Code (except black lung behatit trust or private foundation) ^ Sponsoring organizations of donor advises funds and controlling organizations as defined in section 512(b)(13) must file Form 990 All other organizations with gross receipts less than $500,000 and total assets less than $1,250,000 at the end of the year may use this form ^ The organization may have to use a copy of this return to satisfy state reporting requirements A For the 2009 calendar year, or tax year beginning B Check If applicable Please ❑ Address change use IRS label or ❑ Name change ❑ initial return ❑ Terminated ❑ Amended return ❑ Application pending OMB No 1545-1150 print or 2009 e _ , 2009, and ending 3/ C Name of organization D Emplo e , 20 /0 7o v FlP.Q icap-,d r not delivered to street address) Room/suite E Telephone number type See specific ^^ j00. L- - / City or town, state or country, and ZIP + 4 Instruc- I bons . r identification number /! 0 4.,g- Number and street (or P 0 bog, if mail e ^S 5do - ^O / ^, - 7 ] Zo -1 F Group Exemption S(, 0.2- Number ^ • Section 501(c)(3) organizations and 4941(a)(1) nonexempt charitable trusts must attach a completed Schedule A (Form 990 or 990-EZ). G Accounting Method Other (specify) ^ ❑ Cash ❑ Accrual H Check ^ 19 if the organization is not required to attach Schedule B (Form 990, I Website: ^ J Tax- exempt status (check only one) - % 501(c) ( ) t (insert no) ❑ 4947(a)(1) or ❑ 527 990-EZ, or 990-PF). K Check ^ ❑ if the organization is not a section 509(a)(3) supporting organization and its gross receipts are normally not more than $25,000. A Form 990-EZ or Form 990 return is not required, but if the organization chooses to file a return, be sure to file a complete return. I L Add lines 5o, 6b, and 7b, to line 9 to determine gross receipts, if $500,000 or more, file Form 990 instead of Form 990-EZ Revenue , Expenses , and Changes in Net Assets or Fund Contributions , gifts, grants, and similar amounts received . . . . Program service revenue including government fees and contracts Membership dues and assessments . . . . . . . . . . . 1 2 3 4 Investment income 5a Gross amount from sale of assets other than inventory b c 6 a b . . . . . . . . . . . . . . . . . . . . . . c+D 0 W z rw,^, I LL L y . . . 4 end-of -year figure reported on prior year ' s return ) . . . . . . 5c 6b Net income or (loss) from special events and activities (Subtract line 6b from line 6a) Gross sales of inventory , less returns and allowances . . . . . 7a Less : cost of goods sold . . . . . . . . . . . . . . 7b Gross profit or (loss) from sales of inventory (Subtract line 7b from line 7a) . . . Other revenue (describe 10Total revenue . Add lines 1 , 2 , 3, 4, 5c, 6c , 7c , and 8 Grants and similar amounts paid (attach schedule) . . . . . . . . . . . Benefits paid to or for members . . . . . . . . . . . . . . . . . pensatlon , and employee benefits . . . . . . . . . . oftti1F0D i fees nd other payments to independent contractors . . . . . . ^ ccupac7ty t,Q tllltles, and maintenance 15 Pnntln ubllr fish postage , and shipping AVG ^tQer- enses escrlbe ^ 17 Total ex enses dd lines 10 throu g h 16 15_xcess or (deficit) or the year (Subtract line 17 from line 9) . . . . . . . . et-assets-oFAtnd balances at beginning of year (from line 27 , column (A)) (must C . Less : cost or other basis and sales expenses . . . . . . . 5b Gain or (loss) from sale of assets other than inventory (Subtract line 5b from line 5a) . . . . Special events and activities (complete applicable parts of Schedule 0). If any amount is from gaming , check here lo- E] Gross revenue (not including $ of contributions reported on line 1) . . . . . . . . . . . . . . . . . 6a Less : direct expenses other than fundraising expenses $ 5a c 7a b c 8 9 10 11 12 N UZ) . ^ Ba lance s (See the Instructions for Part I.) . . . . . . . . . 1 ,j, . . . . . . . . 2 . . . . . . . . . 3 319. Oz/ . . . . . . . . . 6c . . . . ) 7C 8 . . . . . . . ^ . . . . . . 9 10 11 12 13 14 15 16 . /0 /8/• .c ?14 0. a+? . ^ . . . . agree with 17 18 40 4 A . 0 3 . 19 _5S 744. . . . y S/ S^ -75Z Other changes in net assets or fund balances (attach explanation ) . . . . . . . . . . w 20 20 21 Net assets or fund balances at end of year . Combine lines 18 throu g h 20 . Oil21 lO odfdnce sneers . Ir I oral assets on line zb, column (ti) are s1,2bU,0uU or more, tile Form 990 instead of Form 990-EZ. (See the Instructions for Part II.) (A) Beginning of year (B) End of year 22 Cash, savings, and investments . . . . . . . . . . . . . . . . . q '1 4 22 4440/- RD ?1/ 23 24 25 26 27 Land and buildings . . . . . . . . . . . . . . . . . . . . . Other assets (describe ^ Total assets . . . . . . . . . . . . . . . . . . . . . . . Total liabilities (describe ^ Net assets or fund balances (line 27 of column ( B) must agree with line 21) For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions . . ) . - &-- 23 / .2 S. ad 24 //2, , a 51 Z -V 25 26 57s.? /_ • 8o S ) .8,f5 Cat No 106421 ."L4 -6- __6_ 27 Spa (. a Form 990-EZ (2009) Form 990 EZ (2009) Page 2 Statement of Prog ram Service Accomplishments (See the instructions for Part III.) LiE= What is the organization's primary exempt purpose? and concise empt purposes In a c Describe what was achieved in carrying out the organization's manner, describe the services p rovided, the number of p ersons benefited, and other relevant information for each program title. 28 Expenses (Required for section 501(c)(3) and 501(c)(4) organizations and section 4947(a)(1) trusts; optional for others.) 4,-u----- - -------------------------------------- --------------------------------------------------------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------------------------------------------------------- ----------------If this amount includes forei g n g rants , check here . ^ ❑ Grants $ 8a 29 ----------------------------------------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------------------------------------------------------- ----------------If this amount includes forei g n g rants , check here . ^ ❑ Grants $ 9a 30 ----------------------------------------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------------------------------------------ ----------------^ ❑ 0a Grants $ If this amount includes forei g n g ran check here . 31 Other program services (attach schedule) . . . . . . . . . . . . . . . . . . . . . If this amount includes forei g n g rants , check here . ^ ❑ 31a (Grants $ ^ 32 32 Total program service expenses (add lines 28a through 31 a) List of Officers, Directors, Trustees, and Key Employees. List each one even if not compensated. (See the i nstruc tions for Part IV.) (b) Title and average hours per week devoted to position (a) Name and address ------------------------------------ --- (c) Compensation (R not paid, enter -0-.) (d) Contributions to employee benefit plans & deferred compensation (e) Expense account and other allowances --------------- ---------------------------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- --------------------------------------------------------------------------- --------------------------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------------- -------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- Form yJJU-tL (2009) Form 990- EZ (2009) JIM Page 3 Other Information (Note the statement requirements in the instructions for Part V.) Yes No 33 Did the organization engage in any activity not previously reported to the IRS? If "Yes," attach a detailed 34 description of each activity . . . . . . . . . . . . . . . . . . . . . . . . . . Were any changes made to the organizing or governing documents? If "Yes," attach a conformed copy of the changes . 35 a b 36 37a b 38a b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 34 If the organization had income from business activities, such as those reported on lines 2, 6a, and 7a (among others), but not reported on Form 990-T, attach a statement explaining why the organization did not report the income on Form 990-T. Did the organization have unrelated business gross income of $1,000 or more or was it subject to section 6033(e) notice, reporting, and proxy tax requirements? . . . . . . . . . . . . . . . . . 35a If "Yes," has it filed a tax return on Form 990 -T for this year? . 35b X 36 Y, . . . . . . . . . . . . . . . Did the organization undergo a liquidation, dissolution, termination, or significant disposition of net assets during the year? If "Yes," complete applicable parts of Schedule N . . . . . . . . . . . . . Enter amount of political expenditures, direct or indirect, as described in the instructions. ^ 37a Did the organization file Form 11 20-POL for this year? . . . . . . . . . . . . . . . . . . 37b Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were any such loans made in a prior year and still outstanding at the end of the period covered by this return? If "Yes," complete Schedule L, Part II and enter the total amount involved . . . . 38b . . . . . . . . 39a 39b 38a Section 501(c)(7) organizations. Enter: 39 a b 40a Initiation fees and capital contributions included on line 9 . . . Gross receipts, included on line 9, for public use of club facilities . . . . . . 671/ (p3, Section 501(c)(3) organizations. Enter amount of tax imposed on the organization during the year under: section 4911 ^ b ; section 4912 ^ ; section 4955 ^ Section 501 (c)(3) and 501 (c)(4) organizations. Did the organization engage in any section 4958 excess benefit transaction during the year or is it aware that it engaged in an excess benefit transaction with a disqualified c d e person in a prior year, and that the transaction has not been reported on any of the organization's prior Forms 990 or 990-EZ? If "Yes," complete Schedule L, Part I . . . . . . . . . . . . . . . Section 501(c)(3) and 501(c)(4) organizations. Enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 . . . . . . . . . . . . . . . . . . . . . . . ^ Section 501(c)(3) and 501(c)(4) organizations. Enter amount of tax on line 40c reimbursed by the organization . . . . . . . . . . . . . . . . . ^ All organizations. At any time during the tax year, was the organization a party to a prohibited tax shelter transaction? If "Yes," complete Form 8886-T .. 41 42a b 40b . . . . . . . . . . . . . . . . . . 40e List the states with which a copy of this return is filed. ^ The organization's books are in care of ^ ______________________ Telephone no. ^ ------- ---------------------Located at ^ ZIP + 4 ^ ------------------------------------------------------------------------------------------------------ ---------------------At any time during the calendar year, did the organization have an interest in or a signature or other authority over a financial account in a foreign country (such as a bank account, securities account, or other financial Yes No account)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42b If "Yes," enter the name of the foreign country: ^ See the instructions for exceptions and filing requirements for Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts. c 43 At any time during the calendar year, did the organization maintain an office outside of the U.S.? . . . . If "Yes," enter the name of the foreign country: ^ Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 -Check here . and enter the amount of tax-exempt interest received or accrued during the tax year . . . . . ^ 1 43 42c . . ^ ❑ Yes No 44 Did the organization maintain any donor advised funds? If "Yes," Form 990 must be completed instead of Form 990-EZ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44 45 Is any related organization a controlled entity of the organization within the meaning of section 512(b)(13)? If "Yes," Form 990 must be completed instead of Form 990-EZ . . . . 45 Form 990-EZ (2009) Form 990-FZ (2009) Page 4 Section 501 (c)(3) organizations and section 4947(a)(1) nonexempt charitable trusts only. All section 501 (c)(3) organizations and section 4947a)(1) nonexempt charitable trusts must answer questions 46-49b and complete the tables for lines 50 and 51. Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates for public office? If "Yes," complete Schedule C, Part I . . . . . . . . . . . . . . Did the organization engage in lobbying activities? If "Yes," complete Schedule C, Part II . . . . . . 46 47 48 49a b 50 Yes No 46 47 Is the organization a school as described in section 170(b)(1)(A)(ii)? If "Yes," complete Schedule E . . . . 48 Did the organization make any transfers to an exempt non-charitable related organization? . . . . . . 49a 4: If "Yes," was the related organization a section 527 organization? . . . . . . . . . . . . . . 49b Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and key employees) who each received more than $100,000 of compensation from the orcianization. If there is none. enter "None." (a) Name and address of each employee paid more than $100,000 (b) Title and average hours per week devoted to p osition (c) Compensation (d) Contributions to employee benefit plans & deferred compensation (e) Expense account and other allowances --------------------- ---- O - -------------------------------------------------------------------------------------------------------------------- ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- f Total number of other employees paid over $100,000 . .' . . ^ -fj- / Complete this table for the organization's five highest compensated independent contractors who each received more than $100,000 of compensation from the organization. If there is none, enter "None." 51 (a) Name and address of each independent contractor paid more than $ 100,000 ------------------------------------------------ --------------------------------------------------------- --------------------------------------------------------------------------------------------------------------------- --------------------------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ d Total number of other independent contractors each receivi Under penalties of perjury, I declare that I have examined this return, and belief , it is true , correct , and complete Declaration of preparer (c Sign Here Czz:5rr-o^- ` x^^JUJ.a,_^ Signatu a of officer ' .4Eo,1.4 hl . 611A/_TO,tI Type or print name and title Paid Preparer ' s Use Only Preparer's signature Firm's name (or yours if self-employed), address, and ZIP + 4 May the IRS discuss this return with the preparer shown above? (b) Type of service (c) Compensation All S6 0 .z ;^S S )4 a , S /y^/v 77 ,^`}- ^C-15 3 o aZc.^ 3, o s 9 3593 S/- vii 9 2 oo CHARITY REPORT 2009-2010 BENSON #3593 --------------------------CHARITY -- ---------- -----------AUX TOTAL AERIE ------- ----- -------- - ART ERHMANN CANCER FUND 50.00 50 . 00 100.00 MAX BAER HEART FUND 50 .00 50 00 100.00 ROBERT HANSEN DIABETES FUND 143 75 143.75 287.50 LEW REED SPINAL CORD FUND 50.00 50 . 00 100.00 DIABETES RESEARCH CENTER 100 00 100 00 200.00 D D DUNLAP KIDNEY FUND 275.00 275. 00 550.00 ALZHEIMERS FUND 50. 00 50 . 00 100.00 MEMORIAL FUND 50.00 50 . 00 100.00 GOLDEN EAGLE LIBRARY FUND 150.00 150.00 300.00 HOSPICE 250. 00 250 . 00 500.00 50. 00 50 . 00 100.00 ST. VINCENT DEPAUL SOCIETY 150 00 150 . 00 300.00 COCHISE COLLEGE SCHLORSHIP 500.00 COCHISE CTY ABUSED CHILDREN 500.00 STATE PRES. PROJECT (AUX) 50. 00 50 . 00 100.00 STATE PRES. PROJECT (AERIE) 50 00 50 . 00 100.00 PSMP & 10 YR SEC. SCHOLARSHIP 100.00 2,068.75 100.00 1,468 75 3,537.50