g 14 6- m"wwwwwoom - Foundation Center

advertisement

01/14/2011

16:02

5135233999

OXFORD COPY SHOP

u"°"

crass

to-k Iq =4110

oo

(

+erma

R

do Ma"dIrl Boom

Wid

sG04000 ena %=

s1^mua fee Fom @f-r2etr+sM== #AM p m^

+^^

aeyeensd eEi r^^YgeeoftTXM

srao4jossta+sr51250

^ 7h"nps^rtar n^tre auaeea^or^t:ret+anloadpsmro^^fr^8^eprw

tlrs.me^nda.+^+r

nswia+Pe..m

M"WWWWWOOM

. 7>^. e__ w+dlno

.J..,,• ell

pegrn+,0

ur ^t

a For tlrs 200Y a^MS+

Msf 31

r G Nmne of ags^eon

6 oh.dk 1.en03ma

sweet for P.O.OM

wego

❑

evpd ft

pty or to. ^ ago a oaartrv, eco

w

❑ 1tokaftnpEr"

dk^

Oxford, OH 45056

Kvrfi^•

4n

me

M" dw

MW M40p

8

w

20

316080610

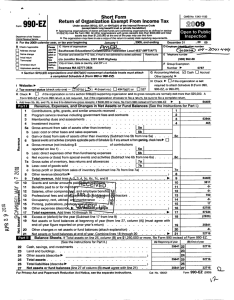

Knppe Sigma Freternfy - mete

tadeow

TSM*WW

wRe rlo ,s.s„ eo

4F.

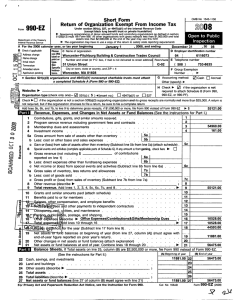

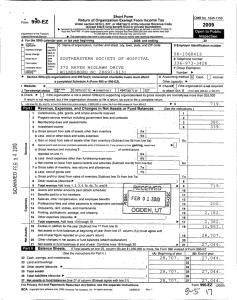

Short Form

Return of Organization Exempt From Income Tax

990-EZ

B

PAGE

404 E Withrow St

••

F Oroto E9emp1ion

Nun ter

P

Ce9N ❑ A=wl

O Accountlng Method :

Oder (eDedf» ^

• 9ectbn Sof (c)(J; one end 49r7(dJ(1) normwarpt C,Wr ob (nwt must Detach

a campilrNO Sche jb A (Form WD w 860-60•

N chock ^ ❑ If the organ otbn [s sot

requred to ettad+ Schedule B (Form 990.

Webe1M

:

^

I

990-EZ. or NO-10F).

601 (c3 ( 7 -4 Omen no. ❑ 4947(g)(1) or ❑ 527

on6 J Tm[-400n199 slaws check

ion 9nd ae grvm nea^Ipta ere normally not moro than p5.0 0. A

K Cftck ^ ❑ a tra organlr m is not a section 509(x)(3) euppenmg orga,

drooae® to NM a ratum, be owe to Me a comlWo slum

ul . but It the

Form 990-¢ or Form 990 reUxn Is not

w

le: a $$00.000 or rrore, fee Form 090 heUgd of Form 0BDt Add Mee SC, 8b Pntl 7 to fir. 9 to oewrmha

the Instructions for

or Fund BalanceB

RavarUo,

ant. and GnanAee In Not Agae

I

2

3

4

6.

Contributions . gifts . grants . and sim ilar amounts received . . . .

Program service revenue Including government fees and contracts

. .

Membership dues end aaeeeements . . . . . . . .

investment Income

. . . .

Oroae amount from sale of eaaete othsr than Inventory

b Less: cost or tither basis and swine eocpenees

c

B

.

.

reported on [Ina 1 ) .

.

.

.

^-r

1-r

.

.

.

.

.

.

.

.

25.472 71

1

2

3

4

.

37152.25

5a

Sb

.

of contributions

.

.

.

.

.

.

.

.

b Lass: direct expenses other than fundralsing expenses

10

11

12

13

14

1S

16

.

..

Gain or (lose) from sale of excels other than inventory (Subtract line 5b from line Se) .

S ecb sheets and a tM0ee (canD a appdrebte pw of Sd,eM Gj. If any wnmot 19 flem gltminp, check We ^ ❑

e Gross revenue (not including S

c

?e

b

c

B

.

.

.

,

93 ,2.74 96

aft I.)

.

.

.

.

Be

.

.

.

.

Gb

Not Income or Voss) from epedai events and activities (subtract line Bb from line 69) .

7e

Grow sales of inventory, We returns and elIowencea . . . .

?b

. . . . . . . . . . . . . .

Leas: coat of goods 90d

Gross profit or (loss) from sales of Inventory (Subtract line 7b from One 7a) . . . .

Other revenue (

. . .

Grants and similar amounts paid (attach schedule) . .

Beneflte paid to or for members .

. . . . . . . . .

Salaries , other compensation . end employee benefits . . . .

professional fees end other payments to Independent contractors :

Occupancy , rent , utulttea. and maintenance . . . . . . .

Printing , pubOcatlona , postage, and shipping . . . . . . .

Other exper , (describe ^ Sunk Charger . Accounting Fe0R

.

.

.

.

.

ec

.

7c

It

)

10

.

, Oc

/^,

I^ y

R

lV

G

62,102.98

11

.

12

13

14

>^ •

16

1

3 180 72

18

(2,129 72

. .

. . .

Excess or (deficit) for the year (Subtract line t 7 from line 9) .

10.

Net assets or fund balances at beginning of year (from Une 27. column (A)) (must agree with

t,05.71

1B

end-of-year figure reported on prior year's return) . . . . .

2t)

Other changes In net assets or fund balances (attach expienat(on) . . .

078,99

21

. ^

at emi 21 Year. Combine Pnes 18 thr otKilh 20

Not MMO or fund

21

25, column (B) are $1250,000 or more, file Fonts 090 Instead of Form 990-Eon

line

Sh

ate.

If

Total

assets

Balance

IN =

W BM" afM End arm

(See the Inatrucflon5 for Part II.)

t8

19

t •>

22

Cash. savings . And Indents

.

.

.

.

.

.

23

la idandbulldh

.

.

.

.

.

.

24

Other e0aets (describe P-

25

Taw assets .

,

.

.

.

.

26

27

Total Ilebliluee (describe Net assns or fund balances P ine 27 of column

s.

.

.

.

,

.

.

.

.

.

.

,

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

must so.

2,605.71 22

with 6ne 21

For P lvacy Act and Paperwork Reduceon Act Modes . see the erpmete hotrweona .

475.99

Ta

.

CUL No 106421

24

2,605.71 2S

d79 99

-

20

2.605.71 27

476.99

Porn 9904M aoM

G 14 6-

02/15

01/14/2011

16:02

5135233999

OXFORD COPY SHOP

PAGE

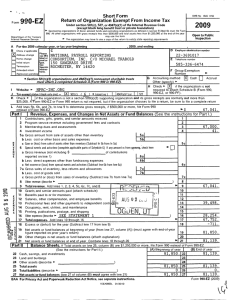

t«m ei .EZ mom

f3M.

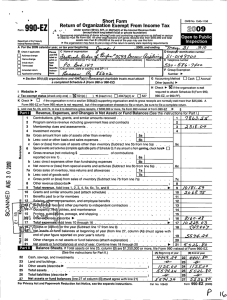

$t temerR of Prog ram SeMca Aoconvill9Rman {See the instructions for Part I11.)

15mme Mne nr.d'r n0rtlehlp M Miami Vr-m -rly

Mat Is the organization's primary exempt purpose?

Describe what was achieved In carryh^g out the organ zatbn ' s exempt purposes, In a clew and concise

describe the services provided. the number of persons benefited , and other relevant information for

each program title.

pqp 2

amen es

(ROQub"fOrE cuw

90tmmaid^(`p

9W Oft-Wn

w)o,md

1m ol1 .l

28

20

Grants S

.....

.. -

- - - If thb amount includes fwel '

30

a1

.b check hens

---- .

^ -

29a

-_...r...----------

^Grenta $

1 f file omount Ineludea for¢ n grants check here

Other program services ( attach schedule) . . .

Drente

32 Total p rogra m service s

If this amount Includ foreigin rants check here

ea add tees 28e than, 31

.

.

^ ❑

Xe

^ ❑

^

31a

34

Uet of omwes, otrsemra, Trvstm, a nd Ke Emplolrew, Ust each one even If not compensated . (See the Irmtnicticna for Part IV.

( 14 O"kftm a

te) Experw

T1116 e Xwerwe

( CaTVIRMo m

a^oure and

even plead

hiiSS per week

(q Name "cakh,=

Pf not Pte.

enex ^.)

OVene0 c^+^.v.m' other Mn^nceD

01001"

de-ow to po idon

Form 9F U L

(MQj

03/15

16:02

01/14/2011

PAGE

OXFORD COPY SHOP

5135233999

Fmti

the statement

✓

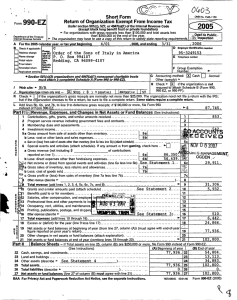

Did the organization engage in any activity not previously reported to the IRS? if -fee ," attach a detailed

32

description of each BctMty .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. .

.

.

.

.

.

.

.

.

.

34

Were any changes made to the organizing or governing documents? B "Yes ," attach a co formed copy of

35

. . . .

the changes . . . . . . . . . . . . . . . . . . . . . . . . . . .

II the organization had Income from bualnsas edlvitlea , suds as those reported oo Ikes 2, 6a, and Ta Iwmng others), but

not reported on Form 990•T. attach a statement exptateing why the orgartt tlon did not report the Income on Form 990-T.

a

Did the organization have unrelated business gross income of $1,000 or more or was it aubyect to section

.

. . . . . . . . . . . . . .

6033(e) notIce. reporting . and proxy tax requirementa7

b If 'Yes.' has It filed a tax return on Form 990-T for this year? .

.

.

.

.

.

.

.

.

.

.

.

.

✓

3s

3,58

a6

Did the orgenlz tion undergo a rqrldatian , dissotutlon . termination , or significant disposition of not assets

. . . . .

during the year? If "Yea," complete applicable parts of Schedule N

. . . .

3Ta

Enter amount of political expenditures, direct or indirect. as deacribod in the instructions. ^

b

We

Did the organization P ie Form 112D-POL for this year? . . . . . . . . . . . . . . . . . .

Did Me organization borrow from , or make any loans to, any officer. director , tr ustee , or key employee or were

37b

any such loans made In a Ixlor year and still outstanding at the end of the period covered by this return? .

Ma

b

If 'Yes.' complete Schedule L, Part 11 and enter the total amount Invoked

.

.

✓

36b

.

sg

37B

.

.

L

3f

39

Section 501(c)(7) orpanttatlona . Enter:

33,082 25

368

. . .

a Initiation fees and capital contributions Included on line 9 . . . . . .

0

39b ^

b Grose receipts , Included on fine 0, for public use of club facilities . . . . . .

1

40a Section 501(x)(3) organizations. Enter amount of tax Imposed on the organization during the year under

; section 4912 ^

section 4911 ^

: section 4955 INb

Section 501(c)(3) and 501(c)(4) organization . Did the organization engage In any section 4058 excess benefit

transaction during the year or Is It aware that It engaged in an excess benefit transaction with B disqualified

c

person In a prior year , and that the transaction has not been reported on any of the organization ' s prior

Forms 990 or 990-EZ? If 'Yes,' complete Schedule L Pert I . . . . . . . . . . . . . . . .

Section 501(c)(3) and 501 ( x)(4) orgenizatlons. Enter amount of tax Imposed on

organization managers or disqualified persons during the year under sections 4912,

4965 . and 4958 . . . . . . . . . . .

d

Section 501(c)(3) and 501 (cK4) organizations . Enter amount of tax on line 40c

reimbursed by the organization . . . . . . . . . . . . . . . . . ^

e

All organizations . At any time during the tax year, was the organization a party to a prohibited tax shelter

transaction? If *Yes , complete Form 688e-T ..

41

42a

Located at Op-

b

.

.

.

List the states with which a copy of this return is filed. 10The organization ' s books are in care of ^

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

40b

408

.............. Telephone no. ^

ZIP + 4 ^

..__....._...... ..... __......... .

At any time during the calendar year, did the organization have an Interest In or a elgnature or other authority

over a financial account In a foreign country (such as a bank account, eecurltlea account, or other financial

account)? . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . .

It "Yes,' enter the name of the foreign country: ^

,1, Report of Foreign Bank

See the kwtructlone for exception and filing requirements for Form TD F 90

and Rnanclal Accounts.

e At any time during the calendar year, did the organization maintain an office outside of the U.S.? . .

If "Yes,' enter the name of the foreign country: ^

43 SectIon 4947(aX 1) nonexempt charitable trusts filing Form 990-EZ In Oau of For.. 1041-Check here

and enter the amount of tax-exempt Interest received or accrued during the tax year .

.

.

.

.

.

Yea No

42b

42c

.

. .

.

^ ❑

^ 1 40 I

No

44

46

Did the organization maintain any donor advised funds? If "Yes, ' Form 990 must be completed Instead of

Fom+ 990-EZ

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is any related organization a controlled entity of the organization within the meaning of section 512(b)(13)? If

"Yes,' Form 990 must be completed Instead of Form 990-[Z . . . . . . . . . . . . . . . .

Fan 990-Q Ross

04/15

16:02

01/14/2011

OXFORD COPY SHOP

5135233999

PAGE

FmO

4

Section 501(o^ orgbN7rgt(otte eM section 4047(Oft) I+onexemp! dtalnable ttwm only. AU section

501(c)(3)a+^ertfast(o^ and section 494T(v(1) nonexempt charitable trusts must answer questions d&-49b

and complete the tables for li nes 50 e nd '51.

polhha(c mpslgn eetivitles on behalf of or In opposition to

Did the organlzatlon sn949e In direct or h

candldetee for public office? if 'Yes,' complete Schedule C. Part I . . . . . . . . . . . . . .

Did the orgenIWIon angage in lobbying actlvltles? If 'Yes," complete Schedule C. Port II . . . . . .

Is the or©antratlon a school as dusa(bed In section 170(b)(11W(U)? If 'Yes," complain Schedule E . . . .

46

47

48

Yes No

48

47

48

09%

tas DIO the organization make any transfers to an exempt nonCierhable related organization? . . . . . .

4911

. . .

b if'Yes.' was the related organization a section 527 organization? . . . . . . . . . .

50 Complete this table for the organization's flue+dgh et compensated employees (other that. offices. directors. trustees and key

...,,.....,.w --]..A ...- w..... a+m nnn m rnn.n..,eatir n hTVn n.a Ommbaflen if there In none. enterNone.'

(i4 None ad ad

d of ^eA+ employee as

ow t1CO,

TRIP 0%d

Megvi V4 =

dew,0 to

rtde

Total number of other employees paid over S10D.01M

f

.

.

.

beesS o^se 6

ode. ce. pww ft.

INEWSM

a=o+4 old

otherd4we1 1

. ^

Complete this table for the orgm nation's five highest compensated Indopenderrt contractors who each received more than

$100.000 of compensation from the organization if there is none. enterNone.'

51

1d Name and addnaa co Poch a+EoxiAent Contractor vdd mom Own S1OO.OW

d

Total number of other Independent contractors each receiving over $100.000

betel, t h

mi0

leas.

1. wdc n late. Dec

of piepxs (

df ic,) b beasO

IN Type of eeMka

1

.

I

(Co

b^

.1k,-

MO

d whbh pup & hoee wV bbwbdge.

05/15