DMCC 2011-12 TX Ret as filed

advertisement

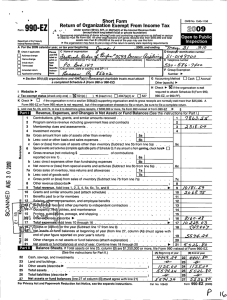

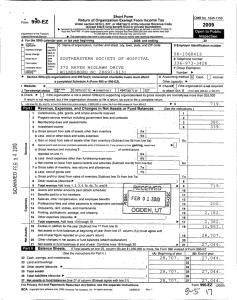

Short Form

Return of Organization Exempt From lncome Tax

,-''990'EZ

)

Deparlment ol the Treasury

lnternal Revenue Servics

A Forthe20ll

calendar

B

Checkifapplicable

I

noar"*"

D

I

I

f]

Nffie chilge

"i,-g,

',

or tax

June:i0

,2011, and ending

Jul

,n

12

O Employer identification numb€r

Dcl l"'iar C;ornmunity Conncctions

33 0938895

Number and street (or P.O. box, if mail is not delivered to stre€t address)

E Telephone number

City or town, state or country, and ZIP + 4

F

lnitiatretum

858 792 5947

Tminareo

Amendeo retum

Applicalion pending

M.rr, CA $2$1,t

J Tax-exemptstatus(checkonlyone)-

L

2@11

Under section 501(c), 527, oilt947(axl) of tho lnternal Reyonuo Code

(excopt black lung benent tust or private loundation)

Sponsoring organizations of donor advised funds, organizations that operate one or more hospital facililies,

and certain controlling organizations as defined in section 512(bX13) must fil€ Form 990 (see instructions).

All other organizations wilh gross receipts tess than $200,000 and total assets less than $s00,000

at the end of the year may use this form.

have to

Cash

G Accounting Method:

I Website: ) L"/','r\'u'.tililr;r;.t:u

K

OMB No. 1545-1 150

> n

Number

59,17

Accrual

8501(cX3)

Group Exemption

Other (specifu)

)

H Check

)

)

[4

if the organization is not

required to attach Schedule B

(Form 990, 990-EZ, or 990-PR.

n Sot(c)( ) <

if the organization is not a section 509(a)(3) supporting organization or a section 527 organizalion and its gross receipts are normally

Check

not more than $50,000. A Form 990-EZ or Form 990 return is not reguired though Form 990-N (e-postcard) may be required (see instructions). But if

the organization chooses to file a return, be sure to file a complete return.

Add lines 5b, 6c, and 7b, to line 9 to determine gross receipts. lf gross receipts are $200,000 or more, or if total assets (Part ll,

l55tlillj

line 25, column (B) below) are $500,000 or more, file Form 990 instead of Form 990-EZ

Revenue, Expenses, and Changes in Net

used Schedule O to

Check if the

or Fund Balances (see the instructions

ion in this Part

I

78057

442{]4

1527

c,

c(,

o

EC

2097.2

97.3

145633

o

6'

o

1

045r11

337A

c

c,

ct

1

x

8000

2!r56

ttJ

:.!6435

1

UI

o

o

b535?

igT

2l

th

339948

z!)

320037

For Paperwork Reduction Act Notice, see the separate instruclions.

187,

Cat. No. 106421

(2011)

Form 990-EZ (2011)

E!@

Page

Balance Sheets. (see the instructions for Part ll.)

Check if the

used Schedule O to

in this Part

ll

.

2

. A

(B) End of year

22

23

24

Cash, savings, and investments

Land and buildings .

Other asseis (describe in Schedule O)

257855

25

Total assets

324A37

26

27

Totalliabilities (describe

621

.

in Schedule O)

Net assets or fund balances (line 27 of column (B) must

with line 21)

31

6618

Statement of Program Seruice Accomplishments (see the instructions for Part lll.)

Check if the orqanization used Schedule O to resoond to anv question in this Part lll

What is the organization's primary exempt

purpose?

To creatc wehi of safety,

se

Expenses

rvice and support for serriors

4947(a)(1)

trusts; optional

for others.)

--o-fl!,S--p1-o-t1ig-qt-tltq-!eligf!'re-!iIt:!9-t-1':,-9il-qP-tt-o-!-l-l9t-:-c-19_i,:-9r!-:{i:9!Lg-.iittfi-u-4y-eL:r------------

lf this amount includes

2g

320037

(Required for section

501(cX3) and s01(cXa)

organizations and section

Describe the organization's program service accomplishments for each of its three largest program services,

as measured by expenses. ln a clear and concise manner, describe the services provided, the number of

persons benefited, and other relevant information for each

e8

Bl

check

here

>n

-!1g:ir-tii:l-o-99-r-t-'111:9-9iil-'"9-LY,-gf:l-:,q91-qg.l]|llll!trg:-t-91-{-ggTp-y-t-q-919:-:t'-:,.!9-c-4i-Tg-q!g-.iL-a-t-q-:9-ii9l

5C!'VlCO5,

lf this amount includes

31

32

check here

here

$

> tr

(Grants

) lf this amount includes foreiqn orants. check

Other program seryices (describe in Schedule O)

lf this amount includes

check here

1E*dltl

Total program service expenses (add lines 28a

31a) .

List of Officers, Directors, Trustees, and Key Employees. List each one even if not compensated. (see the instructions for Part lV.)

used Schedule O to resoond to

in this Part lV

Check if the

!

(b) Title and average

hours per week

{a} Name and address

devoted to position

1!-t

l-1,

-:q::-"-[-

--

Vicc frrcaiCent -" I

Director

-

3l-il Scrilentine DR, Do! mri, i:n-s2-01;

l-,-l g-t:g-1,-t:i v-ll::tl--- --- - -- -107t) Klish llJav, Dr;! tl'la!", Cn 9201d

Vler.v

AVr, r:ul

0-

-0-

0.

.tl.

"0-

.0"

-0.

-0"

"0-

Director

.0.

-0-

c-

President 16

Dircctor

-0-

.0-

0

-0-

0.

0"

(r.

.0.

-0.

.u.

"o,

-0-

,0

.0-

-0"

-0

-0-

.0-

-0-

,0.

-0-

-o-

8--Dirr:r:tor

_llslqll-s-.Jrleilrn- ------ ---zr0 occari'r

(d) Heallh benefits,

:ontributions to employer (sl Estimaled amount ol

compensation

other compensation

benelii plans, and

Forms W-2l1099-MlSC,

(if not paid, enter -0-)

defer€d compensation

(o) Beporlable

--------------

l,liiilii 6l6i;-

lreasure!'- 18

Director

7

-lt_'_-"-iy,-lta!f:459 Carolina RD

L,: ttlg: I lo-, -l-q l,i:

13781 Roscciott way, sair

tt;;6-9;i:0

Secretary

---

I

Director

JI)

Dirccior

--i':it,::::i:'ll5-120-7th s

l, ucl

-

'I

Mar,

cn gioTii------

Director

7

l)ircctor

.i:gYllli:-F-9lli-1f i0 L:rcst f?D, f.rei i\1ar, Cl\gZA1,1

W-9.1-'t.ll9-t-'-Y-

?0i Oceail vie',ir iiVI:, irei M.n

ii[

42.

Dire(:toI

s2d;;

---- -

--- --'

Vice Pres.

Dcvclopmcnt

2

11

Dircctor

0.

rorm

990-EZ

(eott)

Form 990-EZ (201 1)

Other

ule A and

instructions for Pafi V Check if the

3it

u

contract statement

used Schedule O to

tion in this Part V

Did the organization engage in any significant activity not previously reported to the IRS? lf "Yes," provide a

detailed description of each activity in Schedule

O

Were any significant changes made to the organizing or governing documents? lf "Yes," attach a conformed

copy of the amended documents if they reflect a change to the organization's name. Otherwise, explain the

change on Sehedule O (see instructions)

35a

Did the organization have unrelated business gross income of $1,000 or more during the year from business

activities (such as those reported on lines 2, 6a, and 7a, among others)?

b

lf "Yes," to line 35a, has the organization filed a Form 990-T for the year? lf "No," provide an explanation in Schedule O

501 (cX ), 501 (cXs), or 501(c)(6) organization subject to section 6033(e) notice,

reporting, and proxy tax requirements during the year? lf "Yes," complete schedule c, part lll .

c Was the organization a section

Did the organization undergo a liquidation, dissolution, termination, or significant disposition of net assets

during the year? lf "Yes," complete applicable parts of Schedule N

37a Enter amount of political expenditures, direct or indirect, as described in the instructions.

37a

b Did the organization file Form 1120-POL for this year?

38a Did the organization bonow from, or make any loans to, any officer, director, trustee, or key employee or were

any such loans made in a prior year and still outstanding at the end of the tax year covered by this return?

lf "Yes," complete Schedule L, Part ll and enter the total amount involved

38b

Section 501(cX7) organizations. Enter:

lnitiation fees and capital contributions included on line 9

Gross receipts, included on line 9, for public use of club facilities

4Oa Section 501(c)(3) organizations. Enter amount of tax imposed on the organization during the year under:

36

)

b

39

a

b

b

{) ; section 4912>

o

t ; section 4955>

section 491 1 >

Section 501(cX3) and 501 (cX4) organizations, Did the organization engage in any section 4958 excess benefit

transaction during the year, or did it engage in an excess benefit transaction in aprioryear that has not been

reported on any of its prior Forms 990 or 990-EZ? lf "Yes," complete Schedule L, Part I .

Section 501(c)(3) and 501 (c)(4) organizations. Enter amount of tax imposed on

organization managers or disqualified persons during the year under sections 4912,

4955, and 4958

.

(c)(3) and 501(c)(4) organizations. Enter amount of tax on line 40c

reimbursed by the organization

e All organizations. At any time during the tax year, was the organization a party to a prohibited tax shelter

transaction? lf "Yes," complete Form 8886-T. .

List the states with which a copy of this return is filed. ) Catiiornia

41

42a The organization's books are in care of )

-Katlry_l1nl'lLl__---__-_-__-_ _____-___ Telephone no. >___--_-q?_q_19-?_?l_l!l_-_--9r,(t14

Located at > ',).25 tltir 5T, ilci Mrr, Ci\

ZIP + 4 )

Section

501

b

a financial account in a foreign country (such as a bank account, securities account, or other financial account)?

lf "Yes," enier the name of the foreign country: )

See the instructions for exceptions and filing reguirements for Form TD F 90-22.1, Report of Foreign Bank

and Financial Accounts.

c

43

At any time during the calendar year, did the organization maintain an office outside the U.S.? .

lf "Yes," enter the name of the foreign country; )

Section a9a7@)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 -Check here

and enter the amount of tax-exempt interest received or accrued during the tax year

!

. > 143

organization maintain any donor advised funds during the year? lf "Yes," Form 990 must be

completed instead of Form 990-EZ

Did the organization operate one or more hospital facilities during the year? lf "Yes," Form 990 must be

completed instead of Form 990-2.

Did the organization receive any payments for indoor tanning services during the year?

lf "Yes" to line 44c, has the organization filed a Form 720 to report these payments? /f "No, " provide an

explanation in Schedule O

Yes No

44a Did the

c

d

Sa

45b

Did the organization have a controlled entity within the meaning of section 512(bX13)?

Did the organization receive any payment from or engage in any transaction with a controlled entity within the

meaning of section 512(bX13)? lf "Yes," Form 990 and Schedule R may need to be completed instead of

Form 990-EZ (see instructions) .

44e

/

44b

4c

44d

45a

4.5b

rorm

990-EZ

(eorr)

Form 990-EZ (20'11)

Page

4

No

Did the organization engage, directly or indirecily, in political campaign activities on behalf of or in opposition

candidates for public oflice? lf "Yes," complete Schedule C, part I

46

to

501

organizations and section

nonexempt

trusts only. All section

n 4947(a)(1) nonexempt charitable trusts must answer questions 4749b

501 (cX3) organizations and sectio

and 52, and complete the tables for tines 50 and b1.

Check if the

used Schedule O to

in this Part

Vl

tr

No

47

Did the organization engage in lobbying activities or have a section 501(h) election in effect during the tax

yeafl lt "Yes," complete Schedule C, Part il

#

49a

b

50

ls the organization a school as described in section 170(bX1X4(i)? lf "Yes," complete Schedule E

Did the organization make any transfers to an exempt non-charitable related organization? .

lf "Yes," was the related organization a section 52T organizalion?

Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and key

employees) who each received more than $100,000 of compensation from the organization. lf there is none, enter "None."

{

(a) Name and address of each employee

paid more than $100,000

i\.lr;

(b) Title and average

hours per we€k

devoted to position

(c) Reportable

compensation

(Forms W-2l1099-MISC)

{d) Health benefits,

contributions to employee

(el Estimated amount ol

other compensation

irr.

f

51

Total number of other employees paid over $100,000

Complete this table for the organization's five highest compensated independent contractors who each received more than

$100,000 of compensation from the organization. lf there is none, enter "None."

(a) Name and address of each independent contractor paid more than $1 00,000

{c} Compensation

dTotalnumberofotherindependentcontractorseachreceivingover$100,000.>

Did the organization complete Schedule A? Note: All seciion 501(c)(Q organizations and 4947(a)(1)

nonexempt charitable trusts must attach a completed Schedule A

52

) E Yes I

No

Under penalties of perjury, I declare that I have examined this return, including ac$ompanying schedules and statements, and to ihe b€st of my knowledge and belief, it is

true, cofiect, and complete. Declaraiion of preparer (olher than otticer) is based on all information of which preparer has any knowledge.

Sign

Here

Paid

Preparer

Use Only

)*#m

i(;tllt*r in:: lrinirlll, I rcasLu'rr

Type or print name and tille

PtintfType preparcr's name

cnecr

fl

it

self^employed

Firm's EIN

>

Phone no.

thelRSdiScussthisreturnwiththepreparershownabove?Seeinstructions>

porm

990-EZ

(zott)

SCHEDULE A

(Form 990 or 990-EZ)

Department of the Treasury

lnlernal Bevenue Service

OMB No. 1il5-0{X7

Public Gharity Status and Public Support

Complete if the organization is a section 501(cX3) organization or a section

49a7@)(1) nonexempt charitable trust.

)

Attach to Form 990 or Form 9S0-EZ.

)

2@11

See separate instructions.

Name of the organization

Employer identif ication number

l-)cl lilar Cenirnunity Connections

33 Cg38S85

instructions.

The organization is not a private toundation because it is; (For lines 1 through 11, check only one box.)

A church, convention of churches, or association of churches described in section 170(bXlXAX0.

A

n school described in section 170(bXlXAXii). (Attach Schedute E.)

A hospital or a cooperative hospitalseruice organization described in section 17O(bXlXAXli|.

l) A medical research organization operated in conjunction with a hospital described in section 170(bXlXAXiii). Enter the

hospital's name, city, and state:

1 !

2

3 fl

4

5[

An organization operated tor ttre ii-endfil oi-e-aoi6blt oii;nliEi-s],it-own;ei

section 170(bXlXAXiv). (Complete Part ll.)

il

oE];iaT bt a !i;i,;iiim6niai-u;it d;$;iGa-in

6 ! A federal, state, or local government or governmental unit described in section 17o(bXlXAXv).

7 @ An organization that normally receives a substantial part of its support from a governmental unit or from the general public

described in section 170(bXlXAXvi). (Complete Part lt.)

8 fl A community trust described in section 170(bXlXAXvi). (Comptete Part tt.)

9 D Rn organization that normally receives: (1) more than 331/s% of its support

from contributions, membership fees, and gross

receipts from activities related to its exempt functions-subject to certain exceptions, and (2) no more than 33i/g% of its

support from gross investment income and unrelated business taxable income (less section 51 1 tax) from businesses

acquired by the organization after June 30, '1975. See section S0O(aX2). (Complete Part lll.)

10 fl An organization organized and operated exclusively to test for public safety. See section 509(aXa).

11 lAn organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the

purposes of one or more publicly supported organizations described in section 509(aX1) or section 509(aX2). See section

509(aX3), Check the box that describes the type of supporting organization and complete lines 1 1e through 1 t h.

b [] TYPe ll

d n Type lll-Other

c n Type lll-Functionally integrated

D Typel

e D gy checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons

other than foundation managers and other than one or more publicly supported organizations described in section 509(aX1)

or section 509(a)(2).

f lf the organization received a written determination from the IRS that it is a Type I, Type ll, or Type lll supporting

organization, check this box

D

g Since August '17,2006, has the organization accepted any gift or contribution from any of the

following persons?

(i) A person who directly or indirectly controls, either alone or together with persons described in (ii) and

(iii) below, the governing body of the supported organization? .

(ii) A family member of a person described in (i) above? .

(iii) A 35% controlled entity of a person described in (i) or (ii) above? .

h Provide the following information about the supported

a

{i} Name of supported

organization

(iiil Type of organization

(vii) Amount ol

(described on lines 1-9

above or IRC section

(see instructons))

support

(A)

(B)

(c)

(D)

(q

For Papenvork Reduction Act Notice, see the lnslructions

Form 99O or 990-EZ.

for

Cat. No. 11285F

Schedulg A (Form 990 or 990-EZl 2011

Version A, cycle

Schedule A (Form 990 or S90-E4 201

Pase2

1

li@llSupportSchedulefororganizationsDescribedinS

(Complete only if you checked the box on line 5,7, or 8 of Part I or if the organization failed to qualify under

Paft lll. lf the organization fails to qualify under the tests listed below, please complete Part lll.)

Section A. Public

)

Galendar year (or fiscal year beginning in)

'l Gifts, grants, contributions,

Total

and

membership fees received. (Do not

include any "unusual grants.")

71!;01

Tax revenues levied for

the

organization's benefit and either paid

to or expended on its behalf

The value of services or

facilities

furnished by a governmental unit to the

organization without charge .

4

Total. Add lines 1 through 3

5

The portion of total contributions by

19000

1 A

.

lita

584822

each person (other than a

governmental unit or publicly

suppofted organization) included on

line 1 that exceeds 2%o of the amount

shown on line 11, column (f)

Public

.

Subtract line 5 from line 4.

B. Total

Galendar year (or fiscal year beginning in)

7

8

58482?.

)

Total

Amounts from line 4

Gross income from interest, dividends,

payments received on securities loans,

rents, royalties and income from similar

584',d22

sources

9

Net income from unrelated

business

activities, whether or not the business

is regularly canied on

10

Other income. Do not include gain or

loss from the sale of capital assets

(Explain in Pad lV.)

11

12

13

16a

b

7

through '1 0

61 7505

Gross receipts from related activities, etc. (see instructions)

First five years. lf the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501

organization, check this box and stop here

E I t {;$:t

of Public

Section C.

14

15

.

Total support. Add lines

94.7 o/o

Public support percentage tor 2011 (line 6, column (0 divided by line '1 1, column (f))

{t?..3 0/o

Public supporl percentage from 2010 Schedule A, Part ll, line 14

filoo/o support test-2011. lf the organization did not check the box on line 13, and line 14 is 331tsyo or more, check this

boxandstophere.Theorganizationqualifiesasapubliclysupportedorganization>

$1rs%o suppon

test-2010. lf the organization did not check a box on line 13 or 16a, and line 15 is 331rsolo or

more,

checkthisboxandstophere.Theorganizationqualifiesasapubliclysupportedorganization>

a

n

17a 107o-facts-and-circumstances test-2011.

lf the organization did not check a box on line 13, 16a, or 16b, and line 14 is

more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in

Part lV how the organization meets the "facts-and-circumstances" test. The organization qualifies as a publicly supported

organization

1oo/o

b

18

1

or

tr

10%-facts-and-circumstances test-2010. lf the organization did not check a box on line 13, 16a, 16b, or 17a, and line

15 is 10% or more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here.

Explain in Pad lV how the organization meets the "facts-and-circumstances" test. The organization qualifies as a publicly

supported organization

Private foundation. lf the organization did not check a box on line 13, 1 6a, 1 6b, 17a, or 17b, check this box and see

instructions

Schedule A (Form 99O or 99O-EZI2O11

Schedule A (Form 990 or 990-EZ) 201

U!flUl

1

Page

Support Schedule for Organizations Described in Section 5tt9(a)(2)

(Complete only if you checked the box on line 9 of Part I or if the organization failed to qualify under Part ll.

lf the

fails to

under the tests listed below,

Part I

Section A. Public

Calendar year (or fiscal year beginning in)

1

2

3

)

Gifts, grants, contributions, and membership fees

received. (Do not include any "unusual grants.')

Gross receipts lrom admissions, merchandise

sold or services performed, or facilities

furnished in any activity that is related to the

organization's tax-exempt purpose

Gross receipts from activities that are not an

unrelated trade or business under section

for

Tax revenues levied

51 3

the

organization's benefit and either paid

to or expended on its behalf

The value of services or

6

7a

facilities

furnished by a governmental unit to the

organization without charge .

Total. Add lines 1 through 5 ,

Amounts included on lines 1, 2, and 3

received from disqualified persons

Amounts included on lines 2 and 3

received from other than disqualified

persons that exceed the greater of $5,000

or 1Yo of lhe amount on line 13 for the year

I

c Add lines TaandTb

Public support (Subtract line 7c from

line 6.)

.

B. Total

Galendar year (or fiscal year beginning in)

9

10a

)

Amounts from line 6

Gross income lrom interest, dividends,

payments received on securities loans, rents,

royalties and income from similar sources

b

Unrelated business taxable income (less

section 511 taxes) from businesses

acquired after June 30, 1975

c

11

.

Add lines 10a and 10b

Net income from unrelated

business

activities not included in line 10b, whether

or not the business is regularly carried on

12

Other income. Do not include gain or

loss from the sale of capital assets

13

Total support. (Add

(Explain in Part lV.)

.

10c, 11,

and 12.)

14

First five years. lf the Form 990 is for the organization's first, second, third, fourth, or

organization, check this box and stop here

15

16

Public support percentage for 201 1 (line 8, column (0 divided by line 13, column (f)

Public support percentage from 2010 Schedule A, Part lll, line 1 5

tax year as a section 501(cX3)

of Public

%

o/o

of lnvestment lncome

17

18

19a

b

ZO

%

lnvestment income percentage for 2011 (line 1 0c, column {0 divided by line 13, column (f))

%

lnvestment income percentage from 2O1O Schedule A, Part lll, line 17 .

331rs7o support tests-2011. lf the organization did not check the box on line 14, and line 15 is more than 331rso/6, and line

17 is not more than 331rso/o, check this box and stop here. The organization qualifies as a publicly supported organization > !

331rso/osupporttests-2010. lftheorganizationdidnotcheckaboxonline14orlinelga,andline16ismorethan33lroo/o,and

line 18 is not more than 331n%, check this box and stop here. The organization qualifies as a publicly supported organization > n

Private foundation. lf the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions ) n

Schedule A (Form 99O or 990-EZ) 2011

3

eage4

instructions)'

schedule A (Form

99O or 990-EZ! 201'l

SCHEDULE G

(Form 990 or

Depariment of the Treasury

lnternal Revenue Service

Sqpplqm_eqtal lnformation Regarding

Fdndraising or Gaming ActiVities

-

OMB No. 1545-0047

Complete it th€ organization answered ,Yes( to Form 990, Part lV, lines 17, 18, or 19, or if th€

organization entored more than $15,000 on Form 990-EZ, line 6a.

> Attach to Form gOO or Form 990-eZ > Se€ separato inatuctions.

2@1t

the organization

Del Mar fji)mmunitv Ccnncoliollr;

r@F:#a"r'1??fj,lTi"";3iff,,?.3,j"ff

1

a

b

c

d

2a

"T"?,1'"11?J€nswered"Yes"toForm

lndicate whether the organization raised funds through

any of the following activities. Check all that apply.

uaitsolicitations

Soticitation of non-government grants

Solicitation of government grants

lnternet and email solicitations

Phone solicitations

Specialfundraising events

fl ln-person solicitations

Did the organization have a written or oral agreement with any individual (including otficers, directors, trustees

or key employees listed in Form 990, Part Vll) or entity in connection with professional fundraising services? f] Yes fl tto

lf "Yes," list the ten highest paid individuals or entities (fundraisers) pursuant to agreements under which the fundraiser is to be

compensated at least $5,000 by the organization.

en

f n

gI

n

I

f]

(vilAmount paid to

(il Name and address of individual

or entity (fundraise0

(or retained by)

organization

10

List all statei in which the organization is registered or licensed to solicit contributions or has been notified it is exempt from

registration or licensing.

Paperwork Feducton Act Notice, se6 the lnstructions for Form

9{X)

or 99O-EZ.

Cat. No. 50083H

Schedule G (Form 9gO or

990'ul- m1l

Schedule G {Form 990 or 990-E4 201

Ulsll

eage2

1

Fundraising Events. Complete if the organization answered "Yes" to Form 990, Part lV, line 18,

oi

ieported more

than $15,000 of fundraising event contributions and gross income on Form ggO-EZ,lines 1 and 6b. List events with

receipts greater than $5,000.

(b)

Event #2

Gti*:st bar tcnrlor

(cl Otherevents

l.,4omoii;il walk

o)

o)

q)

E

1

2

Gross receipts

Less: Charitable

contributions

3

Gross income (line 1 minus

line 2) .

4

Cash prizes

5

Noncash prizes

0l

o

C

6

RenVfacility costs

o.

7

Food and beverages

8

Entertainment

9

Other direct expenses

o

q)

X

IU

o

c)

.!

o

1O

l1

ii187

3431;

fii,,.

Direct expense summary. Add lines 4 through 9 in column (d)

Net income summary. Combine line 3, column (d), and line 10

answered "Y

orm 990,

,

or reported more

{d) Total gaming (add

col. (a) through col. {c))

I

a

Enter the state(s) in which the organization operates gaming activities: _-__ls the organization licensed to operate gaming activities in each of these states?

b

lf "No," explain:

1Oa

b

Were any of the organization's gaming licenses revoked, suspended or terminated during the

lf "Yes," explain:

- -v;;-n-N;

laxyear?

tr

Yes

n

No

Schedule G {Form 99o or 99O-EiZl2g11

)

Schedule G (Form 990 or 990-FZ) 2011

11

12

eage

ls the organization a grantor, beneficiary or trustee of a trust or a member of a partnership or other entity

formed to administer charitable gaming?

13

lndicate the percentage of gaming activity operated in:

a The organization's facility

b An outside lacility

14 Enter the name and address of the person who prepares the organization's gaming/special events books and

records:

Name

b

c

)

Does the organization have a contract with a third party from whom the organization receives gaming

revenue?

lf "Yes," enter the amount of gaming revenue received by the organization

amount of gaming revenue retained by the third pafty > $

lf "Yes," enter name and address of the third party:

Name

)

tl

$

Yes

n

No

and the

)

Address

16

EYesIHo

)

Address

15a

)

Gaming manager information:

Name

)

Gaming manager compensation

Description of services provided

n

Director/otficer

D

Employee

f]

lndependent contractor

Mandatory distributions:

17

a

ls ihe organization required under state law to make charitable distributions from the gaming proceeds to

retain the state gaming license?

b

[l@|

3

EYesnruo

Does the organization operate gaming activities with nonmembers?

nYesnNo

Enter the amount of distributions required under state law to be distributed to other exempt organizations or

spent in the organization's own exempt activities during the tax year

$

>

Supplemental lnformation. Complete this part to provide the explanations required by Part I, line 2b,

columns (iii)and (v), and Part lll, lines 9, 9b, 10b, 15b, 15c, 16, and 17b, as applicable. Also complete this

paft to

any additional information (see instructions).

Schedule G {Form glxl or 99O-EZ) 2O1 l

SCHEDULE O

(Form 990 or

OMB No. 1545-0047

Supplemental lnformation to Form 99O or 99O-EZ

Department of the Treasury

lntemal Revanue Service

2@ll

Complete to provide information for respons€s to specific questions on

Form 990 of ggO-EZ or to provlds any addltlonal inforriatlon.

> Attach to Form 990 or 990-EZ.

Name of the organization

Employer identificalion number

Dul Mrr Comnlunity Conrrections

33 09388C5

9g0EZPartl, lineS: Futtdsremovedfromrestriction$187,payroll taxandinstirancercfunds$736

For Paperwork Reduction Act Notice, see the lnslructions for Form 9fl) or 990-EZ.

Cat. No.

51056K

Schedule O (Form

$n

or 990'EZ) (2011)

,.",,''

Application for Extension of Time To Flle an

Exempt Organization Return

8868

(Re,'. Janijary 2012)

)

Depa4n?nl of lhe Treesl'),

Inteintl Rs', Jii,e SslY;c?

O[,iB No. 1545-1709

File a separate application for each return.

rlfyouarefiiingforanAutomatic3.MonthExtension,cornpleteonlyPartlanclcheokthisbox.>

r lf !,ou are filing tor an Additional (Not Automatic) 3-Month Extension, complete only Part ll (on page 2 of this form).

Do not complete Part ll unless you have already been granted an automatic 3-month extension on a previously filed Form 8868.

Electronic filing (e-f,te). You can electronically file Form 8868 if you need a 3-month automatic extension of time to file (6 months for

a corporation required to file Form 9S0-T), or an additional (not automatic) 3-rnonth extension of time. You can electronically file Form

8868 to request an extension of time to file any of the forms listed in Part I or Parl ll rvith the exception of Form 8870, lnformation

Return for Transfers Associated With Certain Personal Benefit Contracts, which must be sent to the IRS in paper format (see

instructions). For more details on the electronic filing of this form, visit ututvt.irs.gov/efile and click on e-file for Charities & Nonprofits.

A corporation required to file Form 990-T and requesting an automatic

Part

lonly

-month extension-check this box and complete

> f]

All other corporations (including 1120-C filers), partnetships, RElvllCs, and trusts must use Form 7004 to request an extension of time

to file income tax retums.

Enter tiler's identifying nunrber, see instructions

Type or

Del

print

Fr

e

Cie

Errrployer icientification nunrber (ElN) ot

Na.lte ol exenrpt orgaaizatioir or other {tler, see ir.:str'uclior:s.

Connections

tular

33 0938895

Social security nurlrtrer (SSN)

Nurrrber, street, anci rocnr or suite no. if a P.O. box, see instruclicr.rs.

b),iie

Ciaie iD'

i, lq !|ir

P. O. Box 2947

Ci\r. tot'rrr or post ofiice, state, a'rd ZIP cocie

iLriu, rr. s3E

a loreign aocirsss, see instruciions

Mar, CA 92014

F-l-il

Enter ihe Return code for ihe return that this application is for (file a separate application for each retltrn)

Application

ls For

i

Forrn 990

Form 990-B[.

Form 990-EZ

Form 990-PF

Form 990-T (sec. 40'1 ia) or

Folm 990-T (trust otlter than above)

o

The books are in the care of

)

Return

Code

o2

01

Beturn

Application

ls For

Code

07

Form 990-T

Forrn 1041-A

Form 4724

Form 5227

Form 6069

Form 8870

OB

12

Kathy Finnell

)

- _-__---

No.

FAX

Tereprrone No.

_

_!!!_!91-!3!L.

______-_---- . ---9"!9_-i-911_1_59-_rtot ha'.,e an office or place of business in ihe United Staies, check this box .

does

lf

the

organizaiion

'r

. lf this ls

lf ihis is for a Group Return, enter the organization's four digit Group Exernption Number (GEN)

and

attach

r.,.rhole

group,

group,

this

part

this

box

check

. lf ii is for

check

fJ

of the

for the

a list r';itir the names and ElNs of all members the extension is for.

I request an ar-rtomatic 3-month (6 months for a corp:oration required to file Form 990-T) extension of time

until _ _- - __f9-!-]_!r_-____ - , 2A .11-, to file the exempt organization return for tlre organization named above. The extension is

for the organization's return for:

or

> calendar year

box

. >[

)

> fl

1

I

20

> E tax year beginning

June 30

"-_-."_"..-"-.ty_LIl_-- _ ..--- _ -, , 20 -_-11 _ , and ending ..__-__._____

lnitial return

D Final return

if iire tax year entered in line 1 is for less tl'ran 12 months, checl< reason:

Change in accounting Period

3a lf this application is for Forrn 990-BL, 990-PF, 990-T, 4720, or 6069, enter the teniative tax, less any

nonref undable credits. See instrttctions.

b lf this application is tor Form 990-PF, 590-T, 4720, or 6069, enter any refr-rndable credits and

estimated tax payments made. lnclude any prior year overpayrnent allor,ved as a credit.

3b

ttrrs torm),'tt r-eq*r"d-, bt ,"ins

Balance Aue. Subtracitirre SOfrbm iineTa. trrituae your fiayment

" EFTP$ (Electronic Federal Tax Payment Systenr). See instructions.',vittr

3c l$

Caution. if you are golng to niake arr eleclronic {unci r"iithcirar",,al vJith this Fornr 8868, see Form 8453-EO and Form 8879-EO for payment inslruciions,

Forrn Uts6U (Fte!. 1-2012)

Cat. No.27916D

For Privacy Act and Paperwork Reduction Act Notice, see lnstructions.

2

il

--

n

20t245

c7. 67 20t206 670

086947

3345

92014

29404-287-50873-2

K

:130938895

IITS USF] ONI-Y

A0124r88

]'E

For assistance, call:

ffiql

t-877-829-5s00

f,{ilt+'t;'j;i:Tj':?

Notice Number: CP2l

Date: Novernber

lA

19, 2012

Taxpayer ldentilication Nnmber:

o2t902-!27972.0082.002 1 AT 0.374

373

t,ltlltl,hlt,il11tr1rl111'r1h111t"1111'il'lllrrllt1ll1rl1rrrrl

33-0938f195

Tax Form: 990

I'ax Period: .lune 30, 2012

DEL MAR COMMUNITY CONNECTIONS

Po Bsx ?e47

DEL MAR CA 920L4-5947

P.1::;4

ITI-r+

liEr=

02t902

APPLICATION FOR EXTENSION OF TIME TO FILB AN BXEMPT

ORGANIZATION RETURN . APPROVED

We received and approved your Forrn 8868, Application for Extension of Time to File an Exempt

Organization RetLlrn, tbr tlie return (form) and tax period identified above. Your extetrded due date to file

your retum is February 15, 2013.

When it's time to file your Form 990,990-IF.Z.,990-PF or I 120-POL, you should consicler filing

electronically. Electronic tiling is the fastest, easiest and most accurate way to file your return. For more

infbrmation, visit the Charities and Nonprofit web at www.irs.gov/eo. This site will provide infbrmation

about:

-

The type of retums that can be filed electronically,

approved e-File providers, and

if you are required to file electronically.

If you have any questions, please call us at the number shown above, or you may write us at the address

slrown at the top of this letter.

Page

I

2r

3

lA

TAXABLE YEAJ?

Galifornia Ex

Annual

2Afi

0rganization

r99

Return

01

CalendarYear 201 1 or fiscai year beginning month

year

Corporat,oniorganization Nanre

corporatron number

259686

33093889

Del Mar Communitv Conneclions

Adciress (suile, rcom, or PfuiB no.)

!N

OBox2947

P

Cily

ZIP Code

Del Mar

92014

.......flYes di,ro

A FirstRelurn.

.......O fYes dtuo

B AmendedFelurn..

C lRCSection4947(a)(1)tiust... .......[Yes Mwo

D Final Return

.......[Yes Mitto

.,

lf exempt under B&TC Section 23701 d. has the organizati0n

during the year: (1) participaied in any political campaign,

0r (2) attempted to influence legislation or any hallot l''reasure,

or (3) made an eleciion under R&TC Seciion 23704.5

(relaiing t0 lobbying by public charities)?. .

O DDissolved O[1Sun'enCered (Withdrarvn)

!

a

lv'lerged/Reorganized Enter date:

a

_l _l

ls the organization exempl under R&TC Section 23701g?

Check accounling meihocl:

Federal return liled?

(2)af]9e0(PF) (3)aflsch

ls this a group liling for the subordinates/af{iliates?. . .

H

ls this ofganizati0n in a group exemption?

lf "Yes. ' r,;hat is ihe parent's nanre?

L

qfoE

H (e90)

G

.

.

o [Yes

L

dtuo

If "Yes." atlach a r0ster. See instruclions

I

.. Iyes druo

.

O

[Yes

[diVo

goveining instrilmeni, afiicles 0f incorporation. or bylalis

that have not been repcried r0 ihe Franchise Tax Bcard? .

.l f,Yes

lf organization is exempt under R&TC Section 23701 d and is

exclusively r'eligious, eCucational, or charitable, and is

supp0iied primarily (500./o or more) by pubiic contributions,

checkbox.l,Joiilingfeeisrequired.

H

N

Did the 0rganizaiion ha,ie any changes in iis acrivities,

lf

l-lYes VlNo

lf 'Yes." enier ihe qr0ss receipls frcm nonmember'

ir)ilCash (2)flAccrual (3)n&her

(r).Iee0T

.t

.

lf ''Yes." complete and attach form ffB 3509

dNo

..........atr

lsthe oiganization a Limited Liability Companv? . .

.. ... . O

Did tlte organizallon lile Fotm 100 or Fonn 109 to tepott

llYes

Efttto

laxable income'i

O

[Yes [dNo

ls ihe orqanization under audit by ihe IRS or has lhe

IRS audited in a prior year?

O

L

iYes

l1lNo

Yes." explain, and airach copies of revised documents.

Parl

i

i

I

Receifls

and

I

I

Revenuesl

I

1 Gross sales

or receipts frcm olher sources. From Side 2, Pan ll, line

2 Gross dues anci assessnlents lronr rnernbers and afliliates . . .

a

B

,

,

o

3 Gr0ss c0ntrilruti0ns. gifts, grants, and sinrilar amounis received

4 Total qross receipts for liling requirement test. Add line 1 through line 3.

This line musl be compleled. lf the result is less than $25,000. see General lnst

I

5

Costofgoodssold....

6 Cost oroiherbasis.and salesexpenses

...

0fassetssold

.......... a

....... a

7 Toial costs. Add line 5 and line 6

8

Expenses

9 Total expenses and disbursenrents. Fionr Side

2 Pafi

ll, line i B

s

Flllng

Fee

jrr

Filing fee $i 0 or $25. See General lnstruciion

i't2

Total paynrents

lrs

lra

Use iax. See General

Penalties and lnterest. See General lnsrruction

lnstrucii0n

1

1

linc

F

J . . .. .

.

K

'1

liue, correct, and corp,ete, Declaratlor of preonrer iolher than taxpayef) is based on all informalron of whjch prepnrer has any knowiedge.

Title

Date

,

ll'Teiepno;ie

Sicrature

of-cfirce;

)

Treasurer

i)/is/t?'l

r asa \7s2-rs6s

Preoarer's

onati,te )

Paid

<

Preparer's

Use Only

Firms name (or yoLrrs,

if se,f-employed)

and address

For Privacy Notice, get form FTB 1131,

3651113

Form 199cr 20'11 Side

1

partll

Organizalionswilh0r0ssroceiptsolmorelhan$2S,000andprivrleloundalionsregardlessolamounlolgrossreceiplscomplete Part ll or furnish subslilute inlotmation. See Specilic Line lnshuclions.

1 Grosssalesorreceiptsfrcmallbusinessaclivities.

Seeinstructions

.........O

2 lnterest.

SDividends.

Grossrents...

Grossroyalties.

Reeeipls

trorn

4

5

6

0lher

Sources

......a

..........O

........O

Gross am0unt received from sale of assets (See

lnstructions) . . . .

.

T0therincome.Attachschedule

.....O

I

Tolal gross sales 0r receipls from other sources. Add line 1 through line 7.

g

Contribulions,gifis,grants,andsimilaranrountspaid.Attachschedule

Enler here and on Side 1. Pari l, line

1

,,.

11 Compensation oi oflicers, directors, and trustees. Attach schedule.

12

Other salaries and H'ages. .

Erpenses

and

13 lnierest.

DisbursemBnls

14

.......a

...........O

DisbursementstooIformembers.

'10

.

o

a

Taxes

lSRents

16 Depreciaiionanddepletion(Seeinsti'uctions)......

17 0therExpensesand Disbursements.Altach schedule.

..........a

.....a

...........O

17 Fnter

Schedule

L

Balanse $heels

End ol

ol laxable

larabls

Assels

1 Cash

2 Net accorinis receivable

3 ilet noies receivable

4 lnventories

5 Federal and state government oblioalicns.

6 lnvesimenlsinoiherbonds. ..........

7 lnves:ntents in siock.

I l.,4ortgage loans

I 0thsr in'/eslmenls. Attach scheCxle .

257.855

.

I

.

1

0

a Depreciable assets

.

b Less accuntulaieC depreciirtion . .

11

12

0tlrer assets. Aitach scl'edLlle

13

Toial assets.

.

q2,0e6

.

L-anci

B5

Liahililies and nel worlh

14

15

Accourtts payable

Contfibuii0ns. gifts, or grants pal,/able

Bcnds and r:otes payable..

.

16

17

18

19

|Jo;rgages pa'7able

.

0ther liabililies. Aitach schedule

Capital stock or principle fund. .

20

21

Paid"in or capital surplus. Attach reconciliation

Reiained earnings 0r income

fund . .

.

339,951

.

320.037

liabil ities

per bool(s with income per telurn

D0 n0tcornplete this schedule ifthe amount on Schedule L, line 13, column (d), is less than $25,000

1

2

3

4

lncome recorded on books this year

Net incorne pet books

Fet|eral

incore tar

not included in this return.

Excess of capital losses over capital gairts. .

Attach scl'edule

.

lncome not recorded on bcoks this

Deduciions in ihis return n0t charged

year: Aitach sclreCule

agains: book income this year.

Expenses recorded on books this year noi

deducied in ihis reiurr'r. Attach schedule

6

g

.

10

Total.

Add line 1 through lino

Side

2

Forrn

199ct

5,.

2011

..

.

19,727

3652rL3

Atlach scherlule

Total. Arld line 7 and line

B

Net income per rcturn.

Sublract line 9 irom line 6

ne.727\

DEL MAR COMMUNITY CONNECTIONS

SUPPORTING SCHEDULE FOR FORM 199

30Jun-12

Part l, line 3

Contributions and grants

Program service revenue incl government fees

Fund raising income

78057

44204

20922

143L83

Pe$-l!.&s

7

Payroll tax and worker's comp ins. refunds

Part ll, line 17

Professional fees

Printing and postage

Vehicle maintenance

3378

2956

2042

Senior lunches

L275

Health, legal and social service costs

ln-home service costs

Communications incl internet and phone

2ZA3

1013

Insurance

6233

9198

Storage

1.L76

Other

2795

32269

ANNUAL

REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

MAIL TO:

Registry of Charitable Trusts

P.O. Box 903447

Sacramento, C A I 420347 0

Telephone: (91 8) 44C2021

Sections 12586 and 125/i7, Calitornia Government Code

11 Cal. Code Regs. sections 301-302,3i1 and 3i2

VVEB SITE ADDRESS:

i,: :.

i.i;.:,,.r

r, {:.,r,/,/t:;liti

;1

Failure to submit thls report annually no later than four months and fifteen days after tha

end ofthe organization's accounung period may result in the loss oftax exemption and

the assessment of a minimum tax of 1800, plus lnterest, and/or fines or filing penalties

as definod ln Govornment Code secuon I 2586.1. IRS extensions will be honored.

il'i;i

State Charlty Registtatlon Number

119626

Check if:

flctrange

Del Mar Community Connections

Name of organlzatlon

EAmended rpport

P O Box2947

AdcF$

(NUmbOr

of address

tnd streetl

Corporate or Organization No.

DelMar, CA92014

Clty or To$m, Stlte end AP Codo

Fede.at Emptoyor l.D.

No.

2259686

J

33 0938895

ANNUAL REGISTRATION RENEWAL FEE SCHEDULE (11 Cal. Code Regs. sections 301-307,311 and 312)

Make Check Payable to Attorney Generat's Rogistry of Charitabte Trusts

Gross Annual

Revenue

$25,000

$1@,000

Less than

Between $25,000 and

Revenue

GrossAnnual

Fee

$250,000

million

Between 100,001 and

Bstween $250,001 and $1

0

$25

Fevenue

Fee

GrossAnnual

$50

$75

Bstween $1,000,00{ and $10

Between $10,000,001 and $50

Greater than $50

million

Fee

mllllon

million

$150

$225

$3(X)

PART A . ACTIVITIES

Foryourmostrecentfullaccountlngporiod(beglnnlng

Gross annual revenue

$

7

145633

t1

t11

Totat assets

ending

$

6

/30 r12

;tist:

320037

PART B . STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note:

lf you answer "yes" to any of the questions below, you must attach a separate sheet providing an explanation and detalls for each "yes"

response, Ploase rsview RRF.I instructions for information required.

Ygs

officer. director or lruslee thereof either directly or with an entity in which any such officer, director or trustee had any financial interest?

2.

3.

4.

During this reporting period, was there any theft, embezzlemenl, diversion or misuse of the organization's charitable property or funds?

During this reporting period, did non-program expenditures exceed 50% ofgross revenues?

During lhis reporting period, were any organization funds used to pay any penalty, fine or judgment? lf you filed a Form 4720 with the

lntemal Revenue Service, attach a copy.

5.

Duringthisreportingperiod,weretheservicesofacommercial

6.

During this reporting period, did the organization receive any governmental functing? lf so, provide an attachment listing the name of

the agency, mailing address, contact person, and telephone number.

7.

During this reporting period, did the organization hold a raffe for charitable purposes? lf "yes," provide an attachment indicating the

number of raffles and the date(s) they occurred.

8.

Does the organization conduct a vehicle donation program? lf "yes," provide an attachment inclicating whether the program is operated

by the charity or whether the organization contracls with a commercial fundraiser for charitable purpoaes.

9.

fundraiserorfundraisingcounsel

provide an attachment listing the name, address, and telephone number of the service provider.

organization's e-mait

(

858

.)-

792

7565

t_l

forcharitablepurposesused? lf"yes,"

Did your organizition have prepared an audited financial statement in accordance wilh generally accepled accounting principles for this

reporting period?

Organizalion's area code and telephone number

n

No

,<

il

xl

x

x

x

tFl

r

r

,C

n tE

email@dmcc'cc

address

I declare under ponalty ol potiury that I have examined thig repoG including accompanying documents, and to the beet of my knowledge and bollef,

It is true, correct and complete.

RRF-i (3-05)

DEL MAR COMMUNIW CONNECTIONS

33 0938895

Supporting Schedule for RRF-I

June 3O 2012

Part B, line 6:

Funding was received from:

The City of Del Mar

Mercedes Martin

1050 Camino del Mar

DelMar, CA920L4

8587552794

The County of San Diego

Mark Olson

L500 Pacific Coast Highway #335

San Diego, CA 92101

619 532 5533

Part B, line 7

A raffle was held on March 19,20L2.