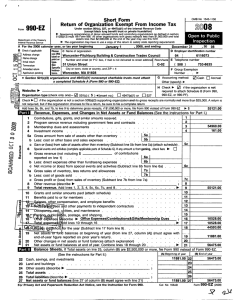

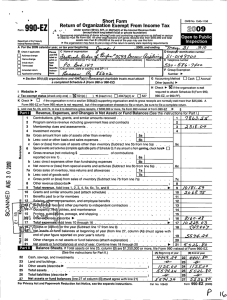

Short Form Form 990-EZ Return of Organization Exempt From

advertisement

C(Qo3

Form

99 0-EZ

Department of the Treasury

Internal Revenue Service

Short Form

Return of Organization Exempt From Income Tax

OMB No. 1545-1150

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

2005

^ For organizations with gross receipts less than $100,000 and total assets less

than $250,000 at the end of the year.

^ The organization may have to use a copy of this return to satisfy state reporting requirer

A

For the 2005 calendar year, or tax year beginnin g

B

Check if applicable :

Address change

Name change

Initial return

4/01

2005, and endin g

% s Order of the Sons of Italy in America

'a" or P , 0

Box 994107

not or

Redding, CA 96099-41077

Specific

Amended return

Instruc'

dons

D

Employer Identification number

E

Telephone number

95-3249153

F Group Exemption

Number ........ ... 10-

App lication pending

G Accounting method: X] Cash []

Other (specify) ^

0 Section 501(cX3) organizations and 4947(a)(1) nonexempt charitable trusts

must attach a completed Schedule A (Form 990 or 990-EZ)L

I

J

K

2006

3 /31

C

Final return

s;Open to Public.,

Accrual

H Check ^ J if the organization is not

Web site: - N/A

required to attach Schedule B (Form 990,

99O-EZ, or 990-PF).

0 anization

X 501 (c

a check onl one 8

( insert no.)

14947(a)(1) or

527

Check ^

if the organization's gross receipts are normally not more than $25,000. The organization need not file a return with the IRS;

but if the organization chooses to file a return, be sure to file a complete return. Some states require a complete return.

L

Add lines 5b, 6b, and 7b, to line 9 to determine gross receipts ; if $100,000 or more , file Form 990

.......... .... I $

Instead of Form 990-EZ ............ ............... ...................... ...... .. ..

Par}.ip

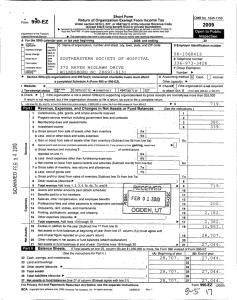

Peven1rP _ FYne_ ncec _ and Channec in Net Accptc nr Fund Ralancec (SPP Incfriie-finncl

1 Contributions, gifts, grants, and similar amounts received ............ ...................... ........ 1

..... 2

2 Program service revenue including government fees and contracts .... ...............

3 Membership dues and assessments..... ........... .............. ............................... . 3

4 Investment income .. ....... ..... .............. .............. ....... .............

5a Gross amount from sale of assets other than inventory .

R

E

N

uE

ie

x

E

5

5

6

................

5b

b Less: cost or other basis and sales expenses ....... .....................

5b

''`'

AIR

Sc

of contributions

a Gross revenue (not including $

......................

6a

86 350

reported on line 1) ..............

b Less: direct expenses other than fundraising

6 b1

56 , 439.

6c

7 c Net income or (loss) from special events and activities (line 6a less line 6b). See. .Statement .1...

a

a Gross sales of inventory, less returns and allowances......... .

7b

b Less: cost of goods sold ....................... .......... .............

......................

7c

c Gross profit or (loss) from sales of inventory (line 7a less line 7b)..........

Other revenue (describe ^

l .. 8

.... ^ 9

..... ......... .. ........... ..... . ..

-Le Total revenue add lines 1, 2 3 4 5c 6c 7c and

0 Grants and similar amounts paid (attach schedule) .................... ..See Statement 2...... 10

Benefits paid to or for members ...........

...

cr. .....

Salaries, other compensation, and employe b

..

Professional fees and other payments to in

l ..

nde^ltrco0trI cl

Occupancy, rent, utilities, and maintenance

...... ...............

Printing, publications, postage, and shippin ...

6

Other expenses (describe ^

853.

....... .

c Gain or (loss) from sale of assets other than inventory (line 5a less line 5b) (attach schedule) ........ .......... ...

Special events and activities (attach schedule). If any amount is from gaming , check here..

1

2

3

4

5

87 , 745.

. . . . . . . . . . . . ......... .......

................. ..........

....... .................. ..

.......

....... ................ . ..

........................ .. . .

^ I S MANAGEME NT

OGDEN

29 , 911.

31 , 306.

5,932.

11

12

13

14

15

111111111111M TIM 1Z See Statement 3 ) .... 16

510.

17

Total expenses (add lines 10 throug h 16) ..........................................

. .......... . 0' 17

6 , 442.

18

Excess or (deficit) for the year pine 9 less line 17) ........................ ......... ............ . .. 18

N e t asse ts or f un d b a l ances a t b eg i nn i ng o f year ( from li ne 27 , column (A)) ( mus t a g ree with end-of- y ear

24 , 864.

N s 19

77 , 936.

figure reported on prior year's return) ............. .............. ... . ............................ 19

T T 20 Other changes in net assets or fund balances (attach explanation ) . ... .. ....................... .... 20

S

102 , 800.

21 Net assets or fund balances at end of year (combine lines 18 throug h 20) . ...... ............. .. . le' 21

are $250 , 000 or more file Form 990 instead of Form 990-EZ.

Pa rt II '

Balance Sheets - If Total assets on line 25 , column

(See Instructions)

(A) Be g innin g of ear 1

(13) End of year

54 , 804.

22 Cash, savings, and investments ............ ............................ ..........

77 , 936. 22

13 , 113.

23 Land and buildings .... .............................. ....... ....................

23

E E

24 Other assets (describe ^ See Statement 4

).............. .....

25 Total assets .................................................... .................

26 Total liabilities (describe ^

) .. ...........

27 Net assets or fund balances ine 27 of column

must ag ree with line 21 ) .......

BAA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

24

77 , 936. 25

34 , 883.

102 , 800.

0. 26

77 , 936. 27

0.

102 , 800.

TFEa08o3L o2/ovo5

Form 990-EZ (2005)

Part IIIA'' Statement of Prog ram Service Accom plishments (S ee

N/A

Instructions )

Expenses

(Required for 501 (c)(3)

What is the organization's primary exempt purpose?

Describe what was achieved in carrying out the organization's exempt purposes. In a clear and concise manner,

nhP fhP ennnrne nrnvid d fhP n.imhor of nPrs nnC hPnPfifM or ot h er relevant information for each

and (4) organizations and

racC

4947(a)(1) trusts : optional

program title.

28

---------------------------------------------------------------------------------------------------------------------------------------------------If this amount includes forei g n rants check here ..............

Grants $

29 ---------------------------------------------------

for others.

8a

---------------------------------------------------------------------------------------------------If this amount includes forei n rants check here ..... ..... ....

Grants $

9a

30 ------------------------------------------------------------------------------------------------------------------------------------------------------.............

If this amount includes forei g n rants check here

Grants $

0a

31

Other program services (attach schedule) ........ ............................ .........................

If this amount includes forei g n g rants, check here ..............

(Grants $

31 a

32

Total p rog ram service expenses (add lines 28a throu g h 31a .. .................... . .... ...........

Part IV- List of Officers , Directors Trustees and Key Em to ees (List each one even if not com p ensated. See Instructions. )

(E) Expense account

(D) Contributions to

(B) Title and average hours (C) Compensation f

not paid, enter -0-.) employee benefit plans and and other allowances

per week devoted

(A) Name and address

deferred com pensation

to p osition

32

----------------------------------------See Statement 5

0.

0.

0.

------------------------------------------------------------------------------------------------------------------------Part V33

34

Other Information (N ote the attachment req uirement in the instructions )

See Statement 6

Did the organization engage in any activity not previously reported to the IRS? If 'Yes,' attach a detailed description

of each activity .. ........ .............. .......................... ................ ............................

Were any changes made to the organizing or governing documents but not reported to the IRS? If 'Yes,' attach a conformed copy of the changes .......

If the organization had income from business activities, such as those reported on lines 2, 6, and 7 (among others), but not reported on Form 990-T, attach

a statement explaining your reason for not reporting the income on Form 990- T.

a Did the organization have unrelated business gross income of $1,000 or more or 6033(e) notice, reporting, and proxy tax requirements? .. ...........

b If 'Yes , ' has it filed a tax return on Form 990-T for this year? ........................ ................ ....... ......

36 Was there a liquidation, dissolution, termination, or substantial contraction during the year? (If 'Yes,' aft a stmnt) ................ ............

0.

37a Enter amount of political expenditures , direct or indirect, as described in the instructions ................... 1-1 37a

............

.................................................

1120-POL

for

this

year?

organization

Form

the

file

b Did

Yes

No

33

X

34

X

35

c Enter amount of tax imposed on organization managers or disqualified persons during the year under

sections 4912, 4955, and 4958 .......................................................................... ..

10.

d Enter amount of tax on line 40c reimbursed by the organization ............................. ................

BAA

TEEao912u ovo6ro6

NI A

35b

X

36

- '

X

37 b

38a Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were

any such loans made in a prior year and still unpaid at the start of the period covered by this return? ............... .. 38a

N /A

b If 'Yes; attach the sch specified in the In 38 instructions and enter the amount involved ...................... 38 b

a o01 39 501(c)(7) organizations. Enter:

N/A

alnitiation fees and capital contributions included on line 9 ........ ....................... 39a

N /A

... .. 39b

b Gross receipts, included on line 9, for public use of club facilities ...............

40a 501(c)(3) organizations. Enter amount of tax imposed on the organization during the year under:

N/A

N/A ; section 4955 ^

section 4911 ^

N/A ; section 4912 ^

b 501(c)(3) and (4) organizations. Did the organization engage in any section 4958 excess benefit transaction during the year or did it become aware of an

excess benefit transaction from a prior year? If 'Yes,' attach an explanation ... ........ ............................ ................

X

35a

40b

X

1.

'

W-

N 'A

0.

0

Form 990-EZ (2005)

Form 990-EZ 200

95-3249153

Order of the Sons of Italy in America

Page 3

Pali V

Other Information (Note the attachment requirement in the instructions) (Continued)

41 List the states with which a copy of this return is filed ^ None

42 aThe books are in care of ^ Carol Dellaragione

Located at ^ 3560 Macmums Way, Redding ,

CA,

Telephone no. ^ 530 - 243-8609

ZIP + 4 ^ 96003

bAt any time during the calendar year , did the organization have an interest in or a signature or other authority over a

financial account in a foreign country (such as a bank account , securities account , or other financial account)?.........

If 'Yes,' enter the name of the foreign country:.. ^

See the instructions for exceptions and filing requirements for Form TD F 90-22.1.

.....................

cAt any time during the calendar year , did the organization maintain an office outside of the U.S.?......................

43

If 'Yes,' enter the name of the foreign country:. .

Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 - Check here.

Yes

42b

No

X

;:

42c

X

LI N/A

Federal Statements

Page 1

Order of the Sons of Italy in America

95-3249153

2005

Client SONS50

04:16PM

5/01/07

Statement 1

Form 990- EZ, Part I, Line 6

Net Income (Loss) from Special Events

Less

Less

Gross

R eceipts

Special Events

Social Events

Total $

86,350.

86,350.

$

0.

0.

$

Net

Direct

Expenses-

Gross

Revenue

Contributions

86,350.

86,350.

$

56,439.

56,439.

Income

(Loss)

$

29,911.

29,911.

Statement 2

Form 990- EZ, Part I , Line 10

Grants and Similar Amounts Paid

Cash Grants and Allocations

Donee's Name :

Relationship of Donee:

Amount Given:

Various Charitable Orgs.

Various,

None

$

5,932.

Total Cash Grants and Allocations $

5,932.

Total Grants and Similar Amounts Paid $

5,932.

Statement 3

Form 990-EZ, Part I, Line 16

Other Expenses

Depreciation ...... ..................... . .. ..................... ... ........... ....

... ..... $

Total $

510.

510.

Statement 4

Form 990-EZ, Part II , Line 24

Other Assets

B eginning

Equipment ..... ..... ....... . ..... .... .................... . ................... $

parking Lot Paving ........... ....... ... ...... .............. ................

Total $

0. $

0.

0. $

E nding

21,408.

13,475.

34,883.

Page 2

Federal Statements

2005

Client SONS50

95-3249153

Order of the Sons of Italy in America

04:16PM

5/01/07

Statement 5

Form 990-EZ, Part IV

List of Officers , Directors , Trustees, and Key Employees

Contri-

Expense

bution to

EBP & DC

Account/

Other

Title and

Name and Addres s

Elrose Caruso

3918 Ranier Dr.

Redding, CA 96001

Average Hours

Per Week Devoted

Recording Secty $

0

Compensation

0. $

0. $

0.

Paul Bosetti

19220 Hill St.

Anderson, CA 96007

Past President

0

0.

0.

0.

Ed Reynolds

4311 Nightbird Way

Redding, CA 96001

Trustee 1

0

0.

0.

0.

Ken Pereira

2881 Boneset

Redding, CA 96002

Vice President

0

0.

0.

0.

Jim Lamanna

1015 Grissom Ct.

Redding, CA 96002

President

0

0.

0.

0.

Orator

0

0.

0.

0.

Treasurer

0

0.

0.

0.

Financial Secty

0

0.

0.

0.

Historian

0

0.

0.

0.

Duane Tomei

1230 Lema Rd.

Redding, CA 96003

Trustee

0

0.

0.

0.

Teresa Foster

2692 Rhonda Rd.

Cottonwood, CA 96022

Trustee

0

0.

0.

0.

Guard

0

0.

0.

0.

Jim Nobili

2391 Cumberland Dr.

Redding, CA 96001

Faye Contreras

7242 Bohn Blvd.

Anderson, CA 96007

Carole Dellaragione

3560 Magnums Way

Redding, CA 96003

Frank Rose

29280 Bullskin Ridge

Oak Run, CA 96069

Vito Cacucciolo

4250 Rutgers P1

Redding, CA 96001

Page 3

Federal Statements

2005

Client SONS50

95-3249153

Order of the Sons of Italy in America

04:16PM

5/01/07

Statement 5 (continued)

Form 990- EZ, Part IV

List of Officers, Directors, Trustees, and Key Employees

Name and Address

Title and

Average Hours

Per Week Devoted

Contribution to

EBP & DC

Compensation

Expense

Account/

Other

Louie Dellaragione

3560 Magnums Way

Redding, CA 96003

Trustee $

0

0. $

0. $

0.

LaVerne Pool

4362 Heather Lane

Redding, CA 96002

Trustee

0

0.

0.

0.

0. $

0. $

0. I

Total $

Statement 6

Form 990-EZ, Part V

Regarding Transfers Associated with Personal Benefit Contracts

Did the organization, during the year, receive any funds, directly or

(a)

indirectly, to pay premiums on a personal benefit contract2 ....................... ..

Did the organization, during the year, pay premiums, directly or

(b)

indirectly, on a personal benefit contract?............ . . ................. .. ............

No

No

4

Application for Extnslon of Time To File an

. . I • . Exempt Oiganizafon Return

8868

o „^r^. >? r

Depa1Ii it 0IhdT4 ury

Irwin Aswma 96*1 k

chi n+a i50-17W

^. Re m eeparnba appsdlan for each return.

• it you are Ong (br an Autcmalic 3-MMAK dr'b n* F Pies and Fart I and dtwk We box . . . . . . . . ^ 0

• 0 you are Nina for an A dband not au tomsM 3-MoO! Oft bn, maple aft Pot 2 (on, pap 2 of ttfo form),

an nayd oomabb Pant N witaie vi,u have already been aranbed w a ftme C I-wL&dh exter bi an a pel ouely Sled Farm 81869.

Aftmeft

onh Extomkin of Tbra-Mly submit odt nal (no COB

Form i-T ourporMono reitlng an auturrmdc ft-rnonth extendar--ahecfc this box and *w0ft Part I only . . . 1' ❑

A o9w coMar4kmo (7MacAJdi Farm 00-C Bars) must use Form 7004 0 f$q t at ti Masi wi of &ne 0 Ve £arnrne mw reflwrre_

Fanny f(pa, REMIICs, and rusts nxts'r c.t Form 876 to req 3t an axtwwJ n of torte to ft Form 10O9b, 1066, or 1G11.

n pd brne to fae one of !hs

Ri^+t ±

aotnonlc FNbv ((-I1ML Fom 88F c be flied efectmnlca Iy It you went a 3-n opNi

er. yc i cann fie it electraftilly if you wait tha edt iontt

ratans noted b*w (S months for corporate Form 990-T A1aca . ffo

not automatki 9-month ceder kit, Instead you mt* subn t the fully completed signed pale 2 at III of Farm 6868 . For more

defile an the elecct mnle filing of No forn, visit w w.irs.poIMY16.

Ham is

print

Fw br thQ

nuo dry tar

MOW

_

Sams of Ilreiy in AJnrtes, 9ha.ta Ledge *'2I,i3

kwi

. greet, muf roam or nutty no. If c P. O. boos, see it idnicfk s.

11Y7D Y out

whom. t

Exenlp't

Emph

iyp or

(

r idan lkwHoi, numbs*

95: 824913

p4 box 22410f

Cdy^ fawn ix pet spice. Wets , end ZIP cvtle. Far a tMilr eWlM . MR innnirti0s.

Reddiita CA 0609964107

Cheek type at n*m to be filed

©

Q

R3

❑

-a e4 i

❑ Form 990-T (aorporaU)n)

Pam 990-T (sec. 401(a) or 408MM t,uat)

d Form gOt3.T (truek ohm than

ova

[J. Fain 1091 -A

Form 994

Form 990-BL

Form 000-EZ

Farm B9O PF

a The books are In the cane of

t* a pplication for each roftw4=

.Care

Qe1lar

❑

❑

0

❑

Form

Form

porn

Faun

iana^ FlWclel 9eenaM

is for the whole group, chs k thl* box lOr [3. If it is for pelt of the group , check this box 0- Q

n47if n and FEI

of all mania the extanero will cover.

___

_

_

.

. ❑

. It this

and al ede a list with the

-- - ------ I request an automelic 3-month (6-months for a Forst OWT corporation) otensim of *rie undi ----------------------------------------------20...

to file the exempt wgsn zativn ruts for the ov nl etiQn ri*nod above. 7he c d meion in for the wgarMmiJan'= return for

❑ ceJendar yettr 20 ... at

^

2

_

_

_, S^D,_ 1 ^b0^4-1626

F^47f Iota. r>r LL?--9!___ _ __ _ _ ___

Talepftor^e Rio.

.......

a If e

nix Nan ecee net hat aan afee or place, of buafneee In the tinted States, check this box

. - a It this is for a Group R tiwn, enter the oFgal*ati n's fair digit Grcp Exe iptlnn Number (GEN)

--- -

1

4720

5227

5069

8870

tax year I:MvnnIng

04101

O6

.20 0-..

ti--. ffi Qa, enl.+ ending ----- ------ ---------

if this ilex year Is for law than 12 months, check ran; ❑ MW shun ❑ Fusel mkm ❑ Conga in acoa1nting period

3a If tie . plfaatidn is for Rxni 990-B1, 1

PF, 1911-T; 472D, er 6069, enter the tantoWs tax, lace any

. . . .

inNructiono

nonrefundable aedI s.

. pplkaHcn is for Form 9911-PP or 990-T, enter any refundable credits and estimated tax pay

if

made. Include any prior yew avamayment allowed as a credit . . . . . . . . . . . .

e Balance Du& Subtract fine 3b from kw 2a. Include your pd inert With his +»r Or, if rNlUired, p

with P10 coupon cr, It requkeed. by using EFFPS (Electronic Federal Tax Payment System".

Instru 1)

. . . . . . . . . . ,

- - - - - - - - - - - - - - - Caulfon. II you am going to make an elm ft

vithdrowat with this Form ONO, we Form 8453-E0

for peyniant instn,eiinna.

Far Pdracy Ad and Paperwork pediution Art Motto, we Yictoac.

Cat. Na. 2791W

a.0o

. . s

ante

gg

. .

ig

Sea

0,44

- - $

and Form 8879-£O

rorm

68 .Ivy.12

1

Pepe 2

fi'irm B& & 0%v. 12-2004)

lets orgy Part n and deck mte box

• If you are flung for an Addltbnel (not puo inatic# 3-Month Eatsnefb i

Note. Only oon jlets Pact II if you have already been granted an aubws& 3 at cnth extension an n previous fiIRd Form MO.

R D

of

1p or

Mattes of a rttpt O?Qe

a r°

1lmrl

printt

Order Sons at #My in Armariva, Shasta Loft* $2463

r>J

Lb

Ninr er, street . artO roam or BiAte na,11 e PO . box, eee instruotiare .

POBox011 147

21P mdi. For a ie

n ad^ta, $* u p1ru Ila^^t.

nor prat atf e, state,

C

Reddin cA 9eo 94107

_

'

$is 0010 for

Emplrsyar atomfto !nMTh w

95; 2UI59

For ifs uas orb

-

-

Check type of return to the Iced (Re a separate appiceltian for each return]:

{]

❑

❑

❑

0 Form 99o

❑ Form 990-BL

Form M-EZ

Awns 090-PF

BTQP: Da not eamplo

Pt 1! If You 1

Fora

Farm

f;mm

Form

0 Farm 5227

❑ Form 6i

❑ Form 8876

990.T (t a. 401 Ca3 or 4V8(a.I ttust*

99O-T oftat

than ab e]

1041-A

4720

trot iliwadY

d an 5Utoma09 3-tnmtth eftnalon an a

v:ptr fi.dIori SIM

*The bonito are in the cam of ^ _ Catrola Dallara^l^net Ffi nelel Saetebept ---------------7 6 -.,..,

Teeepha + * Nb ^ {.FAX No.

..

..^..^.....-- 6-X3 .--------- }-------. . - . . - - C

• If the or nlzaGon does not have t' afar Or place of buahiss In the United Stater, chuck tta box

• If We Is for a Group Rebm enter ms or

tkIi n'll< folar digit Group Ezempdnn Mtrtser (GIPN)

tf ttis is

for ft whale grqup, check this box 11- ❑ . If Pt is tar pert at the group. 011eac this box Ik ❑ and aftsm a list with the

rwrAs and fl4s of Ax ri

bens the sacteneion is for.

p r07

4 I Beet ate additlonel 3irtarrth r:tder icsn of tim4 u+^trT ..----------- F^hru--- -- ^.....-•- 19 FortaIand .trvow -------.arothert ax year begrrtlng------------------------- -2(t--_-,andwT rep,---.....---------------..2_---0 ft this tax ye is for lea, ftn 12 months, check reason: ❑ Initial return ❑ Feral ts6um ❑ Change in acccou tang pnend

F State In data!! why yVu need the exfertsjnn --------------------- .............._.........--------_--------------............._--------.............. ....

....

..,.............---------------.-------------------•

11^ It this applies is fur Form B9O -S .. 980-FE, 894.T 4720, or 6089, Metter Uie oerY=e

v tic, eras eery

rionmhaxIable credits. Sea instructions . . . . . . . . . - . - . . . . . . , . .

$

b It this apptle&ttert is for Form 990-PF. M.T. 4120, ar at3, enter any I urldabl. ore s and eatIn ed

tax payments made . lack a any F*ir year overirsyrnertt altowad as a credit and Any amatrrt paid

previously with Form 8868

. . . . . . . . . . . . . . . . , , . . . . . . . . 3

o mince Due. Subt act flne 8b fi

the OA, k0fude vaN payment with This fam, or. if nepigred, deposit

with ETD t ucsoct or, g real

bsr uito EFTFS (Eleatrtnic Federal Tax Payrnant $Vdefr6, $es in ucdons. $

gnat" and Va

n

Lftd- pi

It Is 11112.

ury, I OKIkV tt I teaaon^nad drh Agra, Ocldrg owr+mne-+yt

comp

$ jhe$ I em euiftrod to pare ?I Imm.

3gnenro . 0

^

JG

'

sow- ube a o racmand to 1h

!1111. Flnsndal Secretary

bQ*t *1 eery kraal

D m •

and blot

Xll

CNChee to AMM

INK-TO Be Corry *st.d by the IRA

We harm a{^ wed Ills an Kett

pMeae attach this farm to the ar{prltpNpn 'e retUf n.

(

We hwvie not appfcvnrg lhlp

Ion.

er . we hwa grail J a T0.d y 9w# pa O 1 rn the later o4 the date shuwai below er the+#-ug

date a(Sie ar

iG^liarr's rahns (kilt ing WW R

a Gf^nelond). This We= perfad Is fiats to t e a ve ld eQrtneion at time far 00ec

u

d1lteFwIse required to ba mode on ,3 tl'r apj retnu . Ple a et ach /Its farm to Sm erg b=fi xl'e r9rum.

❑

We hen =I epp,o ed ulis eQpEmUcn AtWr con *" " the nee ns staled In Nam r. wee mmat grant Your mmme tr an eYKWrP vn of time

to 11 We ere rat

a 14-day grace period.

❑

❑

1l`e alt

ovo it sr this ejtpka icu bes.•wsa it wm filed after the u @nded Cue date of late rehim for which an fmM$0n 5

Iequest d_

Other ... ....................•.--------------------------•------ ..T........-..-....--•-------------------------- . -.-..........-----------

01ac^mr

DOD

Al ME a Mailf6tp Addneea - 6ifler the mats if yea resat the copy of this spplkadnn for an O 1dit(J 13-month a denalan

m&jmivd to an eddr

di ferarrt than the one entered Ax".

Mgme

Tw

Numb°r and

puller room , or apt. no. or e P.Q. box rwrgt

City or town, pr vinoa orstais. ante eotert'y (1whid lto oes(

or ZIP rode}

Fan SIM OW. 12-2004)