Form 990-EZ Short Form - Return of Organization Exempt From

advertisement

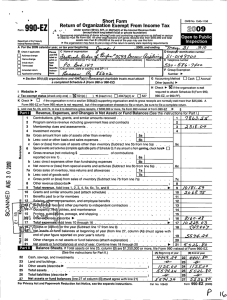

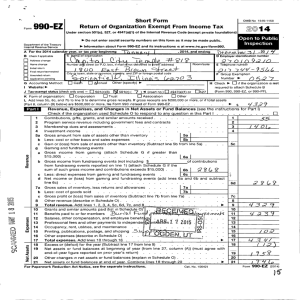

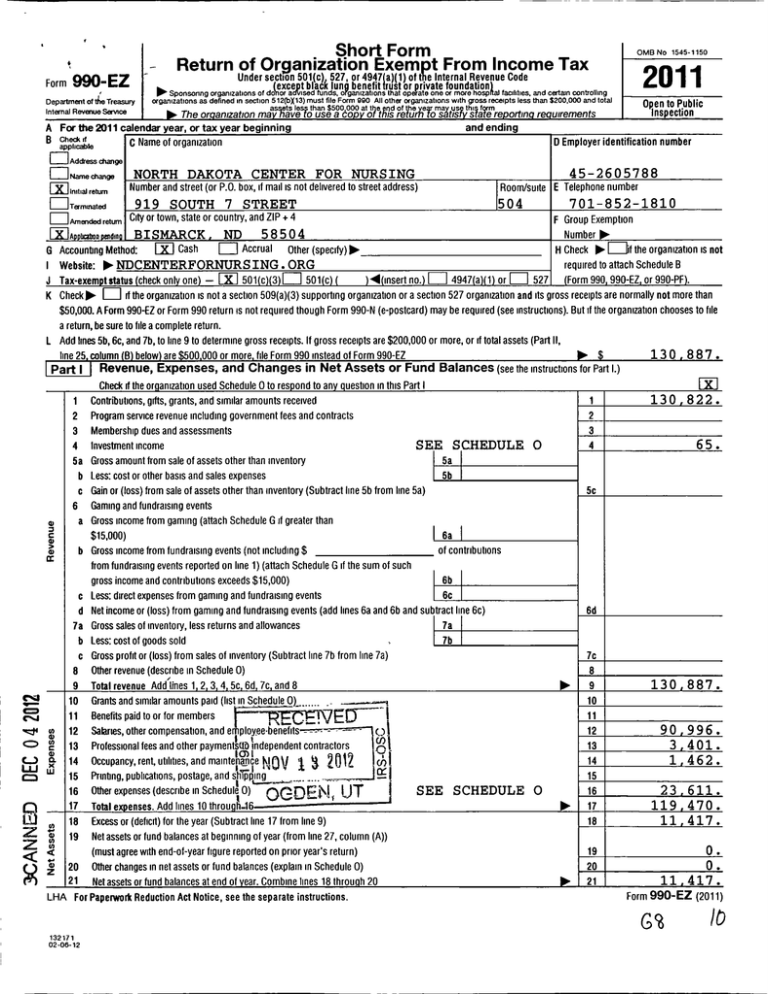

- Short Form Return of Organization Exempt From Income Tax OMB No 1545-1150 Under section 501(c) 527, or 4947(a)( 1) of the Internal Revenue Code except black lung benefit rust or private foundation Form 990-EZ ^ Sponsonng organizations of do or a iced funds, o ganizations that op ate one or more hose at facilities, and certain controlling organizations as defined in section 512(bx13) must file Form 990 All other organizations with gross receipts less than $200,000 and total _ _ assets less than $500,000 at the end of the year may use this form Department of t6 Treasury Internal Revenue Sernce 1 2011 Open to Public Inspection and A For the 2011 calendar year , or tax year beginning g Check e C Name of or g anization applicable D Employer identification number Address change OName change Initial return =Terminated NORTH DAKOTA CENTER FOR NURSING %D-GvuJ100 Number and street (or P.O. box, if mail is not delivered to street address ) Room/suite E Telephone number ®n uabop din BISMARCK ® Cash ND 701-852-1810 504 919 SOUTH 7 STREET =Amended return City or town, state or country, and ZIP + 4 F Group Exemption Number 58504 0 Accrual H Check ^ cif the organization is not required to attach Schedule B Website : ^ NDCENTERFORNURS ING. ORG insert no . ) 0 4947 ( a )( 1 ) or 0 527 , ( Form 990 , 990-EZ, or 990-PF ). Tax-exempt status ( check only one ) - ® 501 ( c )( 3 ) L 501 c Check 00- 1 dthe organization is not a section 509(a)( 3) supporting organization or a section 527 organization and its gross receipts are normally not more than $50,000. A Form 990-EZ or Form 990 return is not required though Form 990-N ( e-postcard) may be required ( see instructions ). But if the organization chooses to file Accounting Method : G I J K Other (specify) ^ a return , be sure to file a complete return. L Add lines 5b, 6c, and 7b , to line 9 to determine gross receipts . If gross receipts are $200,000 or more , or if total assets (Part II, line 25, column ( B ) below ) are $5 00 ,000 or more, file Form 990 instead of Form 990-EZ Revenue, Expenses , and Changes in Net Assets or Fund Balances ( see the instructions for Part I.) Part I 130 , 887. Chw,k if the nrnant7atlnn Ilcerl Sr.. hedlde (1 to resnnnfi to any nllestlnn in this Part I 1 2 3 Contributions , gifts, grants , and similar amounts received Program service revenue including government fees and contracts Membership dues and assessments 4 Investment Income n 1 2 3 Gross amount from sale of assets other than inventory Less: cost or other basis and sales expenses Gain or ( loss) from sale of assets other than inventory (Subtract line 5b from line 5a) Gaming and fundraising events Gross income from gaming ( attach Schedule G if greater than $15,000) b Gross income from fundraising events ( not including $ from fundraising events reported on line 1) (attach Schedule G if the sum of such 0 N to M W C3 W 5c 6a of contributions 16 8z z 17 y Z 6b 6c c Less: direct expenses from gaming and fundraising events d Net income or (loss ) from gaming and fundraising events ( add lines 6a and 6b an d subtract line 6c) 7a 7a Gross sales of inventory, less returns and allowances 7b b Less: cost of goods sold c Gross profit or (loss ) from sales of inventory (Subtract line 7b from line 7a) 8 Other revenue (describe in Schedule 0) 9 Total revenue Add lines 1 2 3 4 5c 6d 7c and 8 10 Grants and similar amounts paid (list in Schedule 0)_....... EID I 11 Benefits paid to or for members 12 Salaries, other compensation , and e ployee- benefits 13 Professional fees and other payment^^ independent contractors 14 15 18 19 20 21 65. 5a 5b gross income and contributions exceeds $15,000) e'er 4 SEE SCHEDULE 0 5a b c 6 a cc 130 , 822. Occupancy, rent, utilities, and maintenan ce A^f^^J Printing , publications , postage, and sippln g _ _ . _... Other expenses ( describe in Schedule 0) OGDEN f UT j Total exp enses . Add lines 10 throw hi Excess or ( deficit) for the year (Subtract line 17 from line 9) Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree with end -of-year figure reported on prior year' s return) Other changes in net assets or fund balances ( explain in Schedule 0) Net assets or fund balances at end of year. Combine lines 18 throw h 20 6d ^ _1 LHA For Paperwork Reduction Act Notice, see the separate instructions. SEE SCHEDULE O 7c 8 9 10 11 12 13 14 15 16 17 18 Op, 19 20 21 130 , 887. 996 . 3 401 . 1 462 . 90 23 , 611. 119 11 0 . 0 . 11 , 417 . Form 990-EZ (2011) G% 132171 02-06-12 470 . 417 . 10 99O-EZ0011) Paft II NORTH DAKOTA CENTER FOR NURSING 45- Balance Sheets . (see the instructions for Part II.) Check if the organization used Schedule 0 to res pond to an y q uestion in this Part II (A) Beginning of year 22 0 . 22 Cash, savings, and investments Land and buildings Other assets (describe in Schedule 0) 23 24 12 , 546. 23 0. 24 SEE SCHEDULE 0 25 Total assets Total liabilities (describe in Schedule 0) SEE SCHEDULE 0 Net assets or fund balances ( line 27 of column B must ag ree with line 21 ) 26 27 (B) End of year 0. 25 1 , 626. 14 , 172. 0. 26 0 . 27 11 2 , 755. 417. Part III Statement of Program Service Accomplishments (see the instructions for Part III.) Expenses Check if the org anization used Schedule 0 to respond to an y q uestion in this Part I I I ® (Required for section 501(c)(3) and 501(c)(4) organizations and section 4947(a)(1) trusts; optional for others.) What is the organization 's primary exempt purpose?SEE SCHEDULE 0 Describe the orga nization ' s program service accomplishments for each of its three largest program services, as measured by expenses In a clear and concise manner, desabe the services provided, the number of persons benefited , and other relevant information for each program title 28 SEE SCHEDULE 0 (Grants $ If this amount includes forei g n g rants , check here 00, 0 28a (Grants $ If this amount includes foreig n rants check here 01, 0 29a If this amount includes foreig n g rants , check here (Grants $ Other program services (describe in Schedule 0) If this amount includes foreig n g rants , check here (Grants 32 Total Progr am service ex enses (add lines 28a throug h 31 a) 30a 111 , 838. 29 30 31 31a 1111P, 32 111 838. Part IV List of Officers , Directors , Trustees, and Key Employees . List each one even if not compensated (see the instructions for Part IV) Check if the organization used Schedule 0 to respond to any question in this Part IV ( a ) Name and address MARGARET REED 919 S 7TH ST BISMARCK , ND 58504 BISMARCK , ND 58504 919 S 7TH ST , BISMARCK , ND 58504 SUSAN PEDERSON 919 S 7TH ST , BISMARCK , ND 58504 919 S 7TH ST , BISMARCK , ND 58504 BISMARCK , ND 58504 BISMARCK , ND 58504 BISMARCK , ND 58504 0. 0. 0. 0. 38 , 958. 2 , 278. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 2.00 EXECUTIVE DIR ECTOR 40.00 DIRECTOR 1.00 1.00 1.00 1.00 1.00 1.00 DIRECTOR BISMARCK , ND 58504 ADELE SIGL 919 S 7TH ST 0. DIRECTOR ROBERT YOUNG 132172 0. 2.00 DIRECTOR TRACY EVANSON 02-08-12 0. DIRECTOR JAMIE SPERLE 919 S 7TH ST 0. 2.00 DIRECTOR JOSH ASKVIG 919 S 7TH ST 0. emP DIRECTOR CHERYL RISING 919 S 7TH ST (d not paid, enter -0-) (e) Estimated amount of other compensation W-2/1089- MISC) (d) Health benefits, TREASURER PATRICIA MOULTON 919 S 7TH ST , BISMARCK , ND 58504 JULIE HANSON 919 S 7TH ST position oyobee benefit plans, anddeferred (C) Reportable ICE PRESIDE CONSTANCE KALANEK 919 S 7TH ST compensation (Forms RESIDENT BISMARCK , ND 58504 KAREN LATHAM 919 S 7TH ST (b) Title and average hours per week devoted to 1.00 DIRECTOR BISMARCK , ND 58504 1.00 0. Form 990-EZ (90111 Pa e 3 Form 990-EZ ( 2011 ) 45-2605788 NORTH DAKOTA CENTER FOR NURSING Part V Other Information (Note the Schedule A and personal benefit contract statement requirements in the instructions for Part V.) Check if the organization used Sch. 0 to respond to any question in this Part V Did the organization engage in any significant activity not previously reported to the IRS? If 'Yes; provide a detailed description of each activity in Schedule 0 34 Were any sign ifi cant changes made to the organizing or governing documents? If 'Yes; attach a conformed copy of the amended documents it they reflect a change to the organization ' s name . Otherwise, explain the change on Schedule 0 (see instructions) 35a Did the organ ization have unrelated business gross income of $1 ,000 or more during the year from business activities ( such as those reported on lines 2, 6a, and 7a, among others)? b If Yes ; to line 35a, has the organization filed a Form 990-T for the year? If 'No,* provide an explanation in Schedule 0 c Was the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization subject to section 6033(e) notice, reporting, and proxy tax 33 36 37 a b 38a b requirements during the year? If 'Yes; complete Schedule C, Part III Did the organization undergo a liquidation, dissolution, termination, or significant disposition of net assets during the year? If 'Yes; complete applicable parts of Schedule N ^ ^ 37a ^ Enter amount of political expenditures, direct or indirect, as described in the instructions. Did the organization file Form 1120-POL for this year? Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or were any such loans made in a prior year and still outstanding at the end of the tax year covered by this return? 38b If Yes,' complete Schedule L, Part II and enter the total amount involved N/A 0 Section 501(c)(7) organizations. Enter: 39a N /A a Initiation fees and capital contributions included on line 9 39b b Gross receipts, included on line 9, for public use of club facilities N/A 40a Section 501(c)(3) organizations. Enter amount of tax imposed on the organization during the year under: section 4911 Bo. 0. 0 . ; section 4912 ^ 0 . ;section 4955 ^ b Section 501(c)(3) and 501(c)(4) organizations. Did the organization engage in any section 4958 excess benefit transaction during the year, or did it engage in an excess benefit transaction in a prior year that has not been reported on any of its prior Forms 990 or 990-EZ? If Yes, complete Schedule L, Part I c Section 501(c)(3) and 501(c)(4) org anizations. Enter amount of tax imposed on organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 ^ 0. d Section 501(c)(3) and 501(c)(4) organizations. Enter amount of tax on line 40c reimbursed by the 39 organization e All organizations. At any time during the tax year, was the organization a party to a prohibited tax shelter 41 transaction? If 'Yes; complete Form 8886-T List the states with which a copy of this return is filed. ^ 0. NONE 42a The organization's books are in care of ^ PATR I C IA MOULTON Located at ^ 919 SOUTH 7TH STREET SOUTH, STE 43 ^ X 504, Telephone no. ^ 701-852-1810 ZIP+4 ^ 58504 BISMARCK, N At any time during the calendar year, did the organization have an interest in or a signature or other authority over a financial account in a foreign country (such as a bank account, securities account, or other financial account)? If 'Yes; enter the name of the foreign country. ^ See the instructions for exceptions and filing requirements for Form TD F 90-22 . 1, Report of Foreign Bank and Financial Accounts. At any time during the calendar year, did the organization maintain an office outside of the U.S.? If 'Yes; enter the name of the foreign country: ^ Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 - Check here and enter the amount of tax-exempt interest received or accrued during the tax year ^ 143 I Yes No 42b X 42c X N/A 44a Did the organization maintain any donor advised funds during the year? If 'Yes; Form 990 must be completed instead of Form 990-EZ b Did the organization operate one or more hospital facilities during the year? If 'Yes; Form 990 must be completed instead of Form 990-EZ c Did the organization receive any payments for indoor tanning services during the year? d If Yes' to line 44c, has the organization filed a Form 720 to report these payments? If 'No,' provide an explanation in Schedule 0 45a Did the organization have a controlled entity within the meaning of section 512(b)(13)? 45 b Did the organization receive any payment from or engage in any transaction with a controlled entity within the meaning of section Form 990-EZ(2011) 132173 02-06-12 Form 990-EZ (2011) 46 NORTH DAKOTA CENTER FOR NURSING 45-2605788 Page 4 Yes No Did the organization engage , directly or indirectly, in political campaign activities on behalf of or in opposition to candidates for public office If'Y 'com p lete Schedule C . Part I 46 X Section 501 (c)(3) organizations and section 4947(a)(1) nonexempt charitable trusts only. All section 501(c)(3) PartVI organizations and section 4947(a)(1) nonexempt chartable trusts must answer questions 47-49b and 52, and complete the tables for lines 50 and 51. Check if the organization used Schedule 0 to respond to any auestion in this Part VI 47 48 49a b 50 Did the organization engage in lobbying activities or have a section 501(h) election in effect during the tax year? If Yes; complete Sch. C , Part II Is the organization a school as described in section 170 (b)(1)(A)(n)7 If 'Yes, complete Schedule E Did the organ ization make any transfers to an exempt non-charitable related organization? If Yes; was the related organization a section 527 organization? f X X X 49b Complete this table for the organization ' s five highest compensated employees ( other than officers , directors, trustees and key employees) who each received more than $100,000 of comp ensation from the organization. If there is none , enter "N one.' (e) Estimated (a) Name and address of each employee (b) Title and average hours (C) Reportable ( d) Health benefits, contributions to compensation (Forms paid more than $100,000 per week devoted to amount of other vloes-rnisc) `" p^ans,oand deferred position p compensation NONE 51 47 48 49a compensation Total number of other employees paid over $100,000 Complete this table for the organization's five highest compensated independent contractors who each received more than $100,000 of compensation from the d Total number of other independent contractors each receiving over $100,000 52 Did the organization complete Schedule A? Note : All section 501( c)(3) organs SCHEDULE A OMB No 1545-0047 Public Charity Status and Public Support (Form 990 or 990-EZ) Department of the Treasury Internal Revenue Severe 2011 Complete if the organization is a section 501(c)(3) organization or a section 4947(a)(1) nonexempt charitable trust. ^ Attach to Form 990 or Form 990-EZ. ^ See separate instructions. Open to Public Inspection Employer identification number Name of the organization AS_7iZ nS700 Part I Reason for Public Charity Status (All organizations must complete this part.) See Instructions. The organization is not a private foundation because it is: (For lines 1 through 11, check only one box.) 1 0 A church, convention of churches, or association of churches described in section 170(bXl)(A)(i). 2 0 A school described in section 170( b)(1)(A)(ii). (Attach Schedule E.) 3 0 A hosprtal or a cooperative hospital service organization described in section 170(b)(1)(A)(iii). A medical research organization operated in conjunction with a hospital described in section 170(b)(1)(A)(iii). Enter the hospital's name, 4 city, and state* An organization operated for the benefit of a college or university owned or operated by a governmental unit described in section 170(b)(1)(A)(iv). (Complete Part II.) 5 A federal, state, or local government or governmental unit described in section 170(b)(1)(A)(v). 6 7 ® An organization that normally receives a substantial part of its support from a governmental unit or from the general public described in section 170(b)(1)(A)(vi ). (Complete Part II.) A community trust described in section 170(b)(1)(A)(vi ). (Complete Part II.) 8 An organization that normally receives: (1) more than 33 1/3% of its support from contributions, membership fees , and gross receipts from 9 activities related to its exempt functions - subject to certain exceptions, and (2) no more than 33 1/3% of its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975. See section 509(a)(2). (Complete Part III.) 10 0 An organization organized and operated exclusively to test for public safety . See section 509(a)(4). An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of one or 11 more publicly supported organizations described in section 509(a)(1) or section 509(a)(2) See section 509(a)(3). Check the box that describes the type of supporting organization and complete lines 11 a through 11 h. d = Type III -Other b 0 Type II c 0 Type III - Functionally integrated a 0 Type I By checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons other than e foundation managers and other than one or more publicly supported organizations described in section 509(a)(1) or section 509(a)(2). If the organization received a written determination from the IRS that it is a Type I, Type II, or Type III f 0 supporting organization , check this box g Since August 17, 2006 , has the organization accepted any gift or contribution from any of the following persons? Yes No (i) A person who directly or indirectly controls , either alone or together with persons described in (I) and (I) below, h the governing body of the supported organization? (ii) A family member of a person described in () above? (iii) A35% controlled entity of a person described in () or () above? Provide the following information about the supported organization(s) (i) Name of supported organization (ii) EIN (iii) Type of organization (described on lines 1-9 above or IRC section (see instructions )) - - (vi) Is the v Did Yyou notify (iv)) Is the organization (1 fY the organization col. in col. (i) listed in your organization in col. (i) organized inin the U.S.? governing document? (i) of your support? Total LHA For Paperwork Reduction Act Notice , see the Instructions for Form 990 or 990-EZ 132021 01-24-12 - Yes No Yes No Yes - 11 i 11 ii 11 iii (vii) Amount of support No Schedule A (Form 990 or 990-EZ) 2011 Schedule A (Form 990 or 990 2011 NORTH DAKOTA CENTER FOR NURSING 45-2605788 Pa e 2 Part II Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi) (Complete only if you checked the box on line 5, 7, or 8 of Part I or if the organization failed to qualify under Part III. If the organization fails to qualify under the tests listed below, please complete Part III.) Section A. Public Support Calendar year (or fiscal year beginning in) ^ 1 Gr ts, grants, contributions, and membership fees received. (Do not (a) 2007 (b) 2008 include any 'unusual grants.') c 2009 2010 (e ) 2011 Total 13 0 8 2 2. 13 0 8 22. 13 0 8 2 2. 130 , 822. 2 Tax revenues levied for the organization's benefit and either paid to or expended on its behalf 3 The value of services or facilities furnished by a governmental unit to the organization without charge 4 Total. Add lines 1 through 3 5 The portion of total contributions by each person (other than a governmental unit or publicly supported organization) included on line 1 that exceeds 2% of the amount shown on line 11, column (f) 6 1 130 , 822. Public su pp ort. Subtract line 5 from line 4 Section B. Total Support Calendar year (or fiscal year beginning in) ^ (a) 2007 (c) 2009 (b) 2008 (e) 2011 ( d) 2010 7 Amounts from line 4 130 822. 8 Gross income from interest, dividends, payments received on securities loans, rents, royalties and income from similar sources 65. 9 Net income from unrelated business activities, whether or not the business is regularly camed on 10 Other income. Do not include gain or loss from the sale of capital assets (Explain in Part IV) 11 Total support. Add lines 7 through 10 12 Gross receipts from related activities, etc (see instructions) 12 13 First five years . If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501 (c)(3) organization, check this box and stop here Section C. Computation of Public Support Percentage Total 130 822. 65. 130 887. ^ 14 Public support percentage for 2011 (line 6, column (f) divided by line 11, column (l) 14 99 . 95 % 15 Public support percentage from 2010 Schedule A, Part II, line 14 15 % 16a 33 1/3% support test - 2011 . If the organization did not check the box on line 13, and line 14 is 33 1/3% or more, check this box and stop here. The organization qualifies as a publicly supported organization oilb 33 1/3% support test - 2010 . If the organization did not check a box on line 13 or 16a, and line 15 is 33 1/3% or more, check this box and stop here . The organization qualifies as a publicly supported organization ^Q 17a 10% -facts - and-circumstances test - 2011. If the organization did not check a box on line 13, 16a, or 16b, and line 14 is 10% or more, and if the organization meets the 'facts-and-circumstances' test, check this box and stop here . Explain in Part IV how the organization meets the 'facts-and-circumstances' test. The organization qualifies as a publicly supported organization o. 0 b 10% -facts - and-circumstances test - 2010. If the organization did not check a box on line 13, 16a, 16b, or 17a, and line 15 is 109'0 or more, and if the organization meets the 'facts-and-circumstances' test, check this box and stop here . Explain in Part IV how the organization meets the "facts-and-circumstances" test The organization qualifies as a publicly supported organization No. Q 18 Private foundation . If the organization did not check a box on line 13. 16a. 16b. 17a, or 17b. check this box and see instructions or. F-1 Schedule A (Form 990 or 990-EZ) 2011 132022 01-24-12 Pag e 3 Schedule A (Form 990 or 990-EZ) 2011 Part III Support Schedule for Organizations Described in Section 509(a)(2) (Complete only if you checked the box on line 9 of Part I or if the organization failed to qualify under Part II. If the organization fads to qualify under the tests listed below, please complete Part II.) Section A. Public Support Calendar year (or fiscal year beginning in) ^ 1 Gifts, grants , contributions, and membership fees received (Do not include any 'unusual grants.') (a) 2007 b 2008 c 2009 d 2010 a 2011 Total ( a) 2007 (b) 2008 c 2009 (d) 2010 (e) 2011 Total 2 Gross receipts from admissions, merchandise sold or services performed, or facilities furnished in any activity that is related to the organization's tax-exempt purpose 3 Gross receipts from activities that are not an unrelated trade or business under section 513 4 Tax revenues levied for the organization's benefit and either paid to or expended on its behalf 5 The value of services or facilities furnished by a governmental unit to the organization without charge 6 Total. Add lines 1 through 5 7a Amounts included on lines 1, 2, and 3 received from disqualified persons b Amounts included on lines 2 and 3 received from other than disqualified persons that exceed the greater of $5,000 or 1% of the amount on Ime 13 for the year c Add Imes 7a and 7b 8 Public su ort Subtract line 7c from line 6 ) Section B. Total Support Calendar year (or fiscal year beginning in) ^ 9 Amounts from line 6 10a Gross income from interest, dividends, payments received on securities loans, rents, royalties and income from similar sources b Unrelated business taxable income (less section 511 taxes) from businesses acquired after June 30, 1975 c Add lines 1 Oa and 1 Ob Net income from unrelated business activities not included in line 10b, whether or not the business is regularly camed on 12 Other income Do not include gain or loss from the sale of capital assets (Explain in Part IV) 13 Total support (Add Imes e, loc,11, and 12 14 First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501(c)(3) organization, 11 check this box and stow here Section C. Computation of Public Su pp ort Percenta g e 15 Public support percentage for 2011 pine 8, column (f) divided by line 13, column (f)) 16 Public support percentage from 2010 Schedule A. Part III line 15 Section D. Com putation of Investment Income Percenta g e ^ 15 16 Investment income percentage for 2011 (line 10c, column (f) divided by line 13, column (f)) 17 18 18 Investment income percentage from 2010 Schedule A, Part ill, line 17 19a 33 1/3% support tests - 2011 . If the organization did not check the box on line 14, and line 15 is more than 33 1/3%, and line 17 is not more than 33 1/3%, check this box and stop here . The organization qualifies as a publicly supported organization b 33 1/3% support tests - 2010 . If the organization did not check a box on line 14 or line 19a, and line 16 is more than 33 1/3%, and line 18 is not more than 33 1/3%, check this box and stop here . The organization qualifies as a publicly supported organization 20 Private foundation . If the organization did not check a box on line 14, 19a, or 19b, check this box an d see instructions % % % % 17 132023 01-24-12 ^0 ^Q ^ Schedule A (Form 990 or 990-EZ) 2011 Supplemental Information to Form 990 or 990-EZ 'SCHEDUL'E 0 (Form 990 or 990-EZ) Complete to provide information for responses to specific questions on Open to Public 110- Attach to Form 990 or 990-EZ ernal Revenue Service Inspection Name of the organization Employer identification number NORTH DAKOTA CENTER FOR NURSING FORM 990-EZ, 2011 Form 990 or 990-EZ or to provide any additional information. DoftheTreasury Inttemal OMB No 1545-0047 PART I, LINE 4, 45-2605788 OTHER INVESTMENT INCOME: DESCRIPTION OF PROPERTY: AMOUNT: INTEREST INCOME FORM 990-EZ, PART I, 65. LINE 16, OTHER EXPENSES: DESCRIPTION OF OTHER EXPENSES: AMOUNT: SUPPLIES 2,708. TRAVEL 7,483. BANK FEES/MISCELLANEOUS 33. CONFERENCE FEES 1,225. BOARD EXPENSES 1,376. FILING FEES 1,360. ND CONSENSUS COUNCIL 2,500. PAYROLL TAXES 6,926. TOTAL TO FORM 990-EZ, LINE 16 FORM 990-EZ, LINE 24, PART II, 23,611. OTHER ASSETS: DESCRIPTION BEG. OTHER DEPRECIABLE ASSETS FORM 990-EZ, PART II, LINE 26, BEG. ACCRUED LIABILITIES PART III, END OF YEAR 0. 1,626. OF YEAR END OF YEAR 0. 2,755. OTHER LIABILITIES: DESCRIPTION FORM 990-EZ, OF YEAR PRIMARY EXEMPT PURPOSE - TO GUIDE THE ONGOING DEVELOPMENT OF A WELL-PREPARED AND DIVERSE NURSING WORKFORCE TO MEET LHA For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990- EL 132211 01-23-12 Schedule 0 (Form 990 or 990- EZ) (2011) (Form 990 or 990- EZ) Complete to provide information for responses to specific questions on Form 990 or 990-EZ or to provide any additional information. ^ Attach to Form 990 or 990- EZ Department of the Treasury Internal Revenue Service Name of the organization 2011 Open to Public Inspection Employer identification number 45-2605788 NORTH DAKOTA CENTER FOR NURSING THE NEEDS OF THE CITIZENS OF NORTH DAKOTA THROUGH RESEARCH, RECRUITMENT AND RETENTION , FORM 990-EZ, OMB No 1545-0047 Supplemental Information to Form 990 or 990-EZ SCHEDULE 0 PART III, EDUCATION, ADVOCACY AND PUBLIC POLICY. LINE 28, PROGRAM SERVICE ACCOMPLISHMENTS: TO GUIDE THE ONGOING DEVELOPMENT OF A WELL-PREPARED AND DIVERSE NURSING WORKFORCE TO MEET THE NEEDS OF THE CITIZENS OF NORTH DAKOTA THROUGH RESEARCH, RECRUITMENT AND RETENTION, FORM 990-EZ, PART V, DURING THE YEAR, RECEIVE ANY FUNDS, DID NOT, DURING THE YEAR, PAY ANY PREMIUMS, DIRECTLY, ON A PERSONAL BENEFIT CONTRACT. LHA For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990-EZ 132211 01-23-12 DIRECTLY, TO PAY PREMIUMS ON A PERSONAL BENEFIT CONTRACT. THE ORGANIZATION, OR INDIRECTLY, ADVOCACY AND PUBLIC POLICY. INFORMATION REGARDING PERSONAL BENEFIT CONTRACTS: THE ORGANIZATION DID NOT, OR INDIRECTLY, EDUCATION, Schedule 0 (Form 990 or 990-EZ) (2011)