1998 Casualty Loss Reserve Seminar September 28-29, 1998 Philadelphia, PA

1998 Casualty Loss Reserve Seminar

September 28-29, 1998

Philadelphia, PA

Session: Capital Models and their Relationship with Loss Reserving

Presentation: Loss Reserves and the NAIC (P&C) RBC Formula

Presenter: Ralph Blanchard

Travelers Property Casualty Corporation

0

Loss Reserves and NAIC P&C RBC

Biography

Ralph S. Blanchard, III, FCAS, MAAA

Ralph is a Second Vice President & Actuary for Travelers Property Casualty (a member of Travelers Group), in their Corporate Finance - Accounting Policy department.

Ralph is a member of the American Academy of Actuaries and a fellow of the Casualty

Actuarial Society. He is currently the chair of the American Academy of Actuaries -

Property & Casualty Risk Based Capital Task Force, as well as a member of the following American Academy of Actuaries committees; Joint Risk Based Capital Task

Force, Environmental Liabilities Work Group, Casualty Practice Council. He is also a past member of the Academy’s Committee on Property Liability Financial Reporting.

Ralph started his career at Aetna is 1978, after graduating from Dartmouth College (B.A. in Math) and was part of Aetna’s Property / Casualty division when it was sold to

Travelers Group in 1996.

1

Loss Reserves and NAIC P&C RBC

Overview

Caveat - NAIC RBC purpose is MINIMUM CAPITAL,

NOT PRUDENT CAPITAL

Not meant to be accurate, but adequate

One tool of many

Basic RBC Structure

Covariance Importance

What Drives RBC

Loss Reserve Impacts

Issues

2

Loss Reserves and NAIC P&C RBC

Basic RBC Structure

RBC for a risk = Exposure times Risk Factor

e.g. (c. stock) 100 x 15%

Risks Considered

R1 - Fixed Income Asset Risk (e.g. Bonds)

R2 - Equity Asset Risk (excl. ins. affil.)

R3 - 1/2 of Credit Risk (incl. reins. collectibility)

R4 - 1/2 of Credit Risk, plus Loss Reserve Risk

R5 - Premium Risk

R0 - Equity Risk for Insurance Affiliates , plus Off Balance Sheet Risk

Required Capital (ACL Level)

R

0

+ R

1

2

+ R

2

2

+ R

3

2

+ R

4

2

+ R

5

2

2

3

Loss Reserves and NAIC P&C RBC

The Importance of Covariance

Two risk example

R

A

R

B

R

A

+R

B

10 1

10 5

( R

A

2

+ R

B

11 vs. 10.05

15 vs. 11.18

2

)

1/2

10 10 20 vs. 14.14

Effects:

Biggest risks dominate the result

Smaller (relative) risks become insignificant

4

R5

22%

Loss Reserves and NAIC P&C RBC

What Drives RBC (i.e. biggest items entering covariance)

Industry (1997)

Multiline

Flagship

R0

15%

R1

2%

R2

21%

R0

27%

R1

3%

R2

4%

R3

3%

R3

4%

R4

48%

R4

36%

R5

15%

Note: Industry amounts for R2 dominated by a handful of companies.

R5

51%

R0

0%

R1

4%

R2

0%

R3

1%

R4

44%

R1

R2

R3

R4

R5

R0

Start Up (2nd Yr.)

R0

0%

R1

10%

R2

0%

R3

0%

R4

23%

R5

67%

Personal Lines

5

Loss Reserves and NAIC P&C RBC

Loss Reserve Impacts

R3

R4

1/2 reinsurance credit risk

(10% of ceded balances)

R5

1/2 reinsurance credit risk

(10% of ceded balances)

Held Schedule P Reserve times Risk Factor (by line)

(11% to 35%)

Company experience adjustment - adjusts reserve risk factor

Based on historic company vs. industry INCURRED developmment

Loss Concentration factor - credit for line diversification

Equals 0.7 + 0.3 x Biggest Line / Total Reserves

Growth risk charge - based on GROUP's 3 yr avg wp growth

Equals (Growth - 10%) x .45 x Total Sched. P Reserves

" Growth" capped at 40%, no charge if under 10%

Company experience adjustment - adjusts premium risk factor

Based on historic company vs. industry 10 yr avg. loss ratio

6

Loss Reserves and NAIC P&C RBC

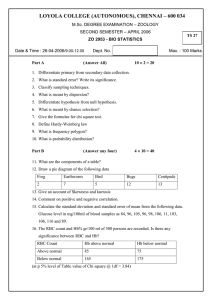

Loss Reserve Risk Factors

Line

Homeowners/Farmowners

Net risk charge *

Personal Auto Liability

Commercial Auto Liability

Workers Compensation

Commercial Multi-Peril

18.3%

15.5

16.5

11.0

20.9

Med. Malp. - Occur.

Med. Malp. - Claims Made

35.2

11.8

Biggest

Special Liability 10.3 Smallest

Other Liability

Fidelity / Surety

Two Year Lines

26.5

19.5

11.5

International

Reinsurance A & C

Reinsurance B

14.7

11.5

34.9

27.5 Products Liability

*charges are before company experience adjustments

7

Loss Reserves and NAIC P&C RBC

Company Experience Adjustment - R4

Strategy Impact on factor applied to reserves

Absolute change Relative change

Reserves always 10% "high"

Increase reserves by 10%

-0.5% to -1.5% -3.5% to -7%

+0.1% to +1.5% +0.7% to +4.5%

Increase reserves by 10% of NEP +0.1% to +0.5% +1% to +2%

Note: Example of company experience adjustment calculation can be found at the back of the handouts.

8

Loss Reserves and NAIC P&C RBC

Issues

Spread / allocation to line

Factors vary from 11% to 35%

Loss concentration factor

Company experience adjustments

Other

Allocation to AY

"All prior" AY not used in company experience adjustment calcs

Current AY not used in R4 company experience adjustment

Reliance on "reasonable" reserve

No adjustment for "inestimables"

No adjustment for where in a reasonable range (other than co. exper. adj.)

(high, low, even below)

Double whammy

Increase reserves

Required capital up (R3, R4, R5)

Held capital down

Non-tabular discount

Reversed by RBC

Retroactive Reinsurance (ceding co. impacts)

Does not reduce required capital

May increase held capital