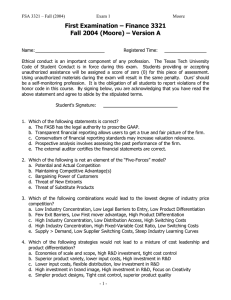

Second Examination – Finance 3321 Summer II (Moore)

advertisement

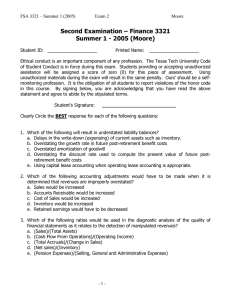

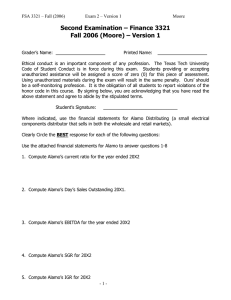

FSA 3321 – Summer II (2004) Exam 2 Moore Second Examination – Finance 3321 Summer II (Moore) Grader’s Name: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Where indicated, use the financial statement for Dell-U-Dead, Inc. (a large computer manufacturer and distributor that sells in both the wholesale and retail markets). Clearly Circle the BEST response for each of the following questions: 1. Which of the following will not result in overstated asset balances? a. Delays in writing down current assets. b. Channel stuffing c. Overstated amortization of goodwill d. Overstating reserves e. Delaying the write-down of obsolete factory equipment 2. Which of the following accounting adjustments would have to be made in the case of improperly accelerating the recognition of revenues? a. Sales would be increased b. Accounts Receivable would be increased c. Cost of Sales would be increased d. Inventory would be increased e. Deferred tax liabilities would have to be increased 3. Which of the following ratios would not be used in the diagnostic analysis of the quality of financial statements as it relates to the detection of manipulated sales? a. (Net sales)/(Cash from sales) b. (Net sales)/(Net accounts receivable) c. (Bad debt expense)/(Net sales) d. (Net sales)/(Unearned revenue) e. (Net sales)/(Warranty Liabilities) -1- FSA 3321 – Summer II (2004) Exam 2 Moore Use the following information for problems 4 through 6 ABC Company is a startup company in an industry that exclusively uses capital leases for it’s expensive medical testing and diagnostic equipment. ABC, however, used operating lease accounting in its first year of operations. Assume the average lifespan of ABC’s leased equipment is 15 years and that their annual cost of debt is 12%. The annual lease payments are $3,000,000. The present value of the future lease payments is $20,432,600 (rounded). ABC’s industry commonly uses straight-line depreciation and the effective tax rate is 35%. 4. Adjust ABC’s books to reflect the lease as being capitalized. The depreciation expense that should have been charged against income in the first year is: a. $200,000 b. $3,000,000 c. $1,362,173 d. $885,413 e. $1,950,000 5. Adjust ABC’s books to reflect the lease as being capitalized. The appropriate charge for interest expense in the second year would be: a. $2,451,912 b. $2,386,141 c. $3,000,000 d. $1,593,743 e. $1,550,992 6. The overall effect on Net Income in the first year for ABC (had the lease been capitalized) would be (relative to the reported Net Income): a. $3,814,085 decrease b. $2,479,155 decrease c. $814,085 decrease d. $529,155 decrease e. $548,088 increase 7. Which of the following would be indicative of manipulated core expenses for the purpose of overstating income? a. Unexpected (unexplained) increases in asset turnover b. Unexpected (unexplained) declines in (Depreciation expense)/(Capital Expenditures) c. Unexpected (unexplained) increases in (Pension expense)/(SG&A expense) d. Unexpected (unexplained) declines in (Net sales)/(Warranty liabilities) e. Unexpected (unexplained) increases in (Operating Cash Flow)/(Operating Income) -2- FSA 3321 – Summer II (2004) Exam 2 Moore 8. Aggressive use of which of the following accounting choices can lead to the problem of “off-balance sheet financing”? a. Operating leases b. Failure to write down obsolete inventory c. Reporting all related party transactions d. Overstating depreciation for long-term assets e. Using the intrinsic method to account for executive stock options 9. The suspect accounting practice for Lucent Technologies involved: a. Operating leases b. Overstating accounts receivable c. Executive stock options d. Overstating inventory e. Understating pension liabilities 10. Which of the following adjustments to the accounts would have to be made when it is found (suspected) a company overstates the balance of it’s long-term assets? a. Increase depreciation expense b. Decrease retained earnings c. Increase income tax expense d. Decrease deferred tax liability e. Increase the asset account Use the attached financial statements for Dell-U-Dead Corp. to answer questions 11-13 11. Dell-U-Dead’s return on equity for the year ended February 1, 2002 was a. 377% b. 9.2% c. 26.5% d. 17.9% e. 4.0% 12. Dell-U-Dead’s debt service margin for the year ended February 1, 2001 was a. 9.32 b. 12.66 c. 7.30 d. 8.24 e. 0.52 13. What would Dell-U-Dead’s Sustainable Growth Rate have been for the year ended February 1, 2002 if it had maintained the same net profit margin as the previous year? (Assume no dividends are paid. Use the previous year’s ending equity to compute ROE.) a. 22.2% b. 15.5% c. 37.7% d. 38.7% e. 45.8% -3- FSA 3321 – Summer II (2004) Exam 2 Moore 14. Which of the following is not a driver of growth and profitability that is associated with product market strategies? a. Investment Management b. Managing Working Capital c. Acquiring the appropriate Fixed Assets d. Finding the most efficient method of financing Fixed Assets e. Developing effective marketing strategies 15. The firm’s spread and net financial leverage: a. Move in the same direction b. Move in opposite directions c. Are independent of one another d. Are two terms that mean the same thing e. Are controlled by the investment management function 16. When comparing the firm’s performance with that of its competitors: a. The analyst should perform time-series analysis b. The analyst should use all the average of all members of the industry as a benchmark c. The analyst should randomly select a member of the industry as a benchmark d. The analyst should compare the firm with direct competitors or from segments of the industry that are direct competitors (in terms of product market strategies). e. The analyst should compare the firm’s ROA with the return on the S&P 500 17. Assume that Dell-U-Dead’s interest expense for the year ended February 2, 2001 was $67,000,000. Compute the basic (not diluted) EBITDA per share for that year. a. $ 0.78 b. $ 0.76 c. $ 0.69 d. $ 0.48 e. $ 1.46 18. Which of the following actions would increase Dell-U-Dead’s SGR? a. Decreasing Inventory turnover b. Purchasing Fixed Assets c. Common Share Repurchases d. Increasing Accounts Payable Turnover e. Issuing more executive stock options 19. Which is not a measure of that is typically used for measuring Financial Leverage? a. Current ratio b. Cash ratio c. Operating cash flow ratio d. Debt-to-capital ratio e. Cash Flow per share ratio -4- FSA 3321 – Summer II (2004) Exam 2 Moore 20. Where did Professor Moore purchase his glass sun-tea maker? a. K-Mart b. Nordstroms c. Sears d. Target e. Wal-Mart Short Problem # 1 (Show all work to receive full credit) – 10 Points Compute all of the relevant liquidity and operating efficiency ratios for Dell-U-Dead for both years. (same ratios as for Vann Inc. homework assignment). Assess the overall changes and overall liquidity/operating efficiency from 2001 to 2002. Comment on major economic factors could explain some of the changes (if any). -5- FSA 3321 – Summer II (2004) Exam 2 Moore Short Problem # 2 (Show all work to receive full credit) – 10 Points In performing background research on Dell-U-Dead, you find that: a. Unearned Revenues increased from $192 million to $444 million (slightly more than double). However, their sales of 3-year service contracts were reported to have increased by more than 6 times. This would bring the Unearned Revenues balance to $1,152 million. Your concern is that all contracts were booked as earned in 2002. b. You are not convinced that production achieved increased efficiency in a down economy during the year ended February 1, 2002. In particular, you doubt the legitimacy of the ending inventory number and are concerned that sales may have been “created” to make profits look better. Consequently, you need to adjust the related items to the previous year’s levels in terms of efficiencies. Required: Assume a 35% tax rate. Make all of the adjustments to the relevant income statement and balance sheet accounts that relate to the problems identified in (a) and (b). Comment on these results. -6- FSA 3321 – Summer II (2004) Exam 2 Moore Dell-U-Dead Computer Corporation Balance Sheet (in Millions) (1 February 20XX) ASSETS Current Assets: Cash and equivalents Short-term Investments Accounts Receivable (net) Inventories Other 2002 2001 $ 3,641 273 2,269 278 1,419 $ 4,910 525 2,424 400 1,467 Total Current Assets $ 7,877 $ 9,726 826 4,373 359 100 996 2,418 290 240 Total non-current assets $ 5,658 $ 3,499 Total Assets $13,535 $13,670 $ 5,075 1,600 444 300 100 $ 4,286 1,550 192 450 300 $ 7,519 $ 6,778 520 302 150 120 230 509 261 120 100 280 Total Non-Current Liabilities $ 1,322 $ 1,270 Total Liabilities $ 8,841 $ 8,048 $ 5,605 (2,249) 1,364 ( 26) $ 4,795 --839 (12) Total Stockholders’ Equity $ 4,694 $ 5,622 Total Liabilities & Stockholders’ Equity -7- $13,535 $13,670 Non-Current Assets: Property, plant and equipment (net) Investments Goodwill Other non-current assets LIABILITIES AND STOCKHOLDERS’ EQUITY Current Liabilities: Accounts Payable Accrued Liabilities Unearned Revenues Notes Payable – Current Other Total Current Liabilities Non-Current Liabilities: Long-Term Debt Pension Liabilities Other Post-Retirement Benefit Liabilities Deferred Tax Liability Other Liabilities Stockholders’ Equity: Common Stock Issued and Outstanding Treasury Stock Retained Earnings Other Comprehensive Income FSA 3321 – Summer II (2004) Exam 2 Moore Dell-U-Dead Computer Corporation Income Statement (in Millions**) For the Year Ending February 1, 20XX)= Net Revenue Less: Cost of Goods Sold Gross Profit Operating Expenses Selling, General and Administrative Lease Expenses Research, Development and Engineering Special charges Total operating expenses Operating Income Investment and other income (loss), net of tax 2002 2001 $31,168 25,661 $31,888 25,445 $ 5,507 $ 6,433 $ 1,900 884 452 482 $ 2,400 793 482 105 $ 3,718 $ 3,780 $ 1,789 (58) $ 2,663 581 Income before taxes and cumulative effect of change in accounting principle $ 1,731 Provision for income taxes 485 $ 3,194 958 Income before cumulative effect of change in accounting principle $ 1,246 Cumulative effect of change in accounting principle --- $ 2,236 59 Net Income Earnings Per Common Share: Basic EPS Diluted EPS Weighted Average Shares Outstanding: Basic Diluted ** $ 1,246 $ 2,177 $ 0.48 $ 0.26 $ 0.87 $ 0.79 2,602 4,543 2,582 2,746 All items in millions of dollars except Earnings per Share data -8- FSA 3321 – Summer II (2004) Exam 2 Moore Dell-U-Dead Computer Corporation Statement of Cash Flows (in Millions) For the Year Ending February 1, 20XX Cash Flows from Operating Activities: Net Income Adjustment to reconcile income to cash provided by operating activities: Depreciation and amortization Tax benefits of employee stock plans Special charges Gains/Losses in investments Other Changes in: Operating working capital Non-current assets and liabilities 2002 2001 $ 1,246 $ 2,177 239 487 742 17 178 240 929 105 (307) 135 826 62 642 274 Net cash provided by operating activities $ 3,797 $ 4,195 Cash Flows from investing activities: Investments in securities: Purchases Maturities and sales Capital expenditures $(5,382) 3,425 (303) $(2,606) 2,331 (482) $(2,260) $ (757) Cash flows from financing activities: Purchase of common stock $(3,000) Issuance of common stock under employee plans 295 Other 3 $(2,700) 404 (9) Net cash used in investing activities Net cash used in financing activities Effect of foreign exchange rates on cash Net increase (decrease) in cash $(2,702) $(2,305) (104) (32) $(1,269) -9- $ 1,101