Second Examination – Finance 3321 Fall 2006 (Moore) – Version 1

advertisement

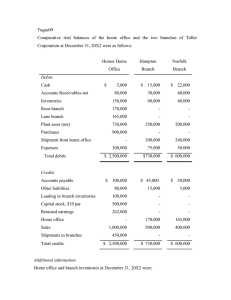

FSA 3321 – Fall (2006) Exam 2 – Version 1 Moore Second Examination – Finance 3321 Fall 2006 (Moore) – Version 1 Grader’s Name: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Where indicated, use the financial statements for Alamo Distributing (a small electrical components distributor that sells in both the wholesale and retail markets). Clearly Circle the BEST response for each of the following questions: Use the attached financial statements for Alamo to answer questions 1-8 1. Compute Alamo’s current ratio for the year ended 20X2 2. Compute Alamo’s Day’s Sales Outstanding 20X1. 3. Compute Alamo’s EBITDA for the year ended 20X2 4. Compute Alamo’s SGR for 20X2 5. Compute Alamo’s IGR for 20X2 -1- FSA 3321 – Fall (2006) Exam 2 – Version 1 Moore 6. Compute Alamo’s ROA for 20X2 7. Compute Alamo’s Times Interest Earned for 20X1 8. Compute Alamo’s Debt Service Margin for 20X2 9. The major benefit of using method of comparables as a stock price screening tool is: a. It provides consistent results b. It is grounded in financial theory c. It requires extensive forecasts and analysis d. It requires little judgment e. It is quick and easy to implement 10 Aggressive use of which of the following accounting choices can lead to the problem of “off-balance sheet financing”? a. Operating leases b. Failure to write down obsolete inventory c. Reporting all related party transactions d. Overstating depreciation for long-term assets e. Using the intrinsic method to account for executive stock options 11 The suspect accounting practice for Lucent Technologies involved: a. Operating leases b. Overstating accounts receivable c. Executive stock options d. Overstating inventory e. Understating pension liabilities -2- FSA 3321 – Fall (2006) Exam 2 – Version 1 Moore 12 Which of the following adjustments to the accounts would have to be made when it is found (suspected) a company understates the balance of it’s long-term assets? a. Increase depreciation expense b. Decrease liabilities c. Increase income tax expense d. Decrease post-retirement benefits liability e. Decrease the asset account 13. Which of the following will result in understated liability balances? a. Delays in the write-down (expensing) of current assets such as inventory. b. Understating the growth rate in future post-retirement benefit costs c. Overstated amortization of goodwill d. Overstating the growth rate in future post-retirement benefit costs e. Delaying the write-down (expensing) of obsolete factory equipment 14. Which of the following will result in increasing operating efficiency? a. Increasing Days Supply of inventory. b. Increasing Working Capital Inventory. c. Extending more generous credit terms from 30 days to 60 days d. Decreasing Accounts Receivable Turnover e. Increasing the Cash to Cash Cycle 15. Identify the best statement regarding seasonal adjustments. a. Seasonal adjustments should be applied to annual data b. Seasonal adjustments with an underlying growth should be computed using the same quarter in previous years and applying an annual growth rate for the year. c. Seasonal adjustments with an underlying growth should be computed using the same quarter in previous years and applying a growth rate based on the quarters. d. Seasonal adjustments should never incorporate underlying growth. e. Seasonal data can be directly identified in the 10-K financial statements. -3- FSA 3321 – Fall (2006) Exam 2 – Version 1 Moore Short Problem # 1 (Show all work to receive full credit) – 15 Points Valuation with P/E and P/B multiples Kinder Morgan is a natural gas producer and distributor that you are trying to value. Using the method of comparables, assess the value of Kinder Morgan. Information is provided concerning the current share price (PPS), current earnings per share (EPS) and the current book value of equity per share (BPS) for Kinder Morgan and three of its main competitors. Required: Value CrossTex using the P/E and P/B multiples. Briefly comment on which method comes closest to the observed market price of $63.40 per share. CrossTex Industries RGC Resources Atmos Engergy Corp. Kinder Morgan PPS 41.75 24.33 25.75 63.40 EPS 2.83 1.78 1.55 3.11 -4- BPS 28.13 17.82 18.15 21.75 FSA 3321 – Fall (2006) Exam 2 – Version 1 Problem 2 (Common Size Financial Statements) – 10 Points Prepare a common size income statement for Alamo Distributing for 20X1 -5- Moore FSA 3321 – Fall (2006) Exam 2 – Version 1 Moore Problem 3(Operating and Capital Lease Adjustments) – 15 Points Use the following information for Part A through Part D ABC Company is a startup company in an industry that exclusively uses capital leases for it’s expensive highway construction equipment. ABC, however, used operating lease accounting in its first year of operations. Assume the average lifespan of ABC’s leased equipment is 20 years and that their annual cost of debt is .092%. The annual lease payments are $4,000,000. The present value of the future lease payments is $36,000,000 (rounded). ABC’s industry commonly uses straight-line depreciation and the effective tax rate is 35%. A. Adjust ABC’s books to reflect the lease as being capitalized. Show initial recognition of the capital lease would have the following impact on the balance sheet (Asset and Liability Accounts) in terms of debits and credits B. Adjust ABC’s books to reflect the lease as being capitalized. The depreciation expense that should have been charged against income in the first year is: C. Adjust ABC’s books to reflect the lease as being capitalized. Compute the appropriate charge for interest expense in the second year. D. Compute the overall effect on Net Income in the first year for ABC (had the lease been capitalized) would be (relative to the reported Net Income, net of tax). Assume the first year interest expense under lease capitalization is $3,312,000. -6- FSA 3321 – Fall (2006) Exam 2 – Version 1 Moore ALAMO DISTRIBUTING COMPANY BALANCE SHEETS December 31, 20X1 and 20X2 ASSETS Current Assets: 20X1 20X2 Cash Accounts Receivable (net) Inventories (at FIFO Cost) Prepaid Expenses $ 70,000 65,000 31,000 6,000 $ 38,000 105,000 52,000 4,500 Total Current Assets $172,000 $199,500 $208,000 150,000 460,000 (240,000) $237,000 150,000 681,000 (338,000) $578,000 $730,000 $750,000 ======== $929,500 ======== Non-current Assets (at cost): Land Buildings Equipment Less: Accumulated Depreciation Total Non-current Assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts Payable Notes Payable Accrued Liabilities $ 22,000 60,000 18,000 $ 47,000 32,000 24,000 $100,000 $103,000 Notes Payable - Long Term 312,000 400,500 Total Liabilities $412,000 $503,500 Stockholders' Equity: Common Stock (no par value) Retained Earnings $200,000 138,000 $220,000 206,000 $338,000 $426,000 $750,000 ======== $929,500 ======== Total Current Liabilities Total Stockholders' Equity Total Liabilities & Stockholder Equity -7- FSA 3321 – Fall (2006) Exam 2 – Version 1 Moore ALAMO DISTRIBUTING COMPANY INCOME STATEMENTS For Years Ending December 31, 20X1 and 20X2 20X1 20X2 Sales $900,000 $1,200,000 Cost of Goods Sold (350,000) (580,000) Gross Profit on Sales $550,000 $ 620,000 Selling Expenses (110,000) (133,500) Administrative Expenses (238,000) (250,000) Income from Operations $202,000 $ 236,500 Interest Expense (52,000) (65,000) Income before Taxes $150,000 $ 171,500 Income Tax Expense (60,000) (63,500) Net Income $ 90,000 ======== Earnings per Common Share* $1.80 Total Depreciation Expense included above ..... $ 82,000 $ 108,000 ========== $1.96 $ 98,000 * Based on 50,000 and 55,000 average common shares outstanding in 20X1 and 20X2, respectively. Summary of Cash Flow Statements Cash Flow from Operating Activities Cash Flow from Investing Activities Cash Flow from Financing Activities 20X1 $150,000 -$ 90,000 $ 20,000 20X2 $180,000 -$130,000 $10,000 Dividends Paid $30,000 $40,000 -8-