Second Examination – Finance 3321 Summer 1 - 2005 (Moore)

advertisement

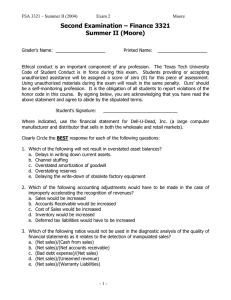

FSA 3321 – Summer 1 (2005) Exam 2 Moore Second Examination – Finance 3321 Summer 1 - 2005 (Moore) Student ID: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: 1. Which of the following will result in understated liability balances? a. Delays in the write-down (expensing) of current assets such as inventory. b. Overstating the growth rate in future post-retirement benefit costs c. Overstated amortization of goodwill d. Overstating the discount rate used to compute the present value of future postretirement benefit costs e. Using capital lease accounting when operating lease accounting is appropriate. 2. Which of the following accounting adjustments would have to be made when it is determined that revenues are improperly overstated? a. Sales would be increased b. Accounts Receivable would be increased c. Cost of Sales would be increased d. Inventory would be increased e. Retained earnings would have to be decreased 3. Which of the following ratios would be used in the diagnostic analysis of the quality of financial statements as it relates to the detection of manipulated revenues? a. (Sales)/(Total Assets) b. (Cash Flow From Operations)/(Operating Income) c. (Total Accruals)/(Change in Sales) d. (Net sales)/(Inventory) e. (Pension Expenses)/(Selling, General and Administrative Expenses) -1- FSA 3321 – Summer 1 (2005) Exam 2 Moore 4. Which of the following would be indicative of manipulated core expenses for the purpose of overstating income? a. Unexpected (unexplained) decreases in asset turnover b. Unexpected (unexplained) increases in asset turnover c. Unexpected (unexplained) increases in (Pension expense)/(SG&A expense) d. Unexpected (unexplained) decreases in (Net sales)/(Inventory) e. Unexpected (unexplained) decreases in (Total Accruals)/(Sales) 5. Aggressive use of which of the following accounting choices can lead to the problem of “off-balance sheet financing”? a. Operating leases b. Failure to write down obsolete inventory c. Reporting all related party transactions d. Overstating depreciation for long-term assets e. Channel Stuffing 6. The suspect accounting practice for Lucent Technologies involved: a. Operating leases b. Overstating accounts receivable c. Channel Stuffing d. Overstating inventory e. Understating pension liabilities 7. Which of the following adjustments to the accounts would have to be made when it is found (suspected) a company overstates the balance of it’s long-term assets? a. Increase depreciation expense b. Decrease retained earnings c. Increase income tax expense d. Decrease post-retirement benefits liability e. Increase the asset account 8. Which of the following will result in overstated asset balances? a. Off-Balance Sheet financing with operating lease accounting. b. Channel stuffing c. Overstated amortization of goodwill d. Improper accounting with operating leases e. Delaying the write-down of obsolete factory equipment 9. Which of the following would be indicative of manipulated core expenses for the purpose of overstating income? a. Unexpected (unexplained) increases in asset turnover b. Unexpected (unexplained) declines in (Depreciation expense)/(Capital Expenditures) c. Unexpected (unexplained) increases in (Pension expense)/(SG&A expense) d. Unexpected (unexplained) declines in (Net sales)/(Warranty liabilities) e. Unexpected (unexplained) increases in (Operating Cash Flow)/(Operating Income) -2- FSA 3321 – Summer 1 (2005) Exam 2 Moore 10. Which of the following is not a factor that affects managers’ accounting choices? a. Regulatory concerns b. Compensation c. Capital Market perceptions d. Inaccurate estimates e. Debt Covenants 11. What is the first step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Undo Accounting Distortions c. Evaluate the actual accounting strategy d. Evaluate the quality of disclosure e. Identify key accounting policies 12. What is the last step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Undo Accounting Distortions c. Evaluate the actual accounting strategy d. Evaluate the quality of disclosure e. Identify key accounting policies 13. Which of the following companies was identified in class as having settled with the SEC for Channel Stuffing during the period from 1999-2002? a. Lucent b. Krispy Kreme c. Visteon d. Enron e. Bristol-Myers 14. How much were profits overstated for the company in question 13 during the period from 1999-2002? a. $2,500,000,000 b. $1,500,000,000 c. $900,000,000 d. $500,000,000 e. $300,000,000 14. How much were revenues overstated for the company in question 13 during the period from 1999-2002? a. $2,500,000,000 b. $1,500,000,000 c. $900,000,000 d. $500,000,000 e. $300,000,000 -3- FSA 3321 – Summer 1 (2005) Exam 2 Moore 15. Which of the following components of the annual financial report is not audited: a. Balance Sheet b. Income Statement c. Management discussion and Analysis d. Statement of Cash Flows e. Statement of Owners Equity 16. Which organization has been delegated the authority to establish US GAAP? a. AICPA b. CPA c. FASB d. IASB e. SEC 17. Investors will find forward-looking information in which component of the financial report? a. Management Discussion and Analysis Section b. Balance Sheet c. Income Statement d. Footnotes to Financial Statements e. The Auditor’s Opinion 18. Channel Stuffing is associated with: a. Cost Management b. Selling unwanted or unordered merchandise c. Intense marketing plans d. Flexible Accounting e. Conservative Accounting 19. With respect to Ford Motor Corporation (and many companies in the US), which of the following statements is correct (based on classroom discussion). a. The quality of disclosure has noticeably improved over the past 5 years. b. Transparency of financial reporting has noticeably improved over the past 5 years. c. The level of dis-aggregation in the primary financial reports has improved over the past 5 years. d. The Sarbanes-Oxley act has had no apparent impact on the quality and transparency of financial disclosure. e. The explanation and level of details in the supplemental disclosure (footnotes) has improved over the past 5 years. -4- FSA 3321 – Summer 1 (2005) Exam 2 Moore Use the following information for problems 20 through 23 ABC Company is a startup company in an industry that exclusively uses capital leases for its expensive highway construction equipment. ABC, however, used operating lease accounting in its first year of operations. Assume the average lifespan of ABC’s leased equipment is 10 years and that their annual cost of debt is 11.225%. The annual lease payments are $12,000,000. The present value of the future lease payments is $70,000,000 (rounded). ABC’s industry commonly uses straight-line depreciation and the effective tax rate is 35%. 20. Adjust ABC’s books to reflect the lease as being capitalized. The initial recognition off the capital lease would have the following impact on the balance sheet: a. $120,000,000 increase to long-term liabilities b. $120,000,000 increase to fixed assets c. $70,000,000 decrease to long-term liabilities d. $70,000,000 increase to fixed assets e. $12,000,000 increase to long-term liabilities 21. Adjust ABC’s books to reflect the lease as being capitalized. The depreciation expense that should have been charged against income in the first year is: a. $1,200,000 b. $7,000,000 c. $12,000,000 d. $70,000,000 e. $120,000,000 22. Adjust ABC’s books to reflect the lease as being capitalized. The appropriate charge for interest expense in the first year would be: a. $1,200,000 b. $7,000,000 c. $7,393,623 d. $7,858,505 e. $12,000,000 23. The overall effect on Net Income in the first year for ABC (had the lease been capitalized) would be (relative to the reported Net Income, net of tax): a. $14,858,505 decrease b. $9,658,028 decrease c. $2,858,505 decrease d. $1,858,028 decrease e. $1,000,047 decrease -5- FSA 3321 – Summer 1 (2005) Exam 2 Moore Use the following information for questions 24-25 (Change in Net Sales)/(Change in Cash from sales) Net Sales/Net Accounts Receivable Net Sales/Warranty Liabilities CFFO/OI CFFO/NOA Total Accruals/Change in Sales 2001 0.99 12.0 104 1.28 0.15 0.50 2002 0.98 10.0 106 1.18 0.18 .049 2003 1.01 11.0 118 1.22 0.17 0.62 2004 1.80 10.5 48 1.95 0.48 0.58 24. Which of the expense diagnostic ratios would provide a “red flag” raising concerns that expenses may have been understated for the purpose of overstating net income in 2004? a. (Change in Net Sales)/(Change in Cash from sales) b. Net Sales/Warranty Liabilities c. CFFO/OI (Cash Flow from Operating Activities)/(Operating Income) d. CFFO/NOA (Cash Flow from Operating Activities)/(Net Operating Assets) e. Total Accruals/Change in Sales 25. Which of the revenue diagnostic ratios would provide a “red flag” raising concerns that revenues may have been overstated for the purpose of overstating net income in 2004? a. Net Sales/Cash from sales b. Net Sales/Net Accounts Receivable c. Net Sales/Warranty Liabilities d. CFFO/OI (Cash Flow from Operating Activities)/(Operating Income) e. CFFO/NOA (Cash Flow from Operating Activities)/(Net Operating Assets) -6-