INTERMEDIATE

ACCOUNTING

Seventh Canadian Edition

KIESO, WEYGANDT, WARFIELD, YOUNG, WIECEK

Prepared by:

Gabriela H. Schneider, CMA

Northern Alberta Institute of Technology

CHAPTER

18

Earnings Per Share

Learning Objectives

1. Understand why EPS is an important number.

2. Understand when and how EPS is required to

be presented.

3. Identify potential common shares.

4. Calculate earnings per share in a simple capital

structure.

Learning Objectives

5. Calculate diluted earnings per share using the ifconverted method.

6. Calculate diluted earnings per share using the

treasury stock method.

7. Calculate diluted earnings per share using the

reverse treasury stock method.

8. Identify antidilutive potential common shares.

Earnings Per Share

Overview

Objective

Presentation

and

disclosure

Basic EPS

Simple capital

structure

Income available

to common

shareholders

Weighted

average common

shares

Comprehensive

illustration

Diluted EPS

Perspectives

Complex capital structure Usefulness

Convertible securities

of EPS

If-converted method

Options and warrants

Treasury stock method

Reverse treasury stock

method

Contingently issuable shares

Antidilution revisited

Additional disclosures

Comprehensive illustration

Importance of EPS

• Calculated for common shares

• Tells shareholders how much of the available

income is associated with the shares they own

(their share of the pie)

• Provides insight to shareholders

– Future dividend payout

– Future share value

– Impact of other financial instruments on

their potential earnings (Diluted EPS)

EPS Calculation

• Basic EPS

– Actual earnings and actual number of issued

common shares

• Diluted EPS

– Earnings and number of common shares adjusted

for “what-if”

• What would the EPS be if any financial instruments

that could be converted to common shares were

actually converted

EPS Calculation

Income available to common

shareholders

EPS

=

Weighted average number of

common shares

EPS Disclosure

• CICA Handbook, Section 3500.60 requires EPS to be

reported as part of the income statement

– Exception: non public (privately held) corporation

• Reported for each income component as reported on

the income statement

• Where applicable, both Basic EPS and Diluted EPS

reported

• Presented for all periods reported

– Prior period EPS restated for any stock dividends

or stock splits

EPS Disclosure

Income Statement Presentation of EPS

Components

Earnings per share:

Income from continuing operations

$4.00

Loss from discontinued operations,

net of tax

(.60)

Extraordinary gain, net of tax

1.00

Net Income

$4.40

EPS Disclosure

EPS Presentation – Complex Capital Structure

Earnings per common share:

Basic earnings per share

$3.30

Diluted earnings per share

$2.70

EPS Disclosure

EPS Presentation, with Extraordinary Item

Basic earnings per share:

Income before extraordinary item

$3.80

Extraordinary item

.80

Net Income

$3.00

Diluted earnings per share:

Income before extraordinary item

$3.35

Extraordinary item

65

Net Income

$2.70

Brief Exercise BE 18-9

EPS Presentation for Schrempf Corp.

• Net Income

• Extraordinary Loss

• Common shares

outstanding

$1,480,000

$ 220,000

50,000

Brief Exercise BE 18-9

Basic Earnings Per Share

Total

Income before

extraordinary loss

$1,700,000

Extraordinary loss

220,000

Net Income

$1,480,000

EPS

$34.00

(4.40)

$29.60

Capital Structure

• Method of EPS calculation based on the

corporations capital structure

• Simple Capital Structure

– When only common shares are issued

– Basic EPS calculated

• Complex Capital Structure

– When common shares plus dilutive securities are

issued

• Potential common shares

– Diluted EPS calculated

Potential Common Shares

• Securities, or other financial instruments

issued by a corporation that have an option

for the holder to convert the security into

common shares

• This conversion could have a negative, or

dilutive effect on EPS

– Cause EPS to decrease

• Contingently issuable shares

– Shares issued for minimal consideration

(asset exchange) once a certain condition has

been met

EPS Reporting Requirements

Capital

Structure

Major Types of Equity

Instruments

Impact on EPS

Calculations

Simple

Common shares

Preferred shares

Basic EPS only

Complex

Common shares

Basic and

Diluted EPS

Potential Common shares:

–Convertible preferred shares

–Convertible debt

–Options/warrants

–Contingently issuable

EPS - Simple Capital Structure

Net Income – Preferred Dividends

Weighted Average # of Shares Outstanding

• If the preferred shares are non-cumulative

– include only declared dividends

• If the preferred shares are cumulative

– include only declared dividends, or

– if no dividends declared, include only one year’s

dividends

EPS – The Numerator

Example: Michael Limited

• Net Income

$3,000,000

• Shares

– 100,000 Class A preferred, cumulative shares,

dividend amount $4.00 per share

– 100,000 Class B preferred, non-cumulative

shares, dividend amount $3.00 per share

• No dividends declared or paid in the current

year

EPS – The Numerator

Net Income

$3,000,000

Amount attributable to Class A:

100,000 x $4.00

400,000

2,600,000

Amount attributable to Class B:

100,000 x $0.00

-0Income available to

common shareholders

$2,600,000

The Class B shares are non-cumulative, with no dividends

declared for the year no amount is deducted from Net Income

EPS - Simple Capital Structure

Net Income – Preferred Dividends

Weighted Average # of Shares Outstanding

• Number of shares issued is weighted by the

period of time they were outstanding

• Each transaction (issue of shares,

reacquisition of shares, retirement of shares)

represents a weighting period

EPS – The Denominator

Date

Share Changes

Shares

Outstanding

90,000

January 1

Beginning balance

April 1

30,000 shares issued

July 1

39,000 shares purchased

November 1

60,000 shares issued

141,000

December 31

Year end balance

141,000

120,000

81,000

EPS – The Denominator

Dates Outstanding

Shares

Outstanding

Fraction Weighted Shares

Portion of Year

Outstanding

Weighted

Shares

Jan. 1st to April 1st

90,000

3/12

22,500

April 1st to July 1st

120,000

3/12

30,000

July 1st to Nov 1st

81,000

4/12

27,000

Nov 1st to Dec 31st

141,000

2/12

23,500

Weighted Average Shares Outstanding

103,000

EPS – The Denominator

Net Income – Preferred Dividends

Weighted Average # of Shares Outstanding

• Stock splits and stock dividends require

restatement of the outstanding number of shares

from the beginning of the year

– Because there has been no change in the

company’s assets, or in the shareholders’ total

investment

EPS – The Denominator

• A final note (CICA Handbook, Section 3500)

– If there is a stock split or stock dividend after the

year end but before the publication of the

financial statements

• The weighted average number of shares

outstanding must be restated

• This applies to the current year, as well as

previous years if comparative statements are

issued

EPS – The Denominator

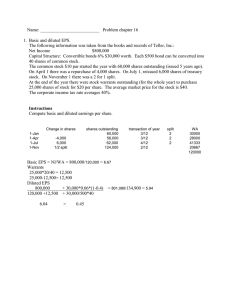

Given – Baiye Limited:

January 1:

100,000 shares outstanding

March 1:

Issued 20,000 shares

June 1:

50% Stock dividend (60,000

additional shares issued)

November 1: Issued 30,000 shares

December 31: Ending Balance = 210,000

shares outstanding

EPS – The Denominator

Dates

O/S

Shares

O/S

Fraction Weighted

Restatement of Year

Shares

Jan-Mar

100,000

X 1.50 X

2/12 =

25,000

Mar-Jun

120,000

X 1.50 X

3/12 =

45,000

Jun-Nov

180,000

X

5/12 =

75,000

Nov-Dec

210,000

X

2/12 =

35,000

Weighted average shares outstanding

180,000

Complex Capital Structure

• Complex capital structure:

– When corporation has convertible securities,

options, warrants or other rights, and

– When converted these could dilute EPS

• Dilution is the reduction in EPS, if:

– Securities, potentially convertible into common

stock, are converted (assumed at beginning of

the year)

• Anti-dilutive securities

– Securities, when converted, increase EPS

– Anti-dilutive EPS are not reported, only basic

EPS - Complex Capital Structure

• Requires dual presentation of EPS

– Basic earnings per share

• Presented for each separate class of common

share

– Fully diluted earnings per share

• Only securities that reduce earnings per share

(dilutive) are considered

• Securities that increase earnings per share (antidilutive) are ignored

Diluted Earnings per Share Methods

• The dilutive effect of convertible securities is

measured by the if-converted method

• The dilutive effect of options and warrants is

measured by the treasury stock method

• For computing dilution, the rate of conversion

most advantageous to the security holder is used

(maximum dilutive conversion rate)

The If-Converted Method

• The conversion of the securities into common

stock is assumed to occur at the beginning of the

year

• The net income must be adjusted for:

– Interest (net of tax) on the convertible debt

– Dividends on the convertible preferred shares

• The weighted average number of shares is

increased by the additional common shares

assumed issued (at the beginning of year)

The If-Converted Method

• Adjust Net Income

– Convertible debt issues

– Income is adjusted for the after-tax interest that would not

have been paid if the debt were converted to common

shares

• Interest adjusted for any premium or discount

amortization

– Convertible preferred shares

• No adjustment to the numerator required if there are

convertible preferred shares

• Adjust (re-calculate) weighted average number of shares

– Adjusted as if all convertible securities were converted to

common shares

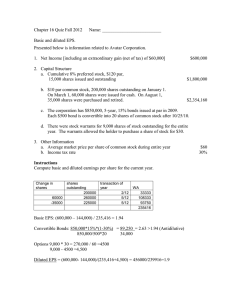

Field Corporation

Net Income for the Year

Add back:

Interest on 6% debentures

$60,000 x (1-.40)

Interest on 10% debentures

$100,000 x (1-.40)

Adjusted Net Income

$210,000

36,000

45,000

$291,000

Field Corporation

Unadjusted Weighted Average

Number of Shares

100,000

Add: Shares assumed issued (converted)

6% debentures

20,000

10% debentures *

24,000

Weighted Average Number of Shares 144,000

Field Corporation

• Conversion is always assumed to be at the

beginning of the year

• If a convertible security is not outstanding for

the full 12 months of the year

• Conversion is pro-rated for the number of

months the convertible security is actually

issued

– Field Corporation 10% debenture was issued

April 1st, therefore the conversion is 32,000

shares times 9 out of 12 months

Field Corporation

• EPS Calculation and Disclosure

• Net Income

$210,000

• Basic EPS

$210,000 100,000

$2.10

• Diluted EPS

$291,000 144,000

$2.02

The Treasury Stock Method

• Options and warrants (and their equivalents)

included in EPS computations

• Options and warrants are assumed exercised at

the beginning of the year

• The proceeds from the exercise of options are

assumed to be used to buy back common shares

• The exercise price per share must be less than

the market price per share for dilution to occur

Options and Warrants Treasury Stock Method

Given:

Exercise price of an option (for one share of stock) $ 30

Market price of one share at exercise date: $ 50

Options deemed exercised: 1,500

Compute the number of weighted shares for determining

diluted earnings per share

Total proceeds from exercise:

Shares issued on exercise:

Assumed reacquisition of shares:

Dilution: 1,000 - 250

=

(increase in outstanding shares)

$45,000

1,500

900

750 Shares

Reverse Treasury Stock Method

•

•

Used with put options and forward purchase

contracts

Two assumptions under this method

1. Enough common shares issued at beginning

of the year for the company to purchase

shares under the option or forward contract

2. Proceeds from the share issue will be used

to purchase shares under the option or

forward contract

Reverse Treasury Stock Method

Given:

Exercise price of an option (for one share of stock) $ 30

Market price of one share at exercise date: $ 20

Options deemed exercised: 1,500

Compute the number of weighted shares for determining

diluted earnings per share

Amount needed to buy back the 1,500 shares:

(1,500 * $30)

$45,000

Shares issued to acquire needed cash:

($45,000 $20)

2,250

Number of shares purchased through put:

1,500

Dilution: 2,250 – 1,500

=

750 Shares

(increase in outstanding shares)

Antidilutive Potential Common

Shares

• Securities that cause an increase in EPS if

included in EPS calculations

• Convertible debt antidilutive if conversion

increases EPS to increase by a greater

amount than EPS before conversion

• For example:

Antidilutive EPS

Kohl Corporation

• $1 million in 6% convertible debt –

convertible to 10,000 common shares

• Net Income is $210,000

• 100,000 common shares outstanding

• Basic EPS = $2.10 per share

Antidilutive Shares

Test for Antidilution

Adjusted Net Income:

Net Income

After-tax interest adjustment

($1.0m x 6%)(1-.40)

Adjusted Net Income

Adjusted Number of Shares:

Shares outstanding

Shares issued on conversion

Adjusted Number of shares

$210,000

36,000

$246,000

100,000

10,000

110,000

Antidilutive Shares

Diluted EPS =

$246,000 110,000 = $2.24

Basic EPS

= $2.10

Antidilutive, therefore not disclosed

Earnings per Share:

Complex Structures - Summary

Dual EPS Presentation

Basic EPS

Net Income adjusted for

interest (net of tax) and

preferred dividends

Weighted average number of

common shares assuming

maximum dilution

Diluted EPS

Dilutive Convertibles

Dilutive Options and Warrants

Dilutive Contingent Issues

Additional Disclosure

• Disclosed in notes to financial statements

1. Adjustments to income

2. Reconciliation of both the numerator and

denominator values

3. Potentially dilutive securities

COPYRIGHT

Copyright © 2005 John Wiley & Sons Canada, Ltd.

All rights reserved. Reproduction or translation of

this work beyond that permitted by Access Copyright

(The Canadian Copyright Licensing Agency) is

unlawful. Requests for further information should be

addressed to the Permissions Department, John

Wiley & Sons Canada, Ltd. The purchaser may make

back-up copies for his or her own use only and not

for distribution or resale. The author and the

publisher assume no responsibility for errors,

omissions, or damages caused by the use of these

programs or from the use of the information

contained herein.