1.Define the time value of money!

advertisement

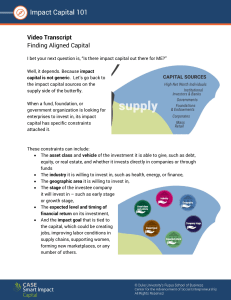

1.Define the time value of money! The Time value of money is term that recognizes the fact that money tomorrow is not worth as much as money today. For example if you can get a 10% return on your investment that means that $100 today = $110 tomorrow. This is important because when we are thinking about future cash flows we have to discount them into today’s values. a) A friend bought a house in on July 1 1988 for CAD 120, 000. They just have sold it on July 1, 2007 for Cad 260,000. What is the annual return? 260 000 = 120 000 (1 + return) 19 Return = 4.15% compounded annually b) Define nominal and real return: Nominal Return is the actual rate of return that you have achieved. For example if you invest $100 and one year later received $110 then your nominal rate of return is 10$ (110-100 / 100) Real Return is your nominal return minus inflation. So in the above example if inflation for the year was 5% then your real return is 5% (10% - 5%) 2. Define the relationship between risk and return! The higher the risk means the higher return. People are risk averse therefore if they are to take on higher risk than they will demand higher return to compensate. 3. Define the term investment! An investment is using your capital assets to generate a monetary return for you over an extended period of time. 4. Define Primary and Secondary Investment Objectives; Give examples; Define compatibility of primary and secondary objectives. What is the main purpose of the investment? What is the main concern. Primary objectives include safety, income, growth of capital. Secondary objectives are called such because they should not dominate primary objectives. They include: liquidity, marketability and tax considerations. Compatibility: The three primary objectives are not all compatible with each other and with the secondary objectives all the time. Typically high growth investments are higher risk and therefore incompatible with a portfolio built primarily for safety. Safety and income may be compatible goals but again high growth assets tend to pay less income. In essence a perfect investment (low-risk/high income/ high growth/highly liquid/low tax) investment does not exist. Investors must set priorities and invest accordingly. 5. Discuss Investment constraints. Investors face constraints concerning what they are able to invest in. Personal income and debt obligations will influence which investment choices available for an individual. Level of investment knowledge, and risk tolerance can also constrain an investor. Investors can also be constrained by legal and ethical issues. Individuals with inside knowledge of a company cannot actively trade its stock. Also some people will not invest in companies they deem to be morally suitable Ex: Companies that pollute excessively or employ child labour; tobacco companies, etc.