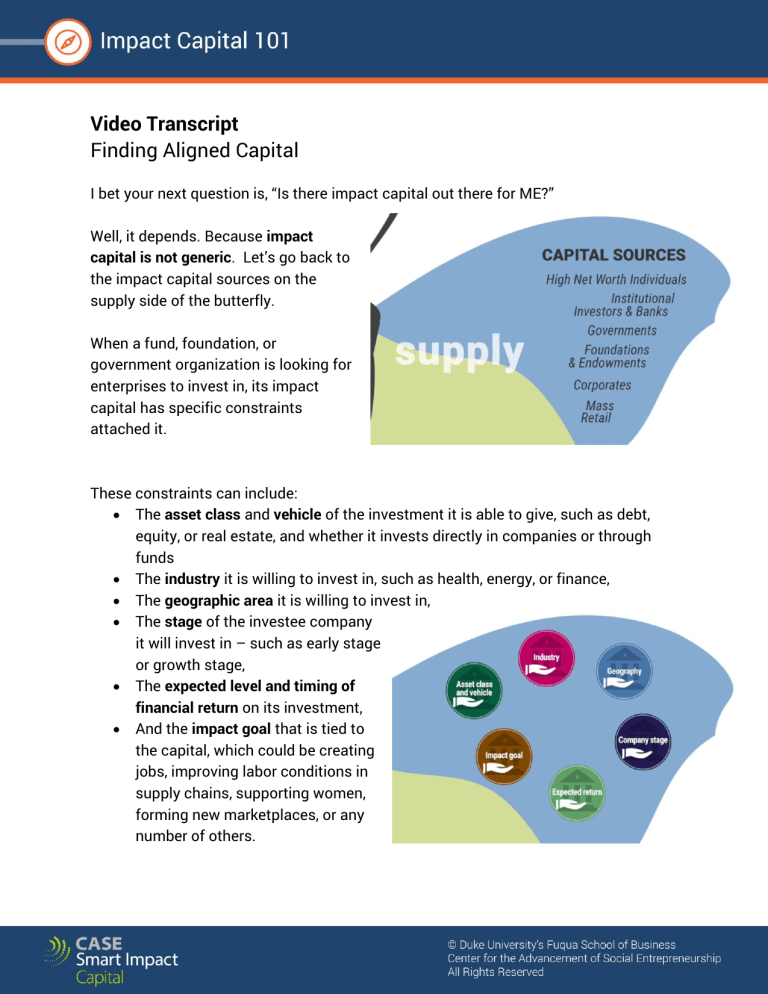

Video Transcript Finding Aligned Capital I bet your next question is, “Is there impact capital out there for ME?” Well, it depends. Because impact capital is not generic. Let’s go back to the impact capital sources on the supply side of the butterfly. When a fund, foundation, or government organization is looking for enterprises to invest in, its impact capital has specific constraints attached it. These constraints can include: The asset class and vehicle of the investment it is able to give, such as debt, equity, or real estate, and whether it invests directly in companies or through funds The industry it is willing to invest in, such as health, energy, or finance, The geographic area it is willing to invest in, The stage of the investee company it will invest in – such as early stage or growth stage, The expected level and timing of financial return on its investment, And the impact goal that is tied to the capital, which could be creating jobs, improving labor conditions in supply chains, supporting women, forming new marketplaces, or any number of others. The different combinations of each of these constraints means there are lots of different and very specific “flavors” of impact capital. Investment managers think strategically about the flavors of capital they issue in order to diversify their portfolios and meet the needs of their clients. The bottom line for you as an impact entrepreneur is this: once you go from billions of dollars of impact capital to identifying the specific flavor of capital that fits YOUR enterprise, you might be talking about only a handful of investors. And it’s uneven. For example, for companies creating mobile money apps to reach the traditionally unbankable in Kenya, there might be dozens of investors. For another intersection of geography, industry, company stage, and impact goal, there might be only 1 or 2. Here’s Eric Savage, an impact investment banker and co-founder of Unitus Capital in Bangalore, India, on his view of this: “I really wish there was an oversupply of capital to the impact sectors. But sadly, the reality is very clear from my viewpoint that there's not nearly enough investors who are really investing in most of the impact sectors out there.” Eric uses the example of raising several rounds of capital for a company called Forus Health. Forus focuses on radically affordable health care technology and their first product was an eye screening device to diagnose major causes of blindness for base of the pyramid clients. “But when we went out to investors, we were raising $5 million. And so whatever amount of money you raise, you immediately eliminate most the investors. Because every investor has their sweet spot of how much they invest. So we know literally, pretty well, hundreds of investors. And so when you go to $5 million, you eliminate most investors, because they want to invest more than that. And then you eliminate some of the investors because they want to invest less than that. And then so for those remaining investors where $5 million is the sweet spot, most of them won't invest in health care or any other sector, because they all have sector focuses. And even those who do do health care probably won't do health care technology. And then if they do health care technology, they may not do optometry. And all the sudden, the funnel gets extremely narrow. And if they do like that specific sector, it's very possible they already have a competing investment in that sector. So when we were raising money for Forus, frankly we got down to the end, and there only two investors who were truly interested. Fortunately, they did invest. Every capital raise we do is really difficult. And while there's lots of investors out there looking for investments, when you get to one specific company, there's a lot of very logical reasons why the vast majority of them say no.” So this is why you need to be smart: the supply of the specific flavor of capital aligned with YOUR venture may be scarce, and the demand, from ventures like yours, is large. If there is only a narrow set of investors whose flavor of capital matches your venture’s characteristics, you need to be as prepared as possible before you talk to them. By being prepared, you earn the chance to get to the next step, which is finding out what the investor may offer, in cash, knowledge, relationships, and cachet. At this point, many entrepreneurs ask, why go to impact capital sources at all, rather than traditional capital sources? The answer comes back to your need for alignment with your investors on two main factors: first, the pace of your expected growth and returns, and second, the aspects of mission and impact you want to protect. Here is an impact investor, Maya Chorengel of Elevar Equity, on the importance of alignment on your pace of growth and profitability: “If you can't generate the kind of margin that would generate a financial return of x, you shouldn't be trying to attract commercial capital that expects a return of x. You should be trying to look for a different capital provider to get you to that point. So I think it's really about what are the right sources of capital for the different kinds of initiatives, depending on what their impact outcome and their financial outcome might be.” As Maya says, it’s about finding a good match. Your investors should be aligned with you on goals for financial return AND impact, and ideally they should be able to provide strategic support as you work towards those goals. So how do you find your way in a growing impact capital market that may actually be somewhat undersupplied for YOUR specific flavor of capital? What you don’t want to do is talk to hundreds of investor leads and try to keep them all interested, answering all of their questions along the way, only to find out months down the line that they never invest in your particular geography, or your particular impact area, or your particular industry. That’s a waste of time and energy, and fundraising is already hard enough. Instead, you need smart shortcuts. You need to develop a strong, clear investment proposition that you can communicate easily. You need to narrow your investor targets down to those offering the specific flavor of capital that matches your venture, so you don’t waste time on the ones who will never be able to invest in you. And then you need to find ways to develop a long-term relationship of trust with the most aligned investors. Mastering these steps is the focus of the rest of our modules.