MGT 3470A ………………………..

advertisement

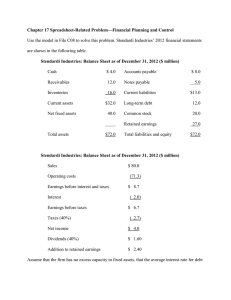

MGT 3470A SPRING 2014 Midterm 1 ……………………….. 1. A firm has an ROE of 7.5% and an ROA of 13.5%. What is the internal growth rate if the firm has a 40% dividend payout ratio? A. 4.71% B. 5.71% C. 8.10% D. 8.81% E. 9.19% 2. Given the following information: sales = $670; costs = $520; tax rate = 34%. Assuming costs run at a constant percentage of sales, if sales rise by 12% next year, what will net income be? A. $150 B. $99.00 C. $89.10 D. $110.88 E. none of the above 3. Given the following information: current assets = $400; fixed assets = $500; accounts payable = $100; notes payable = $45; long-term debt = $455; equity = $300; sales = $450; costs = $400; tax rate = 34%. Suppose that current assets, costs, and accounts payable maintain a constant ratio to sales. If the firm is producing at 80% capacity, what is the total external financing needed if sales increase 25%? Assume the firm pays no dividends. A. $33.75 B. $66.25 C. $143.75 D. $172.50 E. $380.25 4. Given the following information: assets = $900; accounts payable = $110; notes payable = $100; long-term debt = $150; equity = $540; sales = $450; costs = $400; tax rate = 34%; dividends = $16. 50. Costs, assets, and accounts payable maintain a constant ratio to sales. How much external financing is needed if sales increase 15% and the dividend payout ratio is constant? A. $81 B. $94 C. $100 D. $106 E. none of the above 5. Wild Rose Stone, firm's full-capacity sales level is $7,000. If the firm is currently operating at 80% of capacity, what is the current level of sales? A. $8,750 B. $7,000 C. $5,600 D. $5,833 E. none of the above 6. Moore Money Inc. has a profit margin of 11% and a retention ratio of 70%. Last year, the firm had sales of $500 and total assets of $1,000. The desired total debt ratio is 75%. What is the firm's sustainable growth rate? A. none of the below B. 4.0% C. 7.22% D. 11.3% E. 18.2% 7. Sales of Wintergreen, Inc. are expected to increase by 7% next year. Wintergreen is currently operating at maximum capacity. Wintergreen does not pay a dividend. Given this projection, which one of the following statements is correct concerning next year's pro forma statement for Wintergreen Inc. if the percentage of sales approach is used? A. Costs are projected to be $11,311. B. Net income is projected to be $1,986. C. The projected retained earnings is $11,406. D. The long-term debt is projected to be $7,062. E. The EFN is projected to be $52. 8. Sales of Wintergreen, Inc. are expected to increase by 12% next year. Wintergreen is currently operating at 85% of capacity. The plowback ratio is 60%. What is the external financing need? A. -$810 B. -$433 C. $1,290 D. $1,563 E. $2,043 9. Wintergreen, Inc. is producing at 82% of capacity. What is the capital intensity ratio at maximum capacity? A. .53 B. .63 C. 1.22 D. 1.44 E. 1.59 10. Sales of Wintergreen, Inc. are expected to increase by 13% next year. The dividend payout ratio is 35%. The company is currently operating at 93% of capacity. What is the projected retained earnings balance at the end of next year? A. $132 B. $414 C. $1,235 D. $2,087 E. $2,203 11. For pro forma purposes, the Martin-Jones Company uses a 7.5 percent profit margin and a 60 percent dividend payout ratio. Sales for next year are projected to be $267,000. What is the projected addition to retained earnings? A. $8,010 B. $8,660 C. $9,120 D. $12,015 E. $12,455 12. A firm desires a sustainable growth rate of 13.3273 percent while maintaining a 30 percent dividend payout ratio and an 8 percent profit margin. The firm has a total asset turnover ratio of 1.5. What is the debt-equity ratio that is required to achieve the firm's desired rate of growth? A. 28 percent B. 35 percent C. 40 percent D. 44 percent E. 52 percent 13. You purchased a bond for $900 one year ago. Today, you receive your only interest payment for the year of $80. The bond can currently be sold for $964. What is your total percentage return on investment? Ignore tax effects. A. 8.88% B. 16% C. 12.3% D. 7.11% E. none of the above 14. Given the following historical returns, what is the standard deviation? Year 1 = 20%; year 2 = -12%; year 3 = 16%; year 4 = 3%; year 5 = -15%. A. 11.89% B. 12.48% C. 14.18% D. 15.85% E. 16.87% 15. You purchased stock that gives historical average rate of return 7.8% with a standard deviation of 1.8%. What is the Z-score of 11.75 % return? A. 1.27 B. 0.25 C. 2.19 D. - 2.19 E. none of the above