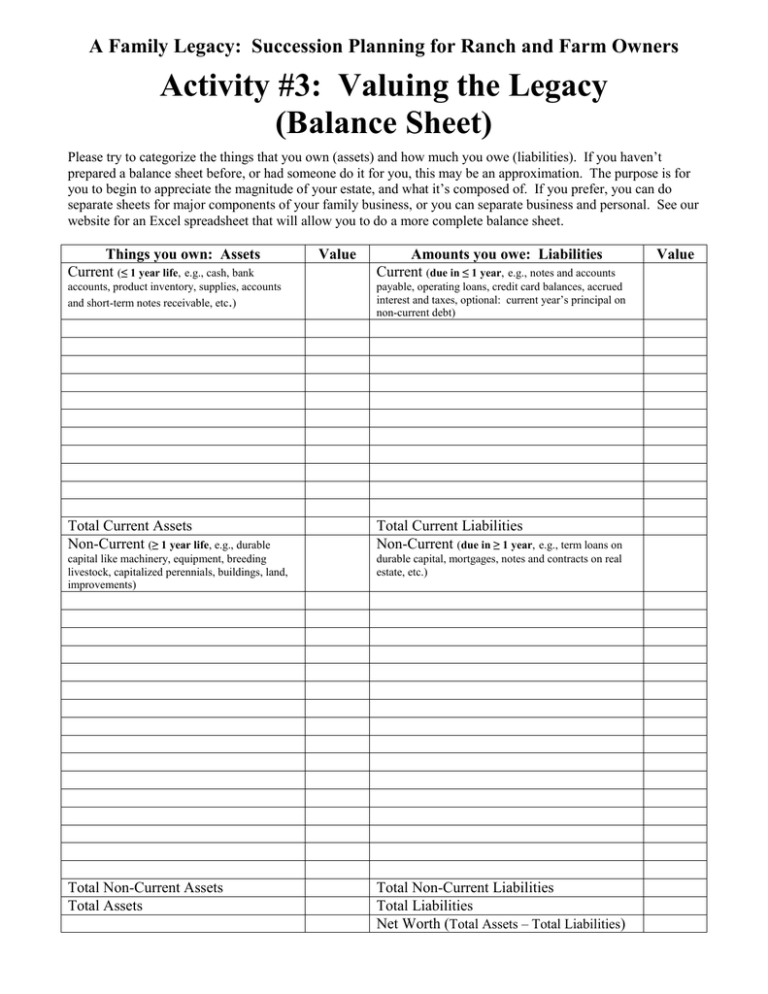

Activity #3: Valuing the Legacy (Balance Sheet)

advertisement

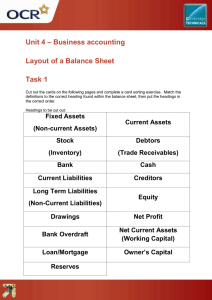

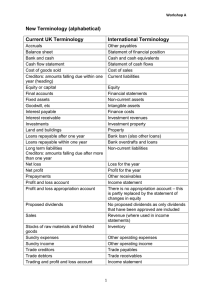

A Family Legacy: Succession Planning for Ranch and Farm Owners Activity #3: Valuing the Legacy (Balance Sheet) Please try to categorize the things that you own (assets) and how much you owe (liabilities). If you haven’t prepared a balance sheet before, or had someone do it for you, this may be an approximation. The purpose is for you to begin to appreciate the magnitude of your estate, and what it’s composed of. If you prefer, you can do separate sheets for major components of your family business, or you can separate business and personal. See our website for an Excel spreadsheet that will allow you to do a more complete balance sheet. Things you own: Assets Current (≤ 1 year life, e.g., cash, bank Value Amounts you owe: Liabilities Current (due in ≤ 1 year, e.g., notes and accounts accounts, product inventory, supplies, accounts and short-term notes receivable, etc.) payable, operating loans, credit card balances, accrued interest and taxes, optional: current year’s principal on non-current debt) Total Current Assets Non-Current (≥ 1 year life, e.g., durable Total Current Liabilities Non-Current (due in ≥ 1 year, e.g., term loans on capital like machinery, equipment, breeding livestock, capitalized perennials, buildings, land, improvements) durable capital, mortgages, notes and contracts on real estate, etc.) Total Non-Current Assets Total Assets Total Non-Current Liabilities Total Liabilities Net Worth (Total Assets – Total Liabilities) Value