Finances in the Animal Science Industry

advertisement

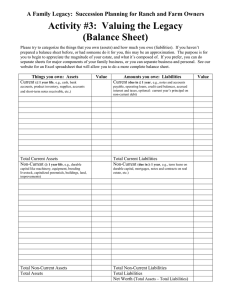

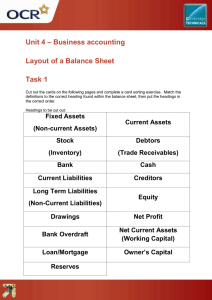

Finances in the Animal Science Industry What kinds of records should businesses keep? • • • • • • • Assets Liabilities Net worth Profit and loss statement Cash receipts Non-cash receipts Invoice Assets • Things that one owns and completely pays for • Tangible in value – Example: A car after all payments have been made. • Two types of assets – Current and non-current Assets Current Assets • Items quickly converted to cash or that will be sold within 12 months – cash – checking – savings – stocks or bonds – non-depreciable inventory of crops and livestock Assets Non-current Assets • Items that have a useful life or more than one year – land – machinery – breeding livestock Liabilities • Things that you owe money to other people for or debts – Example: credit cards Liabilities • Current-debts that are due to be paid this year – fertilizer and feed bills – tractor and building payments – part of the mortgage due this year • Non-Current-debts not due this year – mortgages not due this year Net Worth • Total assets minus total liabilities. • Current Assets + Non-Current Assets=Total Assets • Current Liabilities + Non-Current Liabilities=Total Liabilities Inventory • An itemized list of things owned by a business with the beginning value and depreciated value • Two types of inventory – Non-depreciable – Depreciable Inventory • Non-depreciable-items that will be used or sold within a year – feed – supplies • Depreciable-items that have a useful life of more than one year and lose value because of age, wear or becoming out-of date because of technology advancements. Inventory • Land is NOT depreciable property • Depreciable property examples: – tractor – computer – chainsaw Profit and Loss Statement • A financial statement of a business that reports the profit made by the business or the losses incurred. Receipts • Cash Receipts – Cash that is paid for services or merchandise. • Non-Cash Receipts – Payment for services in other ways than cash. • Food • Services • Gifts Invoice • Shows items and prices for things that have been bought from a certain business. Debt-to-Equity Ratio • Used by banks and lending institutions to decide whether or not to lend money to specific people or businesses Debt-to-Equity Ratio = Total Liability Net Worth Pop Quiz 1. If a beef farmer has 200 head of cow valued at $400 each, 20 tons of feed worth $200 per ton, 2 tractors worth $50,000 each, a manure spreader worth $4,000, and 10 acres of land worth $5,000 per acre, what amount should be entered on the total value of non-depreciable items line of the inventory page? Pop Quiz 2. A swine farmer has current assets listed at $30,000 and non-current assets listed at $150,000, he also has current liabilities listed at $10,000 and non-current liabilities listed at $50,000. Calculated the farmer’s net worth.