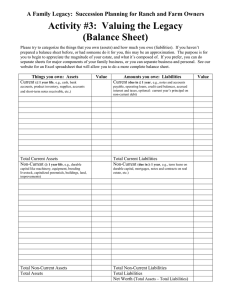

GROUP PROJECT Requirements: 1. This is a group project. 2. The project is worth 20% of your course grade. 3. The project has two (2) questions. 4. Start the response to each question on a new page. 5. Label all responses (parts) appropriately 6. Place the ID number of each group member on the cover page of the project 7. The project is to be typed written and submitted in PDF. 8. Use font style Times New Roman 9. Use font size 12. 10. The due date is November 5, 2023 at 11:55PM. 11. Projects MUST be submitted via the Moodle Container. Emailed projects will attract a zero (0) mark. 12. SHOW ALL WORKINGS! Failure to show workings will result in zero (0) mark!!! 1 QUESTION 1 - RATIO ANALYSIS: (Total Marks 10) Complete the Statement of Financial Position and the sales information in the table that follows for JAYDz Industries using the following financial data. NB. All sales are on credit. Debt ratio: 60% Current ratio 1.8 times Total assets turnover 1.5 times Accounts receivable turnover 10 times Gross profit margin on sales 25% Inventory turnover ratio 5 times 2 Statement of Financial Position ASSETS Non-current assets $000 ? Total non-current assets Current assets ? Inventories Accounts receivable Cash Total current assets ? ? ? ? TOTAL ASSETS 750,000 CAPITAL & LIABILITIES Capital & reserves Ordinary shares Retained earnings Total capital & reserves ? 243,750 ? Non-current liabilities Long-term loan Total non-current liabilities 150,000 150,000 Current liabilities Accounts payable Total current liabilities ? ? TOTAL CAPITAL & LIABILITIES ? Sales Cost of sales ? ? 3 QUESTION 2: RISKS & RETURNS (TOTAL MARKS 10) Jennifer, a close family friend has approached you to help her determine which of the two common stocks she should invest in. Proven Limited Scotia Investment Probability Return Probability Return 0.125 18.5% 0.20 -15% 0.350 9.75% 0.20 16% 0.525 36.0% 0.30 17% 0.30 -8% Required: a) Calculate the expected returns of the Proven Limited Stock (2.5 marks) b) Determine the risk (standard deviation) and return of the Proven Limited Stock (0.5 mark) c) Calculate the expected returns of stock the Scotia Investment (3 marks) d) Determine the risk (standard deviation) and return of the Scotia Investment (0.5 mark) e) Which of the two stock would you invest in? (0.5 mark) f) Your friend Jennifer, has decided that she will invest an additional $100,000 of her savings in the following stocks: Company Company A Percentage of investment 55% Expected rate of return 15% Company B 25% 30% Company C 20% -4% Required: What rate of return should your friend Jenifer expects to receive on her portfolio? (3 marks) 4