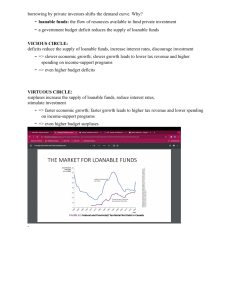

Test Bank of Ch27 (Economics II) 1. To start a business delivering documents, you need to purchase cell phones, bicycles, and desks. a. These purchases are called capital investment. Raising the funds to purchase them makes you a borrower. b. These purchases are called capital investment. Raising the funds to purchase them makes you a saver. c. These purchases are called consumption. Raising the funds to purchase them makes you a saver. d. These purchases are called consumption. Raising the funds to purchase them makes you a borrower. ANSWER: a 2. Atlas Corporation is in sound financial condition. It sells a long-term bond. Which of the following make the interest rate on this bond lower than otherwise? a. Both Altas' sound finances and the long term of the bond. b. Atlas' sound finances but not the long term of the bond. c. The long term of the bond but not Atlas' sound finances. d. Neither Atlas' sound finances nor the long term of the bond. ANSWER: b 3. Which of the following statements is correct? a. The expected future profitability of a corporation influences the demand for its stock. b. When a corporation sells stock as a means of raising funds it is engaging in debt finance. c. The owners of bonds sold by the Microsoft Corporation are part owners of that corporation. d. A corporation is paid every time its shares of stock are traded organized stock exchanges. ANSWER: a 4. If the government's expenditures exceeded its receipts, it would likely a. lend money to a bank or other financial intermediary. b. borrow money from a bank or other financial intermediary. c. buy bonds directly from the public. d. sell bonds directly to the public. ANSWER: d 5. Two bonds have the same term to maturity. The first was issued by a state government and the probability of default is believed to be low. The other was issued by a corporation and the probability of default is believed to be high. Which of the following is correct? a. Because they have the same term to maturity, the interest rates should be the same. b. Because of the differences in tax treatment and credit risk, the state bond should have the higher interest rate. c. Because of the differences in tax treatment and credit risk, the corporate bond should have the higher interest rate. d. It is not possible to say if one bond has a higher interest rate than the other. ANSWER: c 6. Assume the bonds below have the same term and principal and that the state or local government that issues the municipal bond has a good credit rating. Which list has bonds correctly ordered from the one that pays the highest interest rate to the one that pays the lowest interest rate? a. Corporate bond, municipal bond, U.S. government bond b. Corporate bond, U.S. government bond, municipal bond c. Municipal bond, U.S. government bond, corporate bond d. U.S. government bond, municipal bond, corporate bond ANSWER: b 7. The old adage, "Don't put all your eggs in one basket," is very similar to a modern bit of advice concerning financial matters: a. "Buy low-risk bonds." b. "Use a medium of exchange." c. "Diversify." d. "Intermediate." ANSWER: c 8. Index funds typically have a a. higher rate of return and higher costs than managed mutual funds. b. higher rate of return and lower costs than managed mutual funds. c. lower rate of return and higher costs than managed mutual funds. d. lower rate of return and lower costs than managed mutual funds. ANSWER: b 9. Which of the following statements is correct? a. The total income minus consumption and government purchases is called private saving. b. The sum of private saving and national saving is called public saving. c. For a closed economy, the sum of consumption, national saving, and taxes must equal GDP. d. For a closed economy, the sum of private saving and public saving must equal investment. ANSWER: d 10. Suppose private saving in a closed economy is $12b and investment is $8b. a. National saving must equal $12b. b. Public saving must equal $4b. c. The government budget surplus must equal $4b. d. The government budget deficit must equal $4b. ANSWER: d 11. For an open economy, the equation Y = C + I + G + NX is an identity. If we define national saving, S, as the total income in the economy that is left after paying for consumption and government purchases, then for an open economy, it is true that a. S = I. b. S = 0. c. I = S + NX. d. S = I + NX. ANSWER: d 12. In a closed economy, if Y, C, and T remained the same, a decrease in G would a. reduce private saving and public saving. b. increase private saving but not public saving. c. increase public saving but not private saving. d. increase neither private nor public saving. ANSWER: c 13. In a closed economy, if Y and T remained the same, but G rose and C fell but by less than the rise in G, what would happen to private and national saving? a. Private and national saving would rise. b. Private saving would rise and national saving would fall. c. Private and national saving would fall. d. Private saving would fall and national saving would rise. ANSWER: b 14. Katherine is considering expanding her jewelry shop. If interest rates fall she is a. more likely to expand. This illustrates why the supply of loanable funds slopes downward. b. less likely to expand. This illustrates why the supply of loanable funds slopes upward. c. more likely to expand. This illustrates why the demand for loanable funds slopes downward. d. less likely to expand. This illustrates why the demand for loanable funds slopes upward. ANSWER: c 15. In 2002 mortgage rates fell and mortgage lending increased. Which of the following could explain both of these changes? a. The demand for loanable funds shifted rightward. b. The demand for loanable funds shifted leftward. c. The supply of loanable funds shifted rightward. d. The supply of loanable funds shifted leftward. ANSWER: c 16. Suppose a country has only a sales tax. Now suppose it replaces the sales tax with an income tax that includes a tax on interest income. This would make equilibrium a. interest rates and the equilibrium quantity of loanable funds rise. b. interest rates rise and the equilibrium quantity of loanable funds fall. c. interest rates fall and the equilibrium quantity of loanable funds rise. d. interest rates and the equilibrium quantity of loanable funds fall. ANSWER: b 17. Suppose the U.S. offered a tax credit for firms that built new factories in the U.S. Then the a. demand for loanable funds would shift rightward, initially creating a surplus of loanable funds at the original interest rate. b. demand for loanable funds would shift rightward, initially creating a shortage of loanable funds at the original interest rate. c. supply of loanable funds would shift rightward, initially creating a surplus of loanable funds at the original interest rate. d. supply of loanable funds would shift rightward, initially creating a shortage of loanable funds at the original interest rate. ANSWER: b 18. Crowding out occurs when investment declines because a budget a. deficit makes interest rates rise. b. deficit makes interest rates fall. c. surplus makes interest rates rise. d. surplus makes interest rates fall. ANSWER: a 19. If we were to change the interpretation of the term "loanable funds" in such a way that government budget deficits would affect the demand for loanable funds, rather than the supply of loanable funds, then a. crowding out would not be a consequence of an increase in the budget deficit. b. higher interest rates would not be a consequence of an increase in the budget deficit. c. an increase in the budget deficit would cause the demand for loanable funds to decrease. d. we would be making only a semantic change in how we analyze the effects of government budget deficits. ANSWER: d 20. If the government instituted an investment tax credit, then which of the following would be higher in equilibrium? a. Saving and the interest rate b. Saving but not the interest rate c. The interest rate but not saving d. Neither saving nor the interest rate ANSWER: a