ECON 201 Lecture 4-5(a) 1-30-2009 Finance:

advertisement

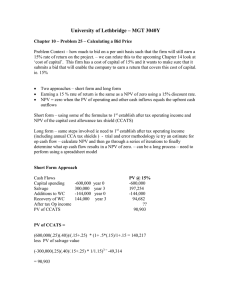

ECON 201 Lecture 4-5(a) 1-30-2009 Finance: Net Present Value & Benefit/Cost Analysis Evaluating Projects • Expansion project – Requires an initial investment, Io – Yields a flow of benefits and costs over time: Bt, Ct Bn Cn Bt Ct B1 C1 NPV I o B0 Co ... I o n t (1 r ) (1 r ) t 0 (1 r ) n The Net Benefits from an Investment • The net benefit of an investment project is the difference between the revenue generated by the project and the project’s cost, including opportunity cost. Interest • Interest is an important part of the investment decision for two reasons: – First, interest must be paid to borrow funds. – Second, interest is the opportunity cost of using money to pay for an investment project. • Money used to purchase capital could have been deposited in a bank to earn interest. Interest (cont’d) • Lenders charge interest: – To compensate themselves for not being able to use their own money to buy the things they want – To compensate themselves for the risk they assume when they make a loan – Because rising prices will reduce the purchasing power of the money when it is repaid Present and Future Value • The present value (PV) of money received in the future is equal to its value today. – In other words, it is the maximum amount that someone would pay today to receive the money in the future. Present and Future Value (cont’d) • The relationship between present and future value can be shown by the following equations: FV PV (1 Interest Rate) PV FV (1 Interest Rate) Present and Future Value (cont’d) • Examples: Suppose the interest rate is 5%. – What is the future value of $10,000 one year from now? • FV = $10,000 x (1 +.05) = $10,500 – What is the present value of $10,000 received one year from now? • PV = $10,000 / (1 +.05) = $9,524 Present and Future Value (cont’d) • Discounting refers to the method used to calculate the present value of a stream of payments over time. – Example: Suppose a firm expects to earn $10,000 of revenue in each of the next 2 years. • • • PV in Year 1 $10,000 (1 .05) $9,524 PV in Year 2 $10,000 (1 .05)2 $9,070 Total Value $9,524 $9,070 $18,594 Net Present Value (cont’d) • Example: Suppose a firm is considering investing $8,000 in new equipment. As a result of the new equipment, the firm expects to earn revenues of $10,000 in each of the next 2 years. NPV $8,000 $10,000 / (1 .05) $10,000 / (1 .05)2 $8,000 $9,524 $9,070 $10,594 • Since NPV is positive, the firm should undertake the investment. Other Applications • How do we determine the value of the firm – Flow of revenues and costs – Bt = “expected” revenue stream – Ct = “expected” expenses n Bn Cn Bt Ct B1 C1 NPV I o B0 Co ... Io n t (1 r ) (1 r ) t 0 (1 r ) • Stock price – NPV/(#shares) Closer to Home • Mortgage Payments n Pi Amount borrowed rannual i 1 (1 ) 12 Washington State Lottery • Jackpot Analysis For Washington MEGA Millions Draw Date: Tuesday, March 11, 2008 • Jackpot is worth $47,000,000 • Payment Options – Annuity • 26 Annual Payments of $1,807,692 – Lump Sum • $29,200,000 Lump Sum or Annuity? annual NPV @ 5% 1,802,692 $25,914,031.54 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 1,802,692 46,869,992 Lump sum 29,200,000