University of Lethbridge – MGT 3040Y

advertisement

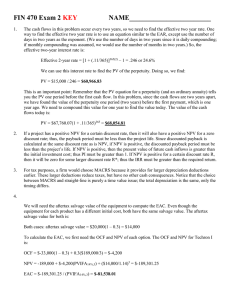

University of Lethbridge – MGT 3040Y Chapter 10 – Problem 25 – Calculating a Bid Price Problem Context – how much to bid on a per unit basis such that the firm will still earn a 15% rate of return on the project. – we can relate this to the upcoming Chapter 14 look at ‘cost of capital’. This firm has a cost of capital of 15% and it wants to make sure that it submits a bid that will enable the company to earn a return that covers this cost of capital. ie. 15% Two approaches – short form and long form Earning a 15 % rate of return is the same as a NPV of zero using a 15% discount rate. NPV = zero when the PV of operating and other cash inflows equals the upfront cash outflows Short form – using some of the formulas to 1st establish after tax operating income and NPV of the capital cost allowance tax shield (CCATS) Long form – same steps involved ie need to 1st establish after tax operating income (including annual CCA tax shields ) - trial and error methodology ie try an estimate for op cash flow – calculate NPV and then go through a series of iterations to finally determine what op cash flow results in a NPV of zero. – can be a long process – need to perform using a spreadsheet model Short Form Approach Cash Flows Capital spending Salvage Additions to WC Recovery of WC After tax Op income PV of CCATS -600,000 300,000 -144,000 144,000 year 0 year 3 year 0 year 3 PV @ 15% -600,000 197,254 -144,000 94,682 ?? 90,903 PV of CCATS = (600,000(.25)(.40))/(.15+.25) * (1+ .5*(.15)/1+.15 = 140,217 less PV of salvage value (-300,000(.25)(.40)/.15+.25) * 1/1.15)3 = -49,314 = 90,903 PV of after tax op. income = Solving for PV of aftertax operating income (3 years of equal op. income – use PV of an annuity factor) NPV at 0 = (-600,000+197,254-144,000+94,682+90,903 +PV op. income) PV of Op. income = 361,161 Annual Op income = 361,161/PVIFA( 3 years, 15% ) = 361,161/2.2832 = 158,182 We have just established what the annual after tax op. income must be in order for the bid to still achieve a NPV of zero ( earn a 15% return) - now we need to back in to what sales would need to be to achieve this op. income. Sales Pre tax Op income = (sales – (40*op. costs)) * (1-tax rate) 158,182 = (x – 3,360,000) * (1-.4) x = 3,623,636 Sales of $3,623,636 representing 40 units = $90,591 per unit!! >>> the bid should be for no less than $90,591 per system – this level of bid would enable the firm to earn its cost of capital of 15%