Chapter 14 notes 1. Operating activities section

advertisement

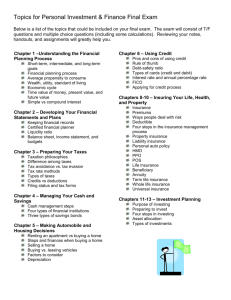

Chapter 14 notes The Cash Flow statement is divided into three sections: 1. Operating activities section a. Day-to-day activities in making profit 2. Investing activities section a. Acquiring and disposing fixed assets 3. Financing activities section a. Issuing and retiring debts b. Issuing and buying back stock and pay dividends 4. Each section is further divided into sources and uses of cash In order to build a Cash Flow statement, we need the following source documents: 1. Last year-end and this year-end balance sheet 2. Income statement for this year 3. Other necessary information (basically, we must have everything that is necessary to build the Cash Flow statement). There are two methods in building a cash flow statement: 1. Direct method 2. Indirect method Under direct method, for the operating activities section, we actually keep track of every dollar going in and out of the company throughout the entire year. Sources of cash include cash sale and collection of A/R, and interest/dividends received. Uses of cash include buying inventory, supplies, and paying for operating expenses/income tax and interest paid. Under indirect method, we start out with net income in the operating activities section. Then we make adjustments to the net income number based on the changes in current asset and current liability accounts (between last year and this year). Any non-cash expenses and losses must be added back to net-income. Any non-cash gains must be subtracted from net income. In the investing activities and financing activities sections, we perform identical procedure under both Direct and Indirect methods. In the investing section, we add and subtract numbers based on the changes in the long-term asset accounts (between last year and this year). Adjustments include: 1. Purchasing and selling fixed assets 2. Purchasing and selling long-term investments 3. Lending and collecting from long-term N/R (for principal only). In the financing section, we add and subtract numbers based on the changes in the long-term liability and stockholders’ equity accounts (between last year and this year). Adjustments include: 1. 2. 3. Issuing stock and bonds Buying back treasury shares and retiring bonds Borrowing and paying off long-term N/P (for principle only) Under either method, we start out with the beginning cash balance of the year, add all sources of cash (from all three sections) and subtract all uses of cash (from all three sections) to come up with the ending cash amount. This ending cash amount is compared with the actual balance of the cash account as of the end of the fiscal year and they should be the same. In addition, a schedule of significant noncash activities must be generated to accompany the Cash Flow statement. Although these activities do not affect the Cash Flow statement, they may have significant impact on the cash position of the company in the future. e.g. acquiring a piece of land by issuing bonds.