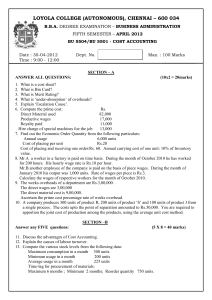

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.B.A. DEGREE EXAMINATION – BUSINESS ADMINISTRATION FIFTH SEMESTER – SUPPLEMENTARY – JUNE 2012 BU 5504/BU 5501 - COST ACCOUNTING Date : 28-06-2012 Time : 2:00 - 5:00 Dept. No. Max. : 100 Marks PART-A ANSWER ALL QUESTIONS (10 X 2 = 20 marks) 1. 2. 3. 4. 5. What is cost centre? What is JIT inventory? State the purposes of Retention Money. Define Scrap. Fill in the Blanks: A. Total of Direct Cost is also known as ----------cost. B. ------------profit is the basis for computing profit on incomplete records. 6. Compute EOQ from the following information: Consumption of material per annum: Rs.8,000 Ordering cost per order: Rs.25 Storage and carrying cost per annum 10% of inventory value 7. How to apportion the following expenses: A. Crèche Expenses B. Welfare Expense 8. Compute the profit to be transferred to P&L account. Notional Profit- Rs.2,00,000 cash received- 10,80,000 contract value- 20,00,000 9. Ascertain the abnormal gain or loss Input- 5000 units Normal loss- 20% Output – 4300 units 10. The production overhead of department A – 12 in a factory is budgeted at Rs.80,000. It is anticipated that the labour hours worked during the same period will be 10,000 hours. Calculate the labour hour rate. SECTION B (5X8=40 Marks) ANSWER ANY FIVE QUESTIONS 11. What are the advantages of cost accounting? 12. Distinguish between Job costing and Process costing. 13. Discuss the different methods of overhead distribution under secondary distribution summary. 14. From the following particulars, prepare Stores Ledger Account showing the pricing of Materials to be issued by adopting the FIFO method. Date Particulars 2008,December,1 Opening stock 1000units @ Rs.2 each 3 Purchased 800 units @ Rs.2.10 Each 5 Issued 800 units 12 Purchased 1,200 units @ Rs.@.2.10 Each 17 Issued 1,500 units 20 Purchased 900units @ Rs.@.2.50 Each 25 Issued 600 units 15. Find out the Machine Hour Rate from the following: a) Cost of Machine – Rs.3,60,000 b) Freight and Installation – 40,000 c) Working Life- 20 Years d) Working Hours – 8,000 hours, p.a e) Repairs Charges – 50% of Depreciation f) Power- 10 units per hour@ 10 Paise per unit g) Lubricating oil@ Rs.2 per day of 8 hours h) Consumable stores @ Rs.10 Per day of 8 hours i) Wages of operator @ Rs.4 Per day j) Scrap value – Nil 16. Prepare a Reconciliation statement from the following. a) Profits as per Costing Records – 45,030 b) Income Tax provided in financial books- 4,000 c) Bank Interest (Cr.) in financial books- 150 d) Depreciation charged in cost books-3,000 e) Depreciation charged in financial books-2,800 f) Works overhead over recovered- 550 g) Administration overhead under recovered- 450 h) Interest on investment – 1,200 i) Stores adjustment(credit in financial books) – 120 17. Calculate the earnings of the Mr. Alex and Mr. Basheer from the following based on Merrick’s Multiple piece rate system. Standard Production per day- 150 units Normal piece Rate – Re.0.50 per unit Production per day Mr. Alex- 140 units, Mr. Basheer – 160 units. 18. The following information relating to contract: 5678 Contract Price – 6, 00,000 Wages- 1, 64,000 General Expenses- 8,600 Raw Materials – 1, 20,000 Plant- 20,000 As on the date cash received was Rs.2, 40,000 being 80% of work certified. The value of materials remaining at the site was Rs. 10,000. Depreciate Plant by 10%. Prepare contract account showing profit to be credited to P& L account. SECTION C (2X20=40) ANSWER ANY TWO QUESTIONS 19. A factory has three production departments X, Y, Z and service departments A and B. The budgeted expenditure for the month of March 1999 are given below: Rent- Rs.15,000,General Lighting-6600, Indirect Wages-20,000,Power-15,000,Depreciation on Machines-100000,and Sundries-10,000. The other details are: Particulars X Y Z A B 30000 20000 30000 15000 5000 Direct Wages 3070 4475 2419 Working Hours 600000 800000 1000000 50000 50000 Value of machines 30 50 10 Horse Power of 60 Machines 100 150 200 100 50 No. of light points 20000 25000 30000 20000 5000 Floor area Service department overheads are apportioned on the following basis. X Y Z A B Service Dept.A 20% 30% 40% 10% Service Dept B 40% 20% 30% 10% Find out the Works Cost of Product ‘X’ which is processed for manufacture in départements X Y and Z for 4 5 and 3 hours respectively, given that its direct materials is Rs 500 and labour cost is Rs.430. 20. The cost of manufacturing 5,000 units of a commodity comprises : Materials – Rs.20,000 Wages - Rs.25,000 Chargeable expenses- Rs.400 Fixed factory overheads - Rs.16,000 Variable factory overheads - Rs.4,000. For manufacturing every 1,000 extra units of the commodity the cost of production increases as follows : Materials : Proportionately Wages : 10% less than proportionately Chargeable expenses- No extra cost Fixed factory overheads – Rs.200 extra Variable factory overheads 25% less than proportionately Calculate the estimated overhead cost of producing 8,000 units of the commodities and show how much it would differ if a flat rate of factory overhed based on wages were charged. 21. The Product of X ltd passes through two process viz., A and B. The following are the particulars relating to them. Process A (Rs) B (Rs) 1,00,000 -- 10,000 20,000 Wages 20,000 30,000 Overheads 12,000 15,000 Normal loss 5% 2% Scrap value per unit 3 5 Actual Output (units) 9,400 9,350 Materials 10,000 units @ Rs.10 per unit Other materials You are required to prepare process accounts, Normal loss accounts and other necessary accounts. $$$$$$$