Advantages of cost accounting - Oman College of Management

advertisement

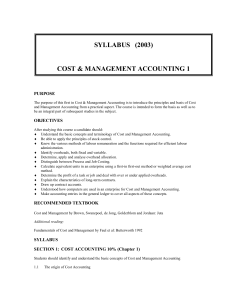

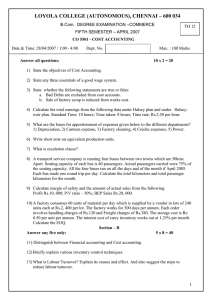

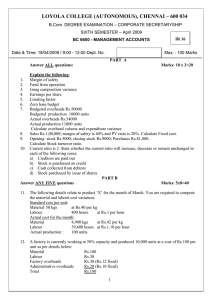

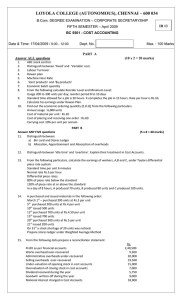

Chapter outcomes: 1.Meaning and nature of cost accounting; 2.Scope of cost accounting; 3.Objectives of cost accounting; 4.Advantages of cost accounting; 5.Limitations of cost accounting; 6.Elements of costs; 7.Cost sheet; 8.Practical exercises; Meaning of cost accounting Cost accounting is a branch of accounting and has been developed due to limitations of financial accounting. Cost accounting is the classifying, recording and appropriate allocation of expenditure for the determination of the costs of products and services, and for the presentation of suitably arranged data for the purposes of control and guidance of managements. Cost accounting is the application of costing and cost accounting principles, methods, and techniques to the science, art and practice of cost control and the ascertainment of profitability. Features of cost accounting The following are the main features of cost accounting: 1. It is a process of accounting for costs; 2. It records income and expenditure relating to production of goods and services; 3. It provides statistical data on the basis of which future estimates are prepared and quotations are submitted; 4. It is concerned with cost ascertainment and cost control; 5. It establishes budgets and standards so that actual cost may be compared to find out deviations or variances; 6. It involves the preparation of right information to the right person at the right time so that it may be helpful to management for planning, evaluation of performance, control and decision making. Scope of cost accounting The scope of cost accounting includes the following: 1. Cost ascertainment: It deals with the collection and analysis of expenses, the measurement of production of the different products at different stages of manufacture and the liming up of the production with the expenses. 1. Cost determination: It is the process of accounting for cost which begins with recording of expenditure and ends with the preparation of statistical data. It is formal mechanism by means of which costs of products or services are ascertained and controlled. 1. Cost control: It is the guidance and regulation by executive action of the costs of operating an undertaking. It aims at guiding the actual towards the line of targets. Objectives of cost accounting To ascertain the cost per unit of the different products manufactured by a business concern; 2. To provide a correct analysis of cost both by process or operations and by different elements of cost; 3. To disclose sources of wastage whether of material, time or expense or in the use of machinery, equipment and tools and to prepare such reports which may be necessary to control such wastage; 4. To provide requisite data and serve as a guide to price fixing of products manufactured or services rendered; 5. To ascertain the profitability of each of the products and advise the management as to how these profits can be maximized. 1. Objectives of cost accounting- contd. 6. To advise the management on future expansion policies and proposed capital projects; 7. To present and interpret data for management planning, evaluation of performance and control; 8. To help in the preparation of budgets and implementation of budgetary control; 9. To guide management in the formulation and implementation of incentive bonus plans based on productivity and cost savings; 10. To supply useful data to management for taking various financial decisions such as introduction of new products, replacement of labour by machines. Advantages of cost accounting 1. It helps the management in determining the cost of production 2. 3. 4. 5. 6. of a given volume of output and thereby fixing the prices; It helps the management in identifying the profitable and unprofitable lines of business; It provides information upon which estimates and tenders are based; It guides future production policies; It provides valuable information for management decision making and forward planning; With effective cost control methods, cost accounting helps the management to increase the overall profitability of the organization. Limitations of cost accounting The following are the main limitations of cost accounting: 1. Cost accounting lacks a uniform procedure – different cost accountant may have different procedures; 2. There are a large number of conventions, estimates and flexible factors such as classification of costs into its elements, issue of materials on average or standard prices, apportionment of overhead expenses, etc. 3. For getting the benefits of cost accounting, many formalities are to be observed by a small and medium size concerns; 4. The contribution of cost accounting for handling futuristic situations has not been much Elements of costs The following are main elements of costs: 1. Direct materials: Direct materials are those materials which can be identified in the product and can be conveniently measured and directly charged to the product. Thus, these materials directly enter the production and form a part of the finished product. 2. Direct labour: Direct labour is all labour expended in altering the construction, composition, confirmation or condition of the product. In simple words, it is that labour which can be conveniently identified or attributed wholly to a particular job, product or process or expended in converting raw materials into finished goods. 3. Overheads: Overheads may be defined as the aggregate of the cost of indirect materials, indirect labour and indirect expenses. Overheads comprise of all expenses incurred for or in connection with the general organization of the whole or part of the undertaking. The main groups into which overheads may be sub-divided are: (i) Manufacturing overheads; (ii) Administrative overheads; (iii) Selling overheads; (iv) Distribution overheads; and (v) Research and development overheads. Cost sheet Cost sheet is a statement designed to show the output of a particular accounting period along with break-up of costs. The data incorporated in cost sheet are collected from various statements of accounts which have been written in cost accounts, either day-to-day or regular records. Cost sheet is a memorandum statement. Therefore, it does not form part of double entry cost accounting records. In spite of this, the relationship between cost sheet and financial accounts which are maintained on double entry system is very important as cost sheet drives its data from financial accounting. Advantage of Cost sheet The main advantages of a cost sheet are: 1. It discloses the total cost and the cost per unit of the units produced during the given period; 2. It enables a manufacturer to keep a close watch and control over the cost of production; 3. By providing a comparative study of the various elements of current cost with the past results and standards costs, it is possible to find out the causes of variations in the costs and to eliminate the variations; 4. It acts as a guide to the manufacture and helps him in formulating a definite useful production policy;; 5. It helps the businessman to submit quotations with reasonable degree of accuracy against tenders for the supply of goods.