Chabot College Fall, 2002 Course Outline for Business 3

advertisement

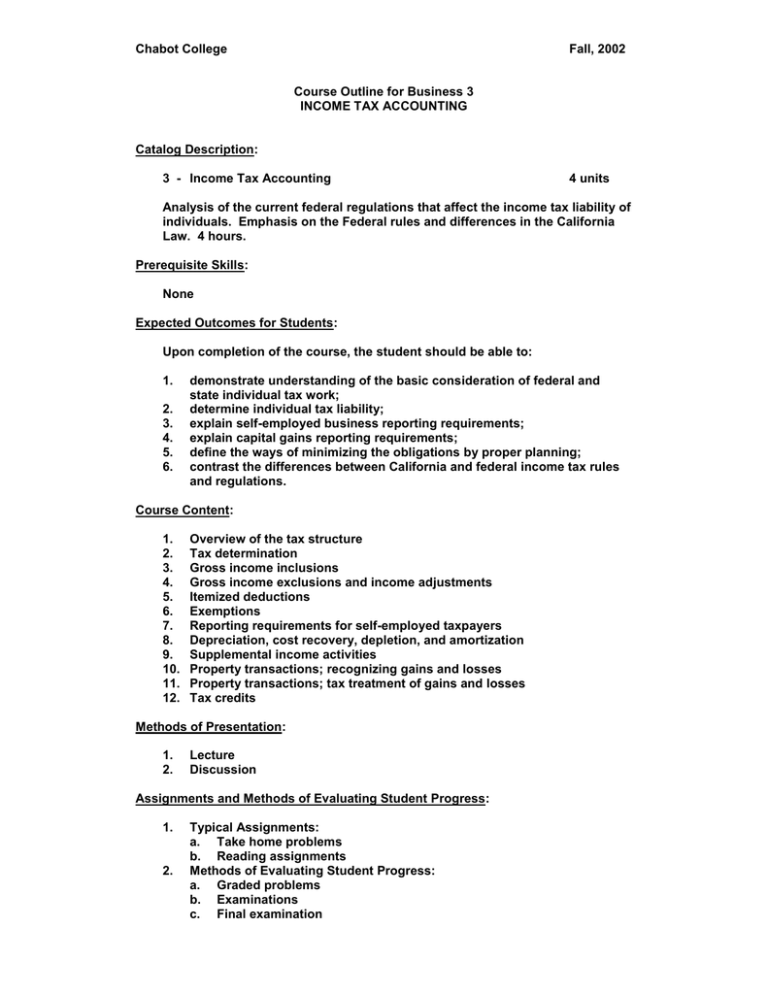

Chabot College Fall, 2002 Course Outline for Business 3 INCOME TAX ACCOUNTING Catalog Description: 3 - Income Tax Accounting 4 units Analysis of the current federal regulations that affect the income tax liability of individuals. Emphasis on the Federal rules and differences in the California Law. 4 hours. Prerequisite Skills: None Expected Outcomes for Students: Upon completion of the course, the student should be able to: 1. 2. 3. 4. 5. 6. demonstrate understanding of the basic consideration of federal and state individual tax work; determine individual tax liability; explain self-employed business reporting requirements; explain capital gains reporting requirements; define the ways of minimizing the obligations by proper planning; contrast the differences between California and federal income tax rules and regulations. Course Content: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Overview of the tax structure Tax determination Gross income inclusions Gross income exclusions and income adjustments Itemized deductions Exemptions Reporting requirements for self-employed taxpayers Depreciation, cost recovery, depletion, and amortization Supplemental income activities Property transactions; recognizing gains and losses Property transactions; tax treatment of gains and losses Tax credits Methods of Presentation: 1. 2. Lecture Discussion Assignments and Methods of Evaluating Student Progress: 1. 2. Typical Assignments: a. Take home problems b. Reading assignments Methods of Evaluating Student Progress: a. Graded problems b. Examinations c. Final examination Chabot College Course Outline for Business 3 Income Tax Accounting Fall 2002 Textbook(s) Typical: FEDERAL INCOME TAXATION, Langenderfer, Stevenson, Sleg, and Bauer, Southwestern, 2000 CALIFORNIA TAXES, CALIFORNIA STATE FRANCHISE TAX BOARD, 2001 Special Student Materials: Calculator mc 11/26/01 COBUS3