TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition

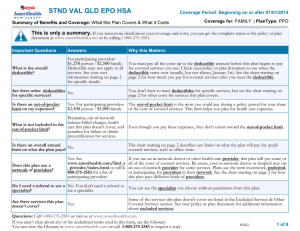

advertisement

TOOLS & TECHNIQUES OF EMPLOYEE BENEFIT AND RETIREMENT PLANNING 11th Edition College Course Materials Deanna L. Sharpe, Ph.D., CFP®, CRPC®, CRPS® Associate Professor CFP® Program Director Personal Financial Planning Department University of Missouri-Columbia Please Note: Correct answers for each question are indicated in bold type. After each question, the number of the page containing information relevant to answering the question is given. When a calculation is necessary or the reasoning behind a given answer may be unclear, a brief rationale for the correct answer is also given. Part B: Employee Benefit Planning Health Coverage Chapter 45: Health Insurance True/False 45.1 Benefits from health insurance are included in employee taxable income as an in-kind benefit 45.2 Most major medical plans cover routine doctor visits. 45.3 According to tax law, individuals with preexisting conditions can be excluded from participation in a group health plan for up to 18 months. Answers: 45.1 False [p. 343] 45.2 False [p. 343] 45.3 False [p. 345] Multiple Choice 45.4 An all-causes deductible is a. b. c. d. e. cumulated over a given period a deductible that applies separately to each type of medical expense a deductible that applies to all medical expenses, whether for the same condition or not a and b a and c Answer: C [p. 344] 45.5 Premiums for commercial health insurance contracts include all but which of the following: a. b. c. d. e. administrative expenses profit for insurance provider expected benefit payments commissions federal premium taxes Answer: E [pp. 344-345] 45.6 Which of the following types of health insurance was originally designed by an organization of hospitals and physicians to facilitate payment of hospital and doctor bills? a. b. c. d. e. hospital contract plans health maintenance organizations commercial health insurance self-insurance Blue Cross / Blue Shield Answer: E [pp. 344-345] Application 45.7 Moribund Industries, Inc. is a five year old company with 25 employees ranging in age from 18 to 24 years of age. As a financial advisor to the company owner, which of the following approaches to health care coverage for employees would you not recommend? a. b. c. d. e. Blue Cross Blue Shield commercial health insurance health maintenance organization self-funding Answer: E [pp. 344-345] 45.8 The owners of MegaStat Corporation have asked your help in designing a health benefit program for retirees. The owners tell you that they need a plan that has a low initial cash flow, is simple to implement, and has no nondiscrimination requirements to meet. You recommend: a. b. c. d. e. a VEBA corporate owned life insurance increased pension benefits a health maintenance plan a pay-as-you-go system Answer: E [p. 349] 45.9 As the employee benefit specialist for Alpha Corp., you are explaining COBRA benefits to a group of pre-retirees, aged 55 to 64. Which of the following do you NOT list for the group as a qualifying event for COBRA? a. b. c. d. e. a minor aged child becomes of legal age employee dies legal separation of employee and spouse employee takes a leave under the Family Medical Leave Act employee becomes eligible for Medicare Answer: D [p. 346] 45.10 Will Hurt has an employer-provided health plan that has a $500 calendar year deductible with a 3 month carry over provision. Will has $100 in medical bills in June that are covered by the plan. In late November, he has $100 additional medical expenses. Then, in January, he has another $700 in medical expenses. Will’s health care plan will cover _____ of his expenses a. b. c. d. e. $1400 $ 900 $ 800 $ 400 $ 300 Answer: E [p. 344- $100 + $700 - $500 deductible = $300, since there is a carry over provision, the deductible is considered paid for the January bill]