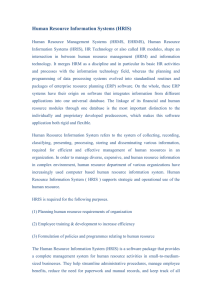

Basic Features of HRIS

advertisement

Basic Features of HRIS In lieu of standardized paperwork, HRIS allows employees to fill out forms online, make changes based on life events, and get information on their benefits at any time. Rather than “pulling an employee’s file,” HR personnel can refer any information about an employee through the system, including personal information, benefits, number of dependents, emergency contacts, and job history. HRIS includes both standardized and customized reports. Standard reports feature templates for various administrative purposes including employee reviews, record keeping, workers’ compensation, employment history, and absence tracking. Customized reports are created that incorporate categories and information unique to business. Most HRIS applications have a comprehensive tracking system. HRIS tracking capabilities can maintain grievances filed by or against the employee stemming from discipline, disputes, and complaints. Quick reference guides can be available relating to all areas of the Human Resources Information System, including staff benefits, benefit contribution rates, calendars, personnel change reason codes, and the payroll process flowchart. Detailed instructions regarding establishing and changing employee benefit and deduction information, including retirement, pension, health care, flexible spending accounts and employee selected deductions. Documentation on the human resource accounting structure can be possible; including staff benefit calculations and charges, review and correction of human resource accounts. Documentation is helpful for payroll issues, including time reporting requirements, check and auto deposit distribution, taxable benefits, terminations, review and correction of employee pay and leave, and tax forms. Instructions and forms for employees to establish or change their employee information related to the Human Resources system, including name, address, retirement, pension, and health care. MBA- Knowledge Base