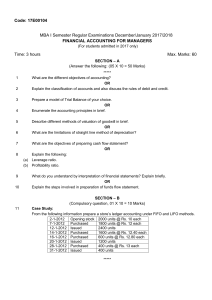

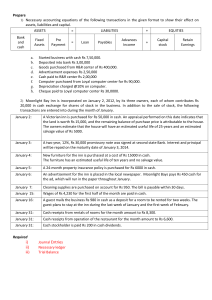

The following are transactions for Zebra Company for 2002:

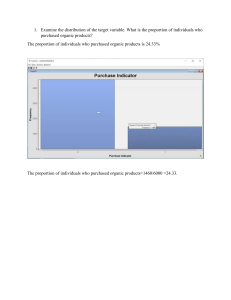

advertisement

The following are transactions for Zebra Company for 2002: 1. The owners started the business by contributing $30,000 cash. 2. The company purchased office equipment for $8,000 cash and land for $15,000 cash. 3. The company earned a total of $22,000 of revenue of which $16,000 was collected in cash. 4. The company purchased $550 worth of supplies for cash. 5. The company paid $6,000 in cash for other operating expenses. 6. At the end of the year, the company owed employees $3,600 for work that the employees had done in 2002. The next payday, however, is not until January 4, 2003. 7. Only $175 worth of supplies was left at the end of the year. The office equipment was purchased on January 1 and is expected to last for 5 years (straight-line depreciation, no salvage value.) Required: Prepare the income statement for the year ended December 31, 2002, and the balance sheet at December 31, 2002.