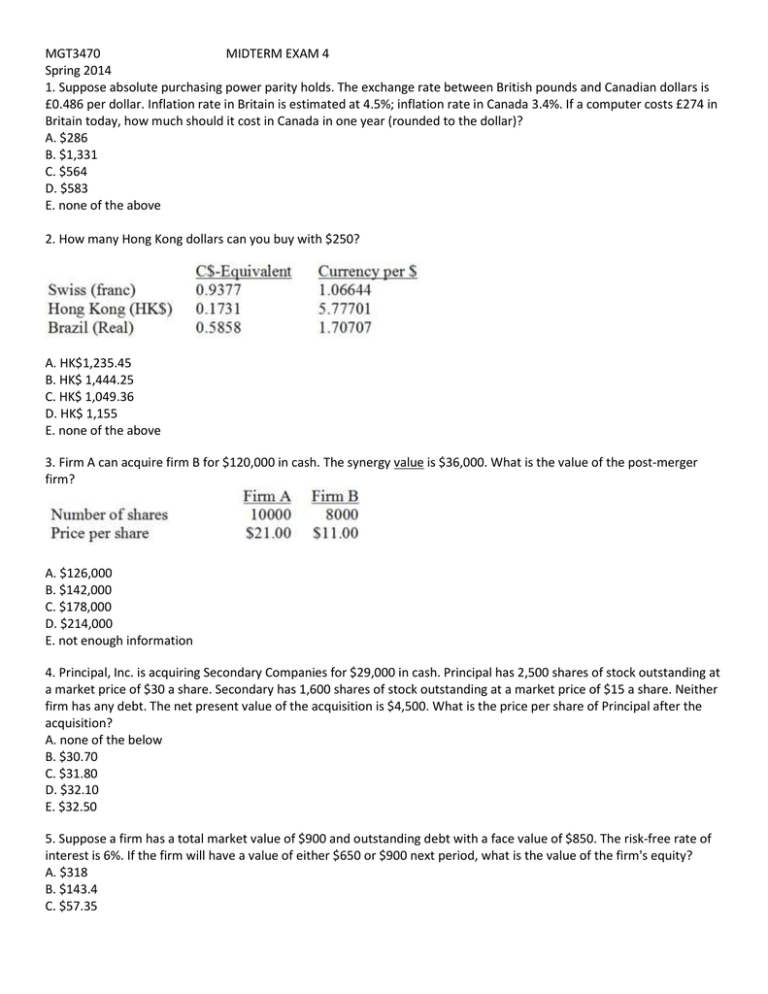

MGT3470 MIDTERM EXAM 4 Spring 2014

advertisement

MGT3470 MIDTERM EXAM 4 Spring 2014 1. Suppose absolute purchasing power parity holds. The exchange rate between British pounds and Canadian dollars is £0.486 per dollar. Inflation rate in Britain is estimated at 4.5%; inflation rate in Canada 3.4%. If a computer costs £274 in Britain today, how much should it cost in Canada in one year (rounded to the dollar)? A. $286 B. $1,331 C. $564 D. $583 E. none of the above 2. How many Hong Kong dollars can you buy with $250? A. HK$1,235.45 B. HK$ 1,444.25 C. HK$ 1,049.36 D. HK$ 1,155 E. none of the above 3. Firm A can acquire firm B for $120,000 in cash. The synergy value is $36,000. What is the value of the post-merger firm? A. $126,000 B. $142,000 C. $178,000 D. $214,000 E. not enough information 4. Principal, Inc. is acquiring Secondary Companies for $29,000 in cash. Principal has 2,500 shares of stock outstanding at a market price of $30 a share. Secondary has 1,600 shares of stock outstanding at a market price of $15 a share. Neither firm has any debt. The net present value of the acquisition is $4,500. What is the price per share of Principal after the acquisition? A. none of the below B. $30.70 C. $31.80 D. $32.10 E. $32.50 5. Suppose a firm has a total market value of $900 and outstanding debt with a face value of $850. The risk-free rate of interest is 6%. If the firm will have a value of either $650 or $900 next period, what is the value of the firm's equity? A. $318 B. $143.4 C. $57.35 D. $95.60 E. $286.8 6. Suppose a firm has a total market value of $900 and outstanding debt with a face value of $850. The risk-free rate of interest is 6%. If the firm will have a value of either $650 or $900 next period, what is the rate of return on the firm's debt? (Assume the bond makes no coupon payments during this time period.) A. 0.87% B. 6.7% C. 7.2% D. 1.008% E. other 7. John and Randy form a company with assets worth $900. They each have four shares of stock. Randy gives Cheri a call option on one share of stock. (Randy will deliver one of his shares and collect the exercise price, not an warrant that will increase the number of existing shares and create cash flow to the company). The option has an exercise price of $100 and expires in one year. In one year, the firm's assets are worth $1,000 and Cheri exercises the option. What is the intrinsic value of the option at maturity? A. $0 B. $25 C. $50 D. $150 E. not enough information (Q. 8 & 9) 8. What is the straight bond value? A. none of the below B. $867.39 C. $939.00 D. $983.64 E. $1,034.32 9. What is the break even stock price (straight bond value = conversion value)? (Hint calculate conversion ratio.) A. 69.8 B. 61.3 C. 62.38 D. 67.23 E. none of the above 10. A firm has stock outstanding with a current price of $35 per share. The price in one period is expected to be either $40 or $48. A call option on ONE share is available with an exercise price of $30. If the risk-free rate of interest is 6%, what would you pay for the call option? A. $6.29 B. $6.50 C. $6.70 D. $7.09 E. other