McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 10

Reporting and Interpreting Liabilities

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Fred Phillips, Ph.D., CA

The Role of Liabilities

Liabilities are created when a company:

Buys goods

and services

on credit

Obtains

short-term

loans

Issues

long-term

debt

Current liabilities are short-term obligations that will

be paid with current assets within the company’s

current operating cycle or within one year of the

balance sheet date, whichever is longer.

10-3

The Role of Liabilities

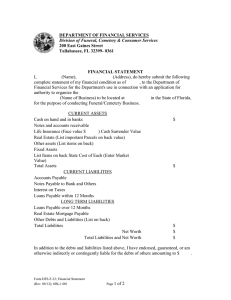

The liability section of the General Mills 2007 and 2008

comparative balance sheets.

10-4

Measuring Liabilities

Initial Amount of the Liability

Cash Equivalent

Additional Liability Amounts

Increase Liability

Payments Made

10-5

Decrease Liability

Current Liabilities

Accounts Payable

Increases

(Credited)

Decreases

(Debited)

when a company

receives goods or

services on credit

when a company

pays on its account

Accrued Liabilities

Liabilities that have been incurred but not yet paid.

10-6

Notes Payable

Four key events occur with any note payable:

1. establishing the note,

2. accruing interest incurred but not paid,

3. recording interest paid, and

4. recording principal paid.

10-7

Current Portion of Long-Term

Debt

Long-Term Debt

Current Portion of

Long-term Debt

Noncurrent Portion

of Long-term Debt

Borrowers must report in Current Liabilities the portion of

long-term debt that is due to be paid within one year.

10-8

Additional Current Liabilities

10-9

Sales Tax

Payable

Payments collected from

customers at time of sale create

a liability that is due to the state

government.

Unearned

Revenue

Cash received in advance of

providing services creates a

liability of services due to the

customer .

Long-Term Liabilities

Common Long-Term Liabilities

1. Long-term notes payable

2. Deferred income taxes

3. Bonds payable

Bonds are financial instruments that outline the

future payments a company promises to make

in exchange for receiving a sum of money now.

10-10

Bonds

Balance Sheet Reporting of Bond Liability

Relationships between Interest Rates and Bond Pricing

10-11

Contingent Liabilities

Contingent liabilities are potential liabilities that arise from past

transactions or events, but their ultimate resolution depends

(is contingent) on a future event.

10-12

Evaluate the Results

Two financial ratios are commonly used to assess a

company’s ability to generate resources to pay

future amounts owed:

1. Quick ratio

2. Times interest earned ratio

Quick Ratio =

(Cash + Short-term Investments + Accounts Receivable, Net)

Current Liabilities

Times Interest

=

Earned Ratio

10-13

(Net Income + Interest Expense + Income Tax Expense)

Interest Expense

Bond Premium

Bond premium or discount decreases each year, until it is completely

eliminated on the bond’s maturity date. This process is called

amortizing the bond premium or discount. The straight-line method of

amortization reduces the premium or discount by an equal amount each

period.

Recall our example when General Mills received $107,260 on the issue date

(January 1, 2010) but repays only $100,000 at maturity (December 31, 2013).

Under the straight-line method, this $7,260 is spread evenly as a reduction in

interest expense over the four years ($7,260 ÷ 4 = $1,815 per year).

1 Analyze

Cash

$6,000

Assets

= Interest Liabilities

+ Stockholders' Equity

(1,815)

Cash (-A) -$6,000Amortization

Premiumof

onPremium

Bonds Payable

Interest Expense

(-L)Expense -$1,815 $4,185

(+E, -SE)

$4,185

Interest

2

Record

dr

dr

10-14

Interest Expense (+E, -SE)

Premium on Bonds Payable (-L)

cr Cash (-A)

4,185

1,815

6,000

Bond Premium

Amortization Schedule of Bonds Issued at a Premium

$7,260 - $1,815 = $5,445

$7,260 ÷ 4 = $1,815

$100,000 × 6% × 12/12 = $6,000

$107,260 – $1,815 = $105,445

$6,000 - $1,815 = $4,185

Notice that each of these amounts would plot as a straight-line!

10-15

Effective Interest Amortization

General Mills issued $100,000 face value, 6%, 4-year bonds at a market

price to yield investors 8%. The bonds were issued at a discount of $6,624.

Let’s determine the effective interest for the first interest payment period.

1 Analyze

Interest (I)= = Principal

(P) × Rate (R)+× Stockholders'

Time (T)

Assets

Liabilities

Equity

Expense

= Carrying

Value

× MarketInterest

Rate ×Expense

n/12

CashInterest

(-A) -$6,000

Discount

on Bonds

Payable

$7,470

× 12/12

(-xL, =

+L)$93,376 × 8%

+1,470

(+E, -SE)

$7,470

2

Record

dr

10-16

Cash Interest

$ 6,000

Interest Expense (+E, -SE)

Effective Interest

7,470 7,470

cr Discount

on Bonds Payable

(+xL, -L)$ 1,470

Amortization

of Discount

cr Cash (-A)

1,470

6,000

Effective Interest Amortization

$7,470 - $6,000 = $1,470

$7,470 - $1,470 = $5,154

Effective Interest Amortization of Bonds Issued at a Discount

$93,376 × 8% × 12/12 = $7,470

$100,000 × 6% × 12/12 = $6,000

$93,376 + $1,470 = $94,846

Both Interest Expense and Discount Amortization

increase each period. Cash interest is unchanged.

10-17

End of Chapter 10