Review - Accounting

advertisement

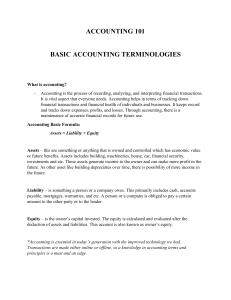

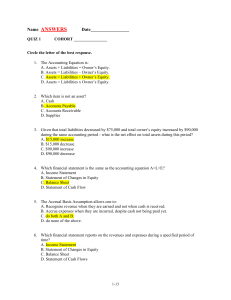

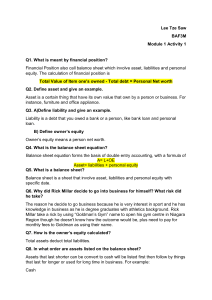

EXAM REVIEW - Accounting Accounting Equation A = L + O.E. Why do businesses bother to record their transactions? To assess the health of the company To ensure accountability Define the following: 1. Asset – things of value that a person or business owns 2. Liability – a debt of a business 3. Owner’s Equity – the owner’s investment in the business or the financial portion of the business that actually belongs to the owner 4. Revenue – the money a business receives for the products / services it sells 5. Expense –expenditures that help a business generate revenue 6. Current Asset – assets that are held for a short period of time and can be quickly converted into cash (eg. Cash, A/R) 7. Long-term Liability – A debt that takes longer than a year to pay in full For the following accounts, label each one as a(n): A – Asset L – Liability OE – Owner’s Equity R – Revenue E - Expense Cash A Bank Loan L Utilities E Sales R Rental Revenue R Rent E Land A Accounts Receivable A Accounts Payable L Capital OE Income Tax E Supplies A Car Loan L Building A Hydro E Note Payable L Note Receivable A Bank A Truck A Internet E Inventory A A/P – Rebecca L A/R – Madison A Advertising E Salaries E Credit Union Loan L Land A The Balance Sheet What goes on a Balance Sheet? 1. ASSETS (LEFT SIDE) 2. LIABILITIES (RIGHT SIDE) 3. OWNER’S EQUITY (RIGHT SIDE) Features of a Balance Sheet: Three Line Heading – Who, What, When Assets listed in order of liquidity (how fast they can be converted to cash) Liabilities listed in the order in which they will be paid Two final totals are listed on the same line and with a double underline beneath them The Income Statement What goes on an Income Statement? 1. REVENUE 2. EXPENSES 3. NET INCOME (OR LOSS) = Revenue – Expenses