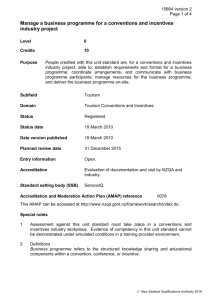

Brief clients on legislation and taxation matters for a conventions... incentives industry project

advertisement

25860 version 1 Page 1 of 3 Brief clients on legislation and taxation matters for a conventions and incentives industry project Level 5 Credits 4 Purpose People credited with this unit standard are able to brief clients on legislation and taxation matters affecting a conventions and incentives industry project. Subfield Tourism Domain Tourism Conventions and Incentives Status Registered Status date 19 March 2010 Date version published 19 March 2010 Planned review date 31 December 2015 Entry information Open. Replacement information This unit standard and unit standard 25863 replaced unit standard 15694. Accreditation Evaluation of documentation and visit by NZQA and industry. Standard setting body (SSB) ServiceIQ Accreditation and Moderation Action Plan (AMAP) reference 0078 This AMAP can be accessed at http://www.nzqa.govt.nz/framework/search/index.do. Special notes 1 Assessment against this unit standard must take place in a conventions and incentives industry workplace when appropriate situations arise, or in a training provider environment if simulated workplace conditions are able to be provided that reflect the standards of a conventions and incentives industry workplace. 2 For the purpose of this unit standard brief refers to drawing a client’s attention to potential legislation and taxation matters. It does not involve the giving of advice which requires the services of a professional lawyer or taxation accountant. New Zealand Qualifications Authority 2016 25860 version 1 Page 2 of 3 3 Definitions Conference and/or convention refers to a formal meeting or assembly of attendees for consultation, discussion, or for some special or occasional purpose which includes a minimum of 50 attendees, two days duration, and the use of a venue. Conventions and incentives industry refers to organisations involved in the management, marketing, or implementation of conventions, conferences, or incentives. Incentive is a global management tool that uses a reward to motivate and/or recognise participants for increased levels of performance in support of organisational goals. Industry practice refers to the expected standards of performance required of a professional working in the conventions and incentives industry. An indication of criteria for standards may include but is not limited to – documented workplace policies and procedures, industry codes of practice, and drafted constitutions and/or codes of ethics of industry associations, such as those produced by the following: Meetings and Events Australia (MEA), Sydney, http://www.meetingsevents.com.au. International Congress and Convention Association (ICCA), Amsterdam, http://www.iccaworld.com. International Association of Professional Congress Organisers (IAPCO), London, http://www.iapco.org. Society of Incentive and Travel Executives (SITE), Chicago, http://www.site-intl.org. Conventions and Incentives New Zealand (CINZ), Auckland, http://www.conventionsnz.com. Project refers to a conference, convention, or incentive. Venue refers to any place where a conference, convention, or incentive is held. 4 Legislation relevant to this unit standard may include but is not limited to – Commerce Act 1986, Copyright Act 1994, Fair Trading Act 1986, Goods and Services Tax Act 1985, Health and Safety in Employment Act 1992, Income Tax Act 2007, Privacy Act 1993, Sale of Liquor Act 1989, Sale of Liquor Regulations 1990. 5 A list of recommended texts can be found at http://www.tcc.co.nz/ATTTO. Elements and performance criteria Element 1 Brief clients on legislation affecting a conventions and incentives industry project. Performance criteria 1.1 Legislation affecting the project is identified and explained to clients in terms of its compliance requirements and likely impact on the project. 1.2 Legislative matters which are outside the expertise of the service provider are identified, and the client advised to seek the services of a professional in accordance with industry practice. New Zealand Qualifications Authority 2016 25860 version 1 Page 3 of 3 Element 2 Brief clients on taxation matters affecting a conventions and incentives industry project. Range examples of taxation matters are – GST, PAYE, withholding tax, FBT. Performance criteria 2.1 Taxation matters affecting the project are identified and explained to clients in terms of their compliance requirements and likely impact on the project. 2.2 Taxation matters which are outside the expertise of the service provider are identified, and the client advised to seek the services of a professional in accordance with industry practice. Please note Providers must be accredited by NZQA, or an inter-institutional body with delegated authority for quality assurance, before they can report credits from assessment against unit standards or deliver courses of study leading to that assessment. Industry Training Organisations must be accredited by NZQA before they can register credits from assessment against unit standards. Accredited providers and Industry Training Organisations assessing against unit standards must engage with the moderation system that applies to those standards. Accreditation requirements and an outline of the moderation system that applies to this standard are outlined in the Accreditation and Moderation Action Plan (AMAP). The AMAP also includes useful information about special requirements for organisations wishing to develop education and training programmes, such as minimum qualifications for tutors and assessors, and special resource requirements. Comments on this unit standard Please contact the ServiceIQ qualifications@serviceiq.org.nz if you wish to suggest changes to the content of this unit standard. New Zealand Qualifications Authority 2016