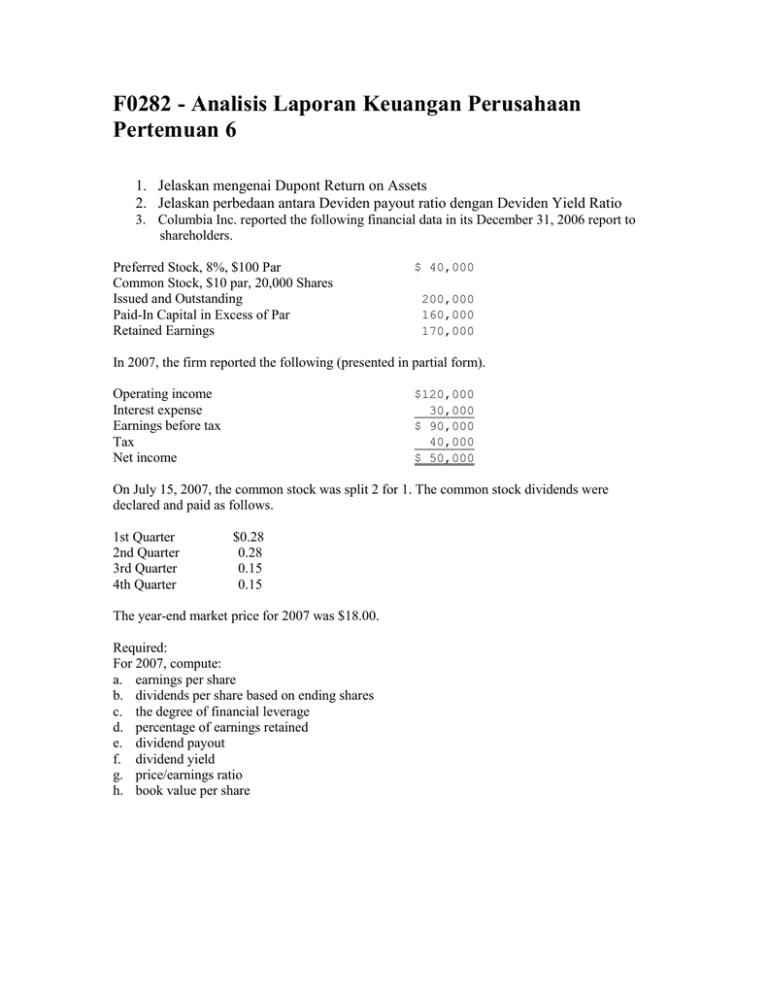

F0282 - Analisis Laporan Keuangan Perusahaan Pertemuan 6

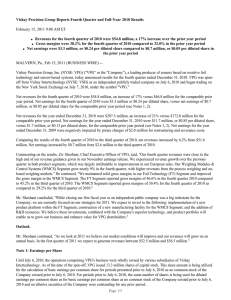

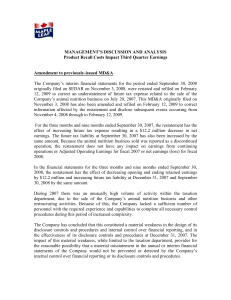

advertisement

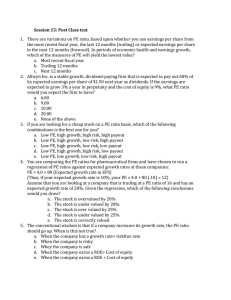

F0282 - Analisis Laporan Keuangan Perusahaan Pertemuan 6 1. Jelaskan mengenai Dupont Return on Assets 2. Jelaskan perbedaan antara Deviden payout ratio dengan Deviden Yield Ratio 3. Columbia Inc. reported the following financial data in its December 31, 2006 report to shareholders. Preferred Stock, 8%, $100 Par Common Stock, $10 par, 20,000 Shares Issued and Outstanding Paid-In Capital in Excess of Par Retained Earnings $ 40,000 200,000 160,000 170,000 In 2007, the firm reported the following (presented in partial form). $120,000 30,000 $ 90,000 40,000 $ 50,000 Operating income Interest expense Earnings before tax Tax Net income On July 15, 2007, the common stock was split 2 for 1. The common stock dividends were declared and paid as follows. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter $0.28 0.28 0.15 0.15 The year-end market price for 2007 was $18.00. Required: For 2007, compute: a. earnings per share b. dividends per share based on ending shares c. the degree of financial leverage d. percentage of earnings retained e. dividend payout f. dividend yield g. price/earnings ratio h. book value per share