Earnings Announcement Disclosures That Spur Differences in Interpretations

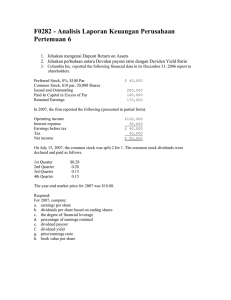

advertisement