Introduction Power Point Presentation

advertisement

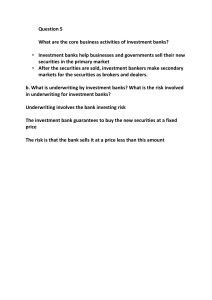

Financial Markets Why Study Financial Markets? Why Study Financial Markets? • Financial markets channel funds from savers to investors, thereby, promoting economic efficiency. • Financial markets also affect personal wealth and the behavior of business firms. Overview of the Financial System INDIRECT FINANCE FUNDS Financial Intermediaries FUNDS FUNDS Lenders-Savers Households Businesses Government Foreigners FUNDS FUNDS Financial Markets DIRECT FINANCE Borrowers-Spenders Businesses Government Households Foreigners Functions of the Financial System • The financial system – Allows transfers of funds from a person or a business without investment opportunities to one who has them. – Improves economic efficiency. Classification of Financial Markets • Debt markets – Short-term (maturity < 1 year) Money Market • U.S. Treasury bills, negotiable bank certificates of deposit (large denomination), commercial paper, etc. – Long-term (maturity > 10 years) Capital Market • Residential mortgages, corporate bonds, U.S. government securities, State and local bonds, bank commercial loans, etc. • Equity markets – Long-term------Corporate stocks Classification of Financial Markets • Primary market – New security issues sold to initial buyers. • Secondary market – Securities previously issued bought and sold. • Exchanges – Trades conducted in central locations. • Over-the-counter markets – Dealers at different locations buy and sell. Internationalization of Financial Markets • International Bond Market – Foreign bonds – Eurobonds • Bond denominated in a currency other than the one of the country in which it is sold. – Eurocurrencies • Foreign currencies deposited in banks outside the home country. • World Stock Markets Some Regulatory Agencies • Securities and Exchange Commission – Requires disclosure of information, restricts insider trading • Office of the Comptroller of the Currency – Charters and examines the books of federally chartered commercial banks and imposes restrictions on the assets they can hold. • Federal Reserve – Examines the books of commercial banks that are members of the system, sets reserve requirements. • State Banking and Insurance Commissions – Charter and examine books of state chartered firms. Regulation of Financial Markets • Three Main Reasons for Regulation: – Increase information to investors • SEC forces corporations to disclose information. – Decrease adverse selection and moral hazard problems. – Ensure the soundness of financial intermediaries • Chartering, reporting requirements, restrictions on assets and activities, deposit insurance – Prevents financial panics – Improve monetary control