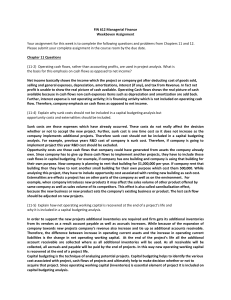

Corporations A Contemporary Approach 202

advertisement

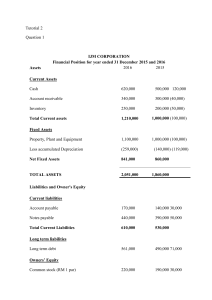

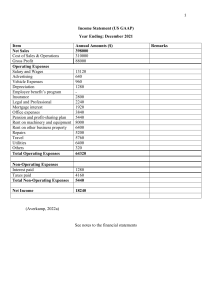

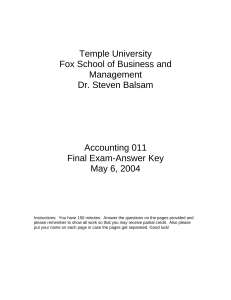

Corporations A Contemporary Approach 202 WIDGET, INC. BALANCE SHEET (As of December 31) Assets Year 2 Year 1 Current Assets Cash 100,000 275,000 Accounts Receivable 1,380,000 1,145,000 Inventories 1,310,000 1,105,000 Prepaid expenses 40,000 35,000 Total Current Assets 2,830,000 2,560,000 Property, Plant, and Equipment Land* 775,000 775,000 Buildings** 2,000,000 2,000,000 Machinery** 1,000,000 935,000 Office Equipment** Total PP&E Accumulated Depreciation*** Intangible Assets**** 225,000 205,000 4,000,000 3,915,000 (1,620,000) (1,370,000) 50,000 0 Total Long-term Assets 2,430,000 2,545,000 Total Assets 5,260,000 5,105,000 900,000 825,000 0 355,000 Accrued expenses payable 250,000 235,000 Other liabilities 600,000 570,000 Total Current Liabilities 1,750,000 1,985,000 Long-term Notes payable, 12.5% due in ten years 2,000,000 2,000,000 Total Liabilities 3,750,000 3,985,000 200,000 200,000 Liabilities and Equity Current Liabilities Accounts payable Notes payable, 11% due next July 1 Stockholders’ Equity Common stock (1,000 shares authorized and outstanding) Paid-in capital 1,310,000 920,000 Total Equity Retained earnings 1,510,000 1,120,000 Total Liabilities and Equity 5,260,000 5,105,000 * The land was purchased 15 years ago for $775,000, the price shown on the balance sheet. A comparable property nearby recently sold for $975,000. ** The machinery and equipment are in good repair. The fair market value of the building and equipment are about $200,000 more than historical cost. *** Depreciation is on a level (straight line) basis over the estimated useful life. **** Intangible assets include patent acquired for $50,000 during Year 2. Chapter 9 Numeracy for Corporate Lawyers STATEMENT OF INCOME (Year Ended December 31) Year 2 Net sales Year 1 203 Year 0 7,500,000 7,000,000 6,800,000 4,980,000 4,650,000 4,607,000 Operating Expenses Cost of goods sold Depreciation Selling and admin expense* R&D Operating Income 250,000 240,000 200,000 1,300,000 1,220,000 1,150,000 50,000 125,000 120,000 920,000 765,000 723,000 Interest expense 320,000 375,000 375,000 Income before taxes 600,000 390,000 348,000 Income taxes 210,000 136,000 122,000 390,000 254,000 226,000 Net Income * Includes $130,000 salaries paid to the owners in Year 2; $100,000 in Year 1; and $100,000 in Year 0, and bonuses totaling $120,000 in Year 2; $100,000 in Year 1; and $80,000 in Year 0. Statement of Cash Flows (Year Ended December 31) Year 2 Year 1 Year 0 From Operating Activities Net Income 390,000 254,000 226,000 Decrease (Increase) in accts receivable (235,000) (34,000) (32,000) Decrease (Increase) in inventories (205,000) (28,000) (33,000) Decrease (Increase) in prepaid expenses (5,000) (3,000) (3,000) Increase (Decrease) in accounts payable 75,000 25,000 20,000 Increase (Decrease) in accr exp payable 15,000 7,000 5,000 Depreciation 250,000 240,000 200,000 Total from Operating Activities 285,000 461,000 383,000 From Investing Activities Sales (Purchases) of machinery (65,000) (378,000) (263,000) Sales (Purchases) of office equipment (20,000) (27,000) (25,000) Sales (Purchases) of patents (50,000) 0 0 (135,000) (405,000) (288,000) Increase (Decrease) in short-term debt 30,000 (40,000) (35,000) Increase (Decrease) in long-term debt (355,000) 0 0 Total from Financing Activities (325,000) (40,000) (35,000) Increase (Decrease) in Cash Position (175,000) 16,000 60,000 Total from Investing Activities From Financing Activities