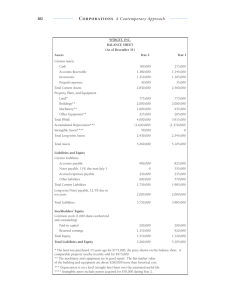

Tutorial 2 Question 1 Assets IJM CORPORATION Financial Position for year ended 31 December 2015 and 2016 2016 2015 Current Assets Cash 620,000 500,000 120,000 Account receivable 340,000 300,000 (40,000) Inventory 250,000 200,000 (50,000) Total Current assets 1,210,000 1,000,000 (100,000) Property, Plant and Equipment 1,100,000 1,000,000 (100,000) Less accumulated Depreciation (259,000) (140,000) (119,000) Net Fixed Assets 841,000 860,000 TOTAL ASSETS 2,051,000 Fixed Assets 1,860,000 Liabilities and Owner's Equity Current liabilities Account payable 170,000 140,000 30,000 Notes payable 440,000 390,000 50,000 Total Current Liabilities 610,000 530,000 561,000 490,000 71,000 220,000 190,000 30,000 Long term liabilities Long term debt Owners’ Equity Common stock (RM 1 par) Capital Surplus 280,000 270,000 10,000 Retained Earnings 380,000 380,000 Total Owner’s equity 880,000 840,000 TOTAL LIABILITY AND OWNER'S EQUITY 2,051,000 IJM CORPORATION Income Statement as at 31 December 2016 Sales 1,000,000 Cost of goods sold (700,000) Administrive expenses (100,000) Depreciation (119,000) Earnings before Interest and Taxes 81,000 Interest Expenses (80,000) Taxable income 1,000 Taxes - Net Income 1,000 Dividend 1,000 1,860,000 You are required to prepare cash flow statement for IJM Corp. Statement of Cash Flow Net Income 1,000 Add: Depreciation 119,000 120,000 Cash Flows from operating activity Increase in account receivable (40,000) Increase in Inventory (50,000) Increase in account payable 30,000 Increase in notes payable 50,000 Cash generated from Operating activities (10,000) 110,000 Cash Flows from Investing activity Property, Plant and Equipment (100,000) Cash Flows from Financing activities Insurance of Common stock 30,000 Capital Surplus 10,000 Long term debt 71,000 Dividend (1,000) Cash Flows from Financing activities 110,000 Net increase in Cash 120,000 Cash at beginning 620,000 Cash at ending 500,000 Question 2 Dollars Percentage of Sales Sales 400,000 100.0% Cost of goods sold (150,000) 37.5% Gross profits 250,000 62.5% Administrative expenses (30,000) 7.5% Depreciation expenses (20,000) 5.0% Selling & marketing expenses (40,000) 10.0% Total operating expenses (90,000) 22.5% Operating income (EBIT) $160,000 40.0% Interest expense (35,000) 8.8% Earnings before taxes $125,000 31.3% Income tax (40,000) 10.0% Net Income $ 85,000 21.3% Operating expenses: Earnings per share ($85,000 net income / 20,000 shares) $4.25 Dividends per share ($15,000 dividends / 20,000 shares) $0.75