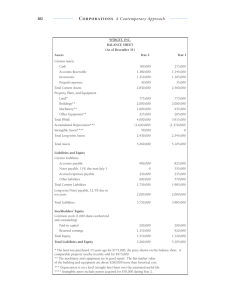

1 Income Statement (US GAAP) Year Ending: December 2021 Item Net Sales Cost of Sales & Operations Gross Profit Operating Expenses Salary and Wages Advertising Vehicle Expenses Depreciation Employee benefit’s program Insurance Legal and Professional Mortgage interest Office expenses Pension and profit-sharing plan Rent on machinery and equipment Rent on other business property Repairs Travel Utilities Others Total Operating Expenses Annual Amounts ($) 398000 310000 88000 13120 640 960 1280 2800 2240 1920 3840 5440 8000 6400 5200 5760 6400 320 64320 Non-Operating Expenses Interest paid Taxes paid Total Non-Operating Expenses 1280 4160 5440 Net Income 18240 (Averkamp, 2022a) See notes to the financial statements Remarks 2 Balance Sheet (US GAAP) Year Ending: _December 2021 Assets Cash Assets Petty Cash Accounts Receivable Inventory Value Amount ($) 12800 39500 31000 Liabilities Amount ($) 20900 3100 1300 5000 Prepaid Expenses 1500 Accounts Payable Taxes Payable (State) Taxes Payable (Federal) Short Term Loans Payable Taxes (Property) Salaries Payable Current Assets 84800 Current Liabilities 39500 Investments Land Land Improvements Buildings Vehicles Equipment Accumulated Depreciation Long Term Assets 3600 Deferred Income Taxes Notes Payable - Long Term Liabilities 45000 Intangible Assets Miscellaneous Assets 2000 - - Total Liabilities Owner’s Equity Total Liabilities & Owner’s Equity 84500 40300 124800 Total Assets 5500 6500 18000 9000 11000 (5600) 38000 124800 (Averkamp, 2022b) See notes to the financial statements 700 8500 25000 20000 3 Balance Sheet (IFRS) Year Ending: December 2021 Assets Amount ($) Liabilities Amount ($) Investments Land Land Improvements Buildings Vehicles Equipment Accumulated Depreciation Long Term Assets 3600 Deferred Income Taxes Notes Payable Long Term Liabilities 25000 20000 Cash Assets Petty Cash Accounts Receivable Inventory Value 12800 39500 31000 20900 3100 1300 5000 Prepaid Expenses 1500 Current Assets 84800 Accounts Payable Taxes Payable (State) Taxes Payable (Federal) Short Term Loans Payable Taxes (Property) Salaries Payable Current Liabilities Intangible Assets Miscellaneous Assets 2000 Total Liabilities 84500 Owner’s Equity Total Liabilities & Owner’s Equity 40300 124800 Total Assets 5500 6500 18000 9000 11000 (5600) 38000 124800 (Averkamp, 2022b) See notes to the financial statements 45000 700 8500 39500 4 PERSONAL MEMO To: Timi Okinwei From: Damiete Ebenibo Date: 20/July/2022 Subject: Information on the Income Statement, Balance Sheet, and differences between US GAAP and IFRS standards with explanations. I write this memo in response to our earlier phone call in which you expressed confusion on the subject matter stated above. I desire to offer clarifications on several items you mentioned that are of importance in having proper financial recording and accounting for your businesses in the United States and Mexico. The example financial statements are based on a 1-year-old business private business for better understanding. Firstly, the income statement is on the first page of this document. It reads from top to bottom starting with the net sales which is subtracted from the cost of goods sold to give you the gross revenue. This gross revenue is then subtracted from the Operating expenses (strictly business activities related) and the non-operating (not strictly business activities related) expenses to arrive at the “bottom line” value of $18,240. This is the net income and represents the actual profit (or sometimes loss) the business has made for the year. Secondly, the balance sheet in US GAAP format is presented on the second page of this document. It reads top to bottom but has 2 distinct columns that must be equal based on the accounting equation. The left column contains the current (1 year or less), non-current (greater than1 year old) and miscellaneous assets. They are added up from top to bottom to give the total assets monetary value. The right column has current, non-current liabilities, and owner’s equity (your personal funds) which are also added up from top to bottom. The balance sheet represents the fixed financial position of the business at a point in time based on a monetary assessment of all its holdings (assets) and all its obligations (liabilities). Key differences between the US GAAP and IFRS standards include the following: the format of the balance sheet, inventory value re-evaluation, and the fixed assets revaluation and depreciation. These will reflect in reporting your US and Mexico locations. Lastly, in preparing the balance sheet in any of the two standards, it is important to note the following differences as demonstrated by the balance sheets (US GAAP and IFRS format) shown on the third and fourth pages of this document. US GAAP lists assets in decreasing order of liquidity (i.e., current assets before noncurrent/long term assets), while IFRS reports assets in increasing order of liquidity (i.e., non-current/long term assets before current assets). Inventory value can increase in the IFRS balance sheet depending on if the market value increases because of improved economic conditions. However, the inventory value of the US GAAP balance sheet ($31,000) can not increase regardless of economic conditions. Any separate component of a fixed asset (building, equipment) with a different useful life is required to be depreciated separately under IFRS. US GAAP allows for such component depreciation but does not require it. 5 References Averkamp, H. (2022a). Balance Sheet Example | AccountingCoach. AccountingCoach.Com. Retrieved July 18, 2022, from https://www.accountingcoach.com/balance-sheetnew/explanation/2 Averkamp, H. (2022b). Income Statement (Explanation). AccountingCoach. AccountingCoach.Com. Retrieved July 18, 2022, from https://www.accountingcoach.com/income-statement/explanation/3