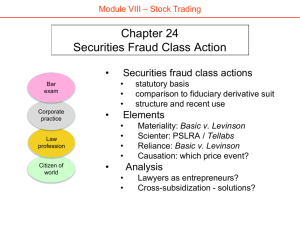

Securities Fraud Scienter

advertisement

Securities Fraud Scienter State of mind: awareness or recklessness Pleading: “particularized facts creating strong inference” Weighing evidence in motion to dismiss (last updated 18 Apr 12) Securities Fraud Action Rule 10b-5 • Transaction (“in connection with • • purchase or sale of securities”) Plaintiff (“purchasers or sellers” / except SEC) Defendant (“primary violator” / including company) • Elements – Material misrepresentation or omission – Scienter – Reliance – Causation – Damages • Procedure – Jurisdictional nexus (federal court) – Statute of limitations / repose – Special rules for class actions Ernst & Ernst v. Hochfelder (US 1976) What was Nay’s “mail rule”? Why didn’t the accountants discover it? Lack of “quality”? What was plaintiffs’ theory under Rule 10b-5? Rule 10b-5 It shall be unlawful for any person, directly or indirectly, (1) To employ any device, scheme, or artifice to defraud, (2) To make any untrue statement of a material fact … or to omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading, or (3) To engage in any act, practice, or course of business which operates or would operate as a fraud or deceit upon any person, in connection with the purchase or sale of any security. Section 10 (‘34 Act) It shall be unlawful for any person, directly or indirectly …(b) To use or employ, in connection with the purchase or sale of any security … any manipulative or deceptive device or contrivance in contravention of [SEC] rules … Section 11 (’33 Act) (a) In case any part of the registration statement, … contained an untrue statement of a material fact … any person acquiring such security … may … sue -(4) every accountant … who certified part of the registration statement … (b) no person … shall be liable … who shall sustain the burden of proof … as regards any part of the registration statement purporting to be made upon his authority as an expert … he had, after reasonable investigation, reasonable ground to believe and did believe… that the statements therein were true Ernst & Ernst v. Hochfelder (US 1976) The argument [effect on investors same whether intentional or negligent] simply ignores … “manipulative, device an contrivance.” [Legislative history gives] no indication that § 10(b) was intended to proscribe conduct not involving scienter [mental state embracing intent to deceive, manipulate or defraud] Lewis F. Powell (corporate lawyer) [When] Congress created express civil liability … it clearly sp[ecifed whether recovery was to be premised on knowing or intential conduct, beligence or entirely innocent mistake. [See § 11, 12(2)] Pleading scienter … Recklessness Motive and opportunity Strong circumstantial evidence Exchange Exchange Act Act 21D(b)(2) 21D(b)(2) In In any any private private action action arising arising under under this this title title in in which which the the plaintiff recover money plaintiff may alleges the defendant damages only onfalse proof that the made [materially defendant acted with a the statement or omission] particular mind,each the complaint state shall of specify complaint with statement shall, alleged to respect have to each or omission to been act misleading, the alleged reason or violate title, with is reasonsthis why thestate statement particularity misleading facts giving rise to a strong inference that the defendant acted with the required state of mind. 9th Circuit • “Deliberate recklessness” • Intentional misconduct 2d and 3d Circuits • Motive and opportunity • Concrete personal benefit • Insider trading 1st, 5th, 6th, 10th, 11th Circuits • Strong inference of scienter • M&O is external marker • Unusual insider trading Sup Ct resolves split … (kinda) • What were plaintiffs’ allegations? How might shareholders know whether executives knew product demand was weak and there was “channel stuffing”? • What did 7th Circuit decide? Can reasonable person “infer” intent? What about defendants’ explanations of innocence? • What was issue as the Supreme Court saw it? What was difference between justices? Tellabs, Inc. v. Makor Issues & Rights, Ltd. (US 2007) … PSLRA strong inference of state of mind (scienter) means … “a reasonable person would deem the inference of scienter cogent and at least as compelling as any opposing inference.” … allegations must also be considered “holistically” [isolated insider sales not enough, must have unusual, broad sales] Ruth Bader Ginsburg (civil rights lawyer) “omissions and ambiguities [in the plaintiffs’ allegations] count against inferring scienter” [discount confidential witnesses] Tellabs, Inc. v. Makor Issues & Rights, Ltd. (US 2007) If a jade falcon were stolen from room to which only A and B had access, could it possibly be said there was a “strong inference” B was the thief? Inconceivable PSLRA manifests the purpose of giving plaintiffs the edge in close cases Antonin Scalia (law professor) Justice Alito: Scalia’s interpretation would align the pleading test with the test used at summary judgment and judgment as matter of law. The end Green Tree Financial (8th Cir. 2001) The issue? Securitization 11.5% 11.5% 11.5% 11.5% 11.5% Home mortgages (P&I) Pool (diversifies risk) 7.2% 7.2% 7.2% 7.2% 7.2% Bonds (P&I) Securitization 11.5% 11.5% 11.5% 11.5% 11.5% Home mortgages (P&I) Pool (diversifies risk) • What is “gain on sale” revenue recognition? •Valuation • Discount rate • Loan default rate • Loan prepayment rate 7.2% 7.2% 7.2% 7.2% 7.2% Bonds (P&I) Green Tree Financial (8th 2001) Eighth Circuit: recklessness is limited to those highly unreasonable omissions or misrepresentations that involve … an extreme departure from the standards of ordinary care, and that present a danger of misleading buyers or sellers which is … so obvious that the defendant must have been aware of it. Green Tree Financial (8th 2001) Eighth Circuit: Coss’s extraordinary compensation package [2.5% of pre-tax income minus other execs bonuses], on the eve of expiring, created a powerful incentive to see to it that Green Tree made plenty of money before his contract expired. …. … they issued financials that did not take account of the disparity between the assumptions and actual experience… the sheer size of the $390 million write-down adds to the inference that the defendants must have been aware the problem was brewing. Lawrence Coss (Green Tree CEO)