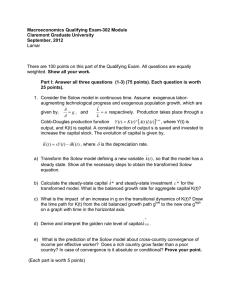

one points. All parts are equally weighted. Part II is... PLEASE MAKE YOUR ANSWERS NEAT AND CONCISE.

advertisement

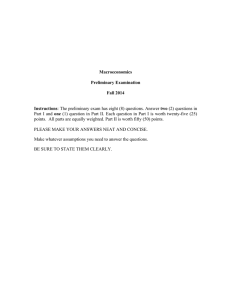

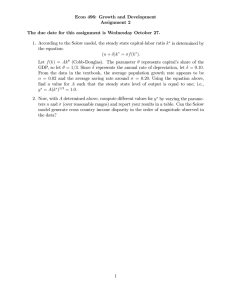

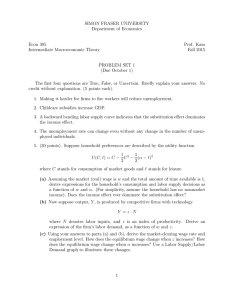

Macroeconomics Preliminary Examination Spring 2014 Instructions: The preliminary exam has eight questions. Answer two (2) questions in Part I and one (1) question in Part II. Each question in Part I is worth twenty-five (25) points. All parts are equally weighted. Part II is worth fifty (50) points. PLEASE MAKE YOUR ANSWERS NEAT AND CONCISE. Make whatever assumptions you need to answer the questions. BE SURE TO STATE THEM CLEARLY. Part I 2 Question I.1 (Lamar) Assume a closed economy with the following two-period utility function 𝑈 = 𝑙𝑛 𝑐! + 2𝑙𝑛(1 − 𝑙!) + 𝑒 !! 𝑙𝑛 𝑐! + 2𝑙𝑛(1 − 𝑙! ) and Cobb-Douglas technology, 𝑌! = 𝐾!! (𝐴! 𝐿! )!!! , where technology follows an AR1 process. Capital depreciation rate is equal to 1 every period. a) Obtain expressions for wages and the rental return of capital. b) Set up the utility maximization problem for the representative household and from the First Order Conditions for the problem find expressions for relative consumption and labor. c) Interpret your findings. d) Assuming that the economy responds optimally to technology shocks; explain what happens if the economy is hit with a positive and temporal technology shock. Be as precise as you can, identify the driving force and the impulse mechanism. e) Show the persistency effects of the technological shock on output. Interpret your result. 3 Question I.2 (Lamar) Consider an economy that last two periods (1 and 2). The economy has a representative household with the following preferences, 𝑈 = 𝑙𝑛 𝐶! + 𝛽𝑙𝑛(𝐶! ), where β is a discount factor. Households are endowed with income (Y1,Y2) and can borrow/save an amount s during period 1 and period 2. The representative household faces consumption taxes 𝜏! on period 2, and does not pay taxes in period 1. The representative household has the following budget constraint: 𝐶! = 𝑌! + 𝑠 1 + 𝜏! 𝐶! = 𝑌! + 1 + 𝑟 𝑠 The government has expenditures (G1,G2) in the two periods financed by levying consumption taxes 𝜏! in the second period and by rising debt b in the first period. At the end of time 2 the government budget constraint must be balanced. a) Solve the household problem and derive first order condition for consumption in both periods, and derive the Euler equation. b) State the meaning of Ricardian Equivalence in this economy. c) Does Ricardian Equivalence hold in this economy? Prove your answer. d) Explain a theoretical case in which Ricardian Equivalence does not hold. e) What is the importance of the result known as Ricardian Equivalence? 4 Question I.3 (Rutledge) Macroeconomic theory and practice have gone through a number of changes of direction over the past century, partly in response to the specific economic conditions and policy issues that confronted professional economists at different times. For each of the following key figures in macroeconomics: a) What was accepted macro theory at the time they wrote? b) What were the principal economic events or conditions they faced that forced them to rethink accepted wisdom? c) What was their principal contribution to macroeconomics, how did it change thinking in the profession and in policy making, and who were some of the leading thinkers that accepted their ideas. d) What were its principal weaknesses that made it vulnerable to the next major economic event? You may feel free to answer the questions at whatever technical level you think is appropriate for a full answer. A. Irving Fisher B. J.M. Keynes C. J.R. Hicks D. A.W. Phillips E. Milton Friedman F. Robert Lucas G. Kydland/Prescott H. Finally, in light of the severity of the recent, and ongoing global financial crisis, which of the leading macroeconomists would have been most able to understand the financial crisis? Which would have been the most surprised by the financial crisis? How would they have analyzed the policy of Quantitative Easing? And what do you think will be the next important change in thinking in the profession as a result? 5 Question I.4 (Rutledge) Consider the following simple macroeconomic model: 1. C(t) = a + bY(t) + cR(t) 2. I(t) = d + e(R(t) 3. X(t) = C(t) + I(t) 4. Y(t) = X(t) 5. Md(t) = fY(t) + gR(t) 6. Ms(t) = M0 7. Md(t) = Ms(t)/P(t) The variables are defined as follows: C = real consumption expenditures on goods and services at annual rates; Y = real income, the level of economic activity at annual rates; R = the market interest rate; I = real investment spending at annual rates; X = real total spending on goods and services at annual rates; Md = quantity of money demanded; Ms = money supply; P = price level of goods and services; t = time period. The symbols a, b, c, d, e, f, g, and M0 are fixed parameters. Please answer all of the following questions: 1. Derive the IS curve. 2. Derive the LM Curve. 3. Derive the expression for equilibrium income, Y(t), assuming that the price level is fixed at P = P0. 6 4. Derive the expression for the equilibrium price level P(t), assuming that income is initially at full employment Y = Y0. 5. Show how you would use the AS-AD model to describe the following comparative statics experiment: Assume the economy is initially at full employment income. What is the impact of doubling the money supply on income and the price level in the short-run? In the long-run? What behavioral assumptions do you need to make to account for an upwardsloping short-run AS curve? 6. What were the major theoretical innovations that led to a change in the analytical framework from this model to the currently popular Real Business Cycle Model? What improvements still need to be made in order to make accepted theory able to explain financial crises, booms and busts? 7 Part II 8 Question II.1 (Lamar) Consider the Solow model in continuous time. Assume exogenous labor-augmenting A! technological progress and exogenous population growth, which are given by, = g , and A L! = n respectively. Production takes place through a Cobb-Douglas production function L 1−α Y (t ) = K (t ) α [A(t ) L(t )] , where Y(t) is output, and K(t) is capital. A constant fraction of output s is saved and invested to increase the capital stock. The evolution of capital is given by, K! (t ) = sY (t ) − δK (t ) , where δ is the depreciation rate. ~ a) Transform the Solow model defining a new variable k (t ) , so that the model has a steady state. Show all the necessary steps to obtain the transformed Solow equation. (7 points) ~ ~ b) Calculate the steady-state capital k * and steady-state investment c * for the transformed model. What is the balanced growth rate for aggregate capital K(t)? (7 points) ~ c) Show analytically and graphically that k * is stable. (8 points) d) What is the impact of an increase in g on the transitional dynamics of K(t)? Draw the time path for K(t) from the old balanced growth path glow to the new one ghigh on a graph with time in the horizontal axis. (7 points) e) What is the main problem with the traditional Solow model? Explain. (7 points) The AK model is one solution to a weakness in the Solow model. In what follows you are required to answer about this model. f) How you can justify the existence of the AK model? (7 points) g) What are the implications of the AK model for economic growth? Be specific and detailed in your answer. (7 points) 9 Question II.2 (Lamar) Assume a closed economy where firms produce output using only labor, i.e., Y= F(L) under the assumptions of diminishing and positive marginal product of labor. Households live forever and derive utility from consumption and holding real money balances, and disutility from working. The representative household’s utility function is given by 𝑈= ! ! !!! 𝛽 𝑈 𝐶! + Γ !! !! − 𝑉(𝐿! ) , 0<β<1, with 𝑈 ! (.) >0, 𝑈 !! . < 0, Γ ! . > 0, Γ !! . < 0, 𝑉 ! > 0, 𝑉 !! > 0. U and Γ have relative-risk-aversion forms, 𝑈 𝐶! = !!!!! !!! , θ > 0, and Γ !! !! = ! ( ! )!!! !! !!! , v > 0. There are two assets: Money which pays no interest and Bonds which pay an interest rate of 𝑖! . Households have a labor income WtLt per period, its consumption expenditures are PtCt., W and P represent nominal wages and the price level respectively. At is the household’s wealth at the start of period t. a) Write down an equation describing the evolution of wealth. (6 points) b) Set up the maximization problem of the household. (6 points) c) Using First Order Condition find, graph, and interpret the IS and LM curves. (7 points) d) Show and explain the effect of an increase in nominal Money supply. (6 points) Now assume the classical model with perfect information, where a representative 1 producer (consumer) of good i supplies labor (in logs) according to li = ( pi − p ) , 1− γ where γ ≻ 1, pi and p are the log of Pi and P respectively. e) What does the labor supplied by each individual implies for the labor supply? (6 points) f) Assume that demand for good i is represented by the following log-linear demand function qi = y − η ( pi − p) . Find the equilibrium output for each producer. (6 points) g) Now assume that information about prices is not perfect. Explain how labor supplied by each individual changes and what it implies for the labor supply? (6 points) f) Assume Aggregate Demand is represented in logs by y = m – p. What is the effect of money in this model. Explain. (7 points) 10 Question II.3. Endogenous Growth Model (Rutledge) Assume a production function 𝒀𝒕 = 𝑨𝑲𝒕 + 𝑩𝑲∝𝒕 𝑳𝟏!∝ where A and B are constant 𝒕 multifactor productivity parameters (Hint: Note that the production function is the sum of a linear function and a Cobb Douglas function). Population growth is given by 𝑛= ! !! 𝐿! ; the rate of depreciation of capital is 𝛿; and the constant saving rate is s. There is no technological progress over time. a) Show that that the production function exhibits constant returns to scale. b) Find the intensive form of the production function (Define capital per worker as 𝑘! = !! !! ! and output per worker 𝑦! = !! ) ! c) Show that the production function exhibits positive and diminishing returns to scale. d) Check whether the production function satisfies the Inada conditions e) Derive the Solow fundamental equation for this model. Assume the law of motion of aggregate capital is 𝐾! = 𝑠 𝐴𝐾! + 𝐵𝐾!∝ 𝐿!!∝ − 𝛿𝐾! . ! ! f) Find the rate of growth of capital per worker, ( !! ). Assume that 𝑠𝐴 > (𝑛 + 𝛿). Is ! there economic growth in this model with this assumption? 11 Question II.4 Real Business Cycle (Rutledge) Consider the individual maximizes a two period utility function 1 𝑏 𝑢! = ln 𝑐! + 𝑏𝑙𝑛 1 − ℓ𝓁! + ln 𝑐! + 𝑙𝑛(1 − ℓ𝓁! ) 1+𝜌 1+𝜌 such that ! ! ! 𝑐! + !!! = 𝑤! ℓ𝓁! + !!! 𝑤! ℓ𝓁! , where 𝑐 is consumption, ℓ𝓁 is labor, r is the interest rate, and 𝜌 determines how individuals weight current consumption and labor against the future consumption and labor. a) Set up the Lagrangian equation for the constrained maximization problem. b) Show the first order optimal conditions for c! , c! , ℓ𝓁! and ℓ𝓁! . c) Find the equation that shows the intertemporal marginal rate of substitution between consumption in period 1 (c! ) and consumption in period 2 (c! ). d) What will be the impact of a decrease in the interest rate on the intertemporal consumption decision? What will be the impact of a decrease in the value of ρ? e) Find the equation which shows the intertemporal substitution between labor in period 1 (ℓ𝓁! ) and labor in period 2 (ℓ𝓁! ). f) What will be the impact of a decrease in the interest rate on the intertemporal labor decision? What will be the impact of a decrease in the value of ρ? 12