Macroeconomics Qualifying Exam-302 Module Claremont Graduate University May, 2009

advertisement

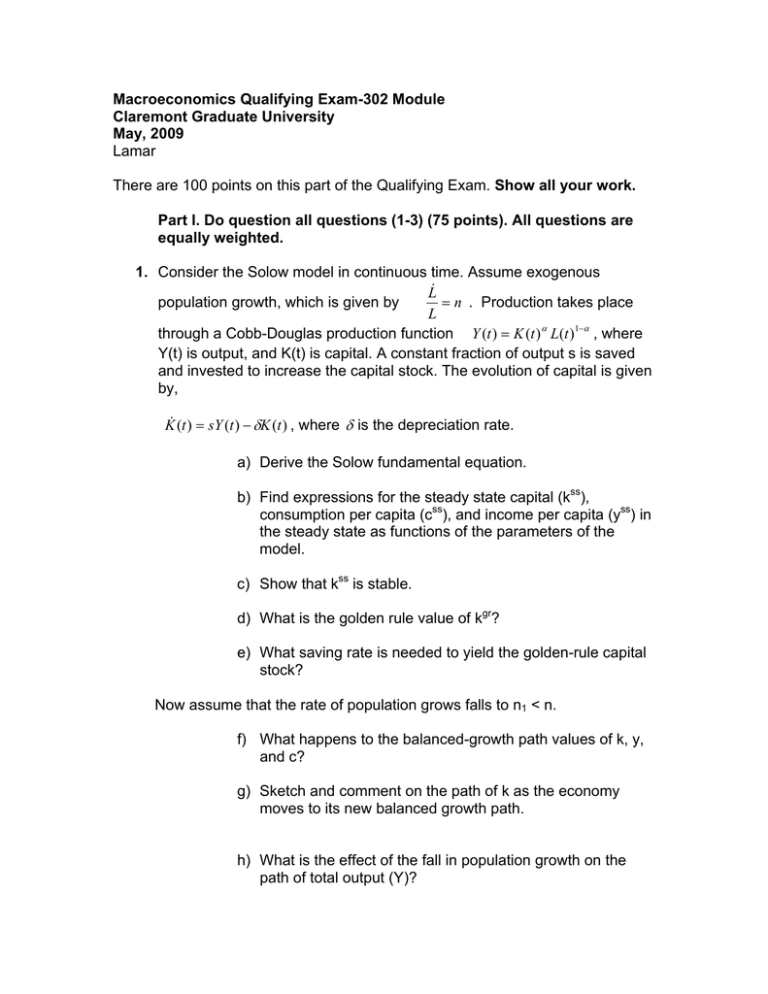

Macroeconomics Qualifying Exam-302 Module Claremont Graduate University May, 2009 Lamar There are 100 points on this part of the Qualifying Exam. Show all your work. Part I. Do question all questions (1-3) (75 points). All questions are equally weighted. 1. Consider the Solow model in continuous time. Assume exogenous L& = n . Production takes place population growth, which is given by L through a Cobb-Douglas production function Y (t ) = K (t ) α L(t )1−α , where Y(t) is output, and K(t) is capital. A constant fraction of output s is saved and invested to increase the capital stock. The evolution of capital is given by, K& (t ) = sY (t ) − δK (t ) , where δ is the depreciation rate. a) Derive the Solow fundamental equation. b) Find expressions for the steady state capital (kss), consumption per capita (css), and income per capita (yss) in the steady state as functions of the parameters of the model. c) Show that kss is stable. d) What is the golden rule value of kgr? e) What saving rate is needed to yield the golden-rule capital stock? Now assume that the rate of population grows falls to n1 < n. f) What happens to the balanced-growth path values of k, y, and c? g) Sketch and comment on the path of k as the economy moves to its new balanced growth path. h) What is the effect of the fall in population growth on the path of total output (Y)? 2. Assume an economy with government that produces with the following technology, Yt = AK tα Gt1−α . A is a constant, and G represents government spending which is assumed to be desirable. To finance G the government collect income tax from individuals which are taxed at a rate τ. Tax revenue is proportional to income. Capital accumulates according to K& (t ) = sY (t ) − δK (t ) . Assume exogenous population growth, which is L& =n . given by L G Yd and y d ≡ , where L L Yd is disposable income do the necessary transformations to write down the capital accumulation equation in percapita terms. Assume that government spending is equal to tax collection in any period and write down the government budget constraint in per-capita terms. Using what you did in b) find an expression for economic growth and briefly explain your result. Show that y, c, g, and Y grow at a constant rate. What is effect of taxes on economic growth? Provide a brief explanation. Find the tax rate that maximizes economic growth. Provide a brief explanation why the introduction of the government in this model is desirable. a) Using the following definitions, g ≡ b) c) d) e) f) g) 3. Assume an economy described by the following IS-MP model, IS: Y = C (Y − T ) + I (r ) + G MP: r = r (π ) , where rπ > 0 a) b) c) d) Why in this model the money supply is said to be endogenous? Draw the model in (Y,r) space. Explain the effects of a shift to a looser monetary policy. Derive the Aggregate Demand curve in (Y,π) space. State your assumption. e) Draw the Aggregate Supply curve under the following assumptions: i) inflation at any point in time is given, ii) in the absence of inflation shocks, inflation rises when output is above its natural rate and falls when output is below its natural rate. f) Assume the economy is at long-run equilibrium (output is at its natural rate and inflation is steady). Now assume an increase in government purchases. Using two diagrams (one for the IS-MP model and other for the AD/AS model described above) show the short and long-run impact of the increase in government spending. Part II. Answer one of the following two questions (25 points). Each question is worth 25 points. 4. Consider the classical model with perfect information, where a representative producer (consumer) of good i supplies labor (in logs) 1 according to li = ( pi − p) , where γ f 1 , pi and p are the log of Pi and 1− γ P respectively. a) Interpret the labor supplied by each individual. b) Assume that demand for good i is represented by the following log-linear demand function qi = y − η ( pi − p) . Find the equilibrium output for each producer. c) Show that money is neutral in this model. Aggregate Demand is represented in logs by y = m – p. Explain. d) How does the imperfect information model change the result you got in part b)? Note: Here you do not have to derive the complete model, only show the equation(s) that prove your point. 5. Assume the simple model of efficiency wages, Y = F (e( w), L) , F ' (.) > 0 , F '' (.) p 0 e = e(w) , e ' (.) > 0 L=L a) Assuming profit-maximizing firms derive the optimality condition for the typical firm. b) Explain the condition you derived in a) c) What will be the effect of a recession on the efficiency wage and unemployment? Explain your result. d) What will be the effect on unemployment and the efficiency wage of an increase in the labor force? e) What would be the effect of economic growth on the efficiency wage and unemployment? Explain your result.