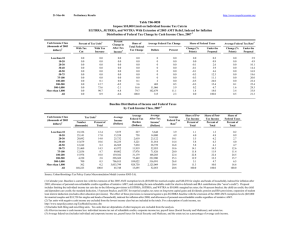

9-Feb-06 Preliminary Results Less than 10 10-20

advertisement

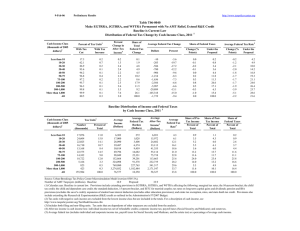

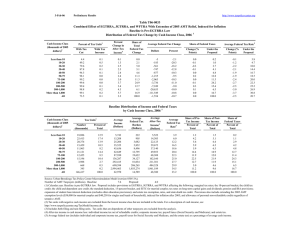

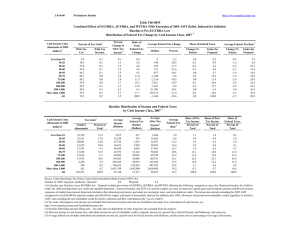

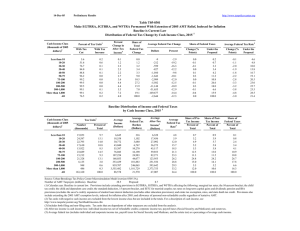

9-Feb-06 Preliminary Results http://www.taxpolicycenter.org Table T06-0042 Make EGTRRA, JGTRRA, and WFTRA Permanent with No AMT Relief Baseline is Current Law Distribution of Federal Tax Change by Cash Income Class, 2011 1 Cash Income Class (thousands of 2005 dollars)2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units3 With Tax Cut With Tax Increase 5.2 51.4 78.1 86.0 91.0 94.6 95.3 91.6 89.4 98.2 98.9 73.7 0.2 0.7 0.2 0.1 0.1 0.4 0.2 0.1 0.1 0.1 0.1 0.3 Percent Change in After-Tax Income4 0.1 1.2 2.3 2.3 2.2 2.2 2.1 2.2 2.5 5.3 7.3 2.9 Share of Total Federal Tax Change 0.1 1.9 4.9 5.0 4.5 10.4 8.7 18.0 11.4 9.2 25.7 100.0 Average Federal Tax Change Dollars -7 -197 -577 -771 -892 -1,192 -1,603 -2,501 -5,718 -28,931 -157,552 -1,665 Percent -2.7 -19.2 -16.9 -12.1 -9.4 -8.1 -7.2 -6.4 -6.3 -12.7 -14.3 -9.1 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.2 -0.1 0.0 0.1 0.2 0.8 0.5 -0.3 -0.9 0.0 Under the Proposal 0.2 0.8 2.4 3.6 4.4 11.8 11.3 26.6 17.1 6.3 15.4 100.0 Average Federal Tax Rate5 Change (% Points) -0.1 -1.2 -2.1 -2.0 -1.8 -1.7 -1.6 -1.6 -1.8 -3.8 -4.8 -2.2 Under the Proposal 4.2 4.9 10.1 14.2 16.9 19.3 21.1 24.0 26.4 25.9 28.9 21.7 Baseline Distribution of Income and Federal Taxes by Cash Income Class, 2011 1 Cash Income Class (thousands of 2005 dollars)2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units3 Number (thousands) 17,076 24,604 22,025 16,710 13,168 22,575 14,102 18,722 5,166 825 423 155,984 Percent of Total 11.0 15.8 14.1 10.7 8.4 14.5 9.0 12.0 3.3 0.5 0.3 100.0 Average Income (Dollars) 6,303 17,000 28,090 39,487 50,814 69,796 98,049 152,864 324,098 769,080 3,274,032 76,577 Average Federal Tax Burden (Dollars) 272 1,028 3,408 6,374 9,459 14,682 22,331 39,201 91,378 227,763 1,102,484 18,250 Average After-Tax Income4 (Dollars) 6,031 15,972 24,682 33,113 41,355 55,114 75,718 113,663 232,719 541,317 2,171,547 58,327 Average Federal Tax Rate5 4.3 6.1 12.1 16.1 18.6 21.0 22.8 25.6 28.2 29.6 33.7 23.8 Share of PreTax Income Percent of Total 0.9 3.5 5.2 5.5 5.6 13.2 11.6 24.0 14.0 5.3 11.6 100.0 Share of PostTax Income Percent of Total 1.1 4.3 6.0 6.1 6.0 13.7 11.7 23.4 13.2 4.9 10.1 100.0 Share of Federal Taxes Percent of Total 0.2 0.9 2.6 3.7 4.4 11.6 11.1 25.8 16.6 6.6 16.4 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0305-3A). Number of AMT Taxpayers (millions). Baseline: 16.9 Proposal: 33.9 (1) Calendar year. Baseline is current law. Provisions include extending provisions in EGTRRA, JGTRRA, and WFTRA affecting the following: marginal tax rates; the 10-percent bracket; the child tax credit; the child and dependent care credit; the standard deduction, 15-percent bracket, and EITC for married couples; tax rates on long-term capital gains and dividends; pension and IRA provisions (excludes the saver's credit); expansion of student loan interest deduction (excludes other education provisions); and estate tax exemption, rates, and state death tax credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units. Tax units that are dependents of other taxpayers are excluded from the analysis. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.