President Obama's State of the Union Proposal: Major Tax Reduction... Baseline: Current Law

advertisement

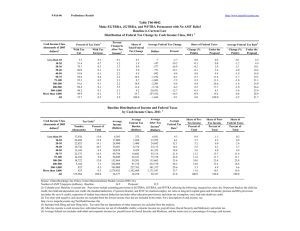

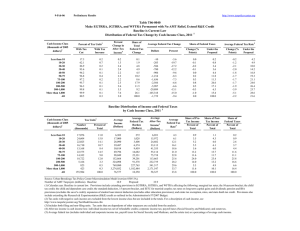

28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T15-0009 President Obama's State of the Union Proposal: Major Tax Reduction Provisions Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2016 ¹ Summary Table Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units with Tax Increase or Cut 3 With Tax Cut Pct of Tax Units 36.3 31.7 20.4 18.5 18.9 23.8 32.8 53.2 31.6 6.3 4.6 30.7 Avg Tax Cut -576 -669 -507 -453 -451 -548 -635 -648 -399 -1,295 -1,763 -586 With Tax Increase Avg Tax Pct of Tax Units Increase 0.0 0.5 1.1 1.7 1.4 1.8 1.3 1.5 * 0.0 0.0 1.1 0 293 742 832 836 823 794 749 ** 0 0 765 Percent Change in After-Tax Income 4 3.6 1.3 0.4 0.2 0.2 0.2 0.3 0.3 0.1 0.0 0.0 0.2 Share of Total Federal Tax Change 8.0 16.4 6.6 3.9 3.4 10.1 11.5 34.6 4.4 0.3 0.2 100.0 Average Federal Tax Change ($) -209 -211 -95 -69 -74 -116 -198 -334 -126 -82 -80 -171 Average Federal Tax Rate5 Change (% Points) -3.4 -1.3 -0.4 -0.2 -0.2 -0.2 -0.2 -0.2 0.0 0.0 0.0 -0.2 Under the Proposal 1.2 1.1 4.6 7.7 10.0 13.4 15.8 18.2 22.6 28.4 35.3 19.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). Number of AMT Taxpayers (millions). Baseline: 4.8 Proposal: 4.8 * Less than 0.05 ** Insufficient data (1) Calendar year. Baseline is current law. Proposal would: (a) enact a credit for second earners of up to $500; (b) expand the earned income tax credit (EITC) for childless workers; (c) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (d) expand the American Opportunity Tax Credit (AOTC); (e) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); and (f) enact an “auto-IRA” proposal. Although the education credit provisions provide a net tax increase for some tax units because of the repeal of the Lifetime Learning Credit, they are included in this table instead of the Tax Increase Provisions tables, T15-0007 and T15-0008. Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0009 President Obama's State of the Union Proposal: Major Tax Reduction Provisions Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2016 ¹ Detail Table Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 36.3 31.7 20.4 18.5 18.9 23.8 32.8 53.2 31.6 6.3 4.6 30.7 0.0 0.5 1.1 1.7 1.4 1.8 1.3 1.5 * 0.0 0.0 1.1 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 3.6 1.3 0.4 0.2 0.2 0.2 0.3 0.3 0.1 0.0 0.0 0.2 8.0 16.4 6.6 3.9 3.4 10.1 11.5 34.6 4.4 0.3 0.2 100.0 Average Federal Tax Change Dollars -209 -211 -95 -69 -74 -116 -198 -334 -126 -82 -80 -171 Percent -73.7 -55.6 -7.3 -2.4 -1.5 -1.3 -1.3 -1.2 -0.2 0.0 0.0 -0.9 Share of Federal Taxes Change (% Points) -0.1 -0.2 -0.1 0.0 0.0 0.0 0.0 -0.1 0.2 0.1 0.2 0.0 Under the Proposal 0.0 0.1 0.8 1.5 2.0 7.0 7.7 25.3 21.7 7.8 25.9 100.0 Average Federal Tax Rate5 Change (% Points) -3.4 -1.3 -0.4 -0.2 -0.2 -0.2 -0.2 -0.2 0.0 0.0 0.0 -0.2 Under the Proposal 1.2 1.1 4.6 7.7 10.0 13.4 15.8 18.2 22.6 28.4 35.3 19.8 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2016 ¹ Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Pre-Tax Income Number (thousands) Percent of Total Average (dollars) 10,764 21,954 19,661 16,011 12,822 24,605 16,308 29,194 9,885 1,183 678 164,808 6.5 13.3 11.9 9.7 7.8 14.9 9.9 17.7 6.0 0.7 0.4 100.0 6,190 16,095 26,361 37,032 47,606 65,365 91,774 146,327 299,793 713,230 3,336,255 94,528 Federal Tax Burden Percent of Total 0.4 2.3 3.3 3.8 3.9 10.3 9.6 27.4 19.0 5.4 14.5 100.0 After-Tax Income 4 Average (dollars) Percent of Total Average (dollars) 284 379 1,298 2,931 4,821 8,881 14,716 26,977 67,818 202,519 1,176,375 18,855 0.1 0.3 0.8 1.5 2.0 7.0 7.7 25.3 21.6 7.7 25.7 100.0 5,906 15,715 25,062 34,101 42,785 56,485 77,058 119,350 231,975 510,711 2,159,880 75,672 Percent of Total 0.5 2.8 4.0 4.4 4.4 11.1 10.1 27.9 18.4 4.8 11.7 100.0 Average Federal Tax Rate 5 4.6 2.4 4.9 7.9 10.1 13.6 16.0 18.4 22.6 28.4 35.3 20.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). Number of AMT Taxpayers (millions). Baseline: 4.8 Proposal: 4.8 * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would: (a) enact a credit for second earners of up to $500; (b) expand the earned income tax credit (EITC) for childless workers; (c) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (d) expand the American Opportunity Tax Credit (AOTC); (e) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); and (f) enact an “auto-IRA” proposal. Although the education credit provisions provide a net tax increase for some tax units because of the repeal of the Lifetime Learning Credit, they are included in this table instead of the Tax Increase Provisions tables, T15-0007 and T15-0008. Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0009 President Obama's State of the Union Proposal: Major Tax Reduction Provisions Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2016 ¹ Detail Table - Single Tax Units Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 41.0 37.0 22.2 14.9 11.4 10.4 7.9 6.1 1.8 1.7 1.8 21.9 0.0 0.7 1.8 2.7 2.0 2.3 0.2 0.0 0.0 0.0 0.0 1.3 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 4.1 1.6 0.4 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.3 24.1 45.2 13.6 4.4 2.1 3.8 2.8 2.5 0.3 0.0 0.0 100.0 Average Federal Tax Change Dollars -238 -247 -98 -44 -30 -32 -45 -46 -27 -25 -34 -118 Percent -57.1 -28.2 -4.3 -1.0 -0.4 -0.3 -0.3 -0.1 0.0 0.0 0.0 -1.3 Share of Federal Taxes Change (% Points) -0.3 -0.5 -0.1 0.0 0.1 0.2 0.1 0.2 0.1 0.1 0.2 0.0 Under the Proposal 0.2 1.5 3.8 5.4 6.0 17.3 14.1 21.8 10.9 4.0 14.6 100.0 Average Federal Tax Rate5 Change (% Points) -3.9 -1.5 -0.4 -0.1 -0.1 -0.1 -0.1 0.0 0.0 0.0 0.0 -0.2 Under the Proposal 2.9 3.9 8.4 11.6 13.9 17.7 20.3 22.7 25.7 30.5 37.6 18.6 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2016 ¹ Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Pre-Tax Income Number (thousands) Percent of Total Average (dollars) 8,866 16,020 12,106 8,702 6,249 10,357 5,309 4,814 985 130 79 74,432 11.9 21.5 16.3 11.7 8.4 13.9 7.1 6.5 1.3 0.2 0.1 100.0 6,177 16,023 26,183 36,976 47,482 65,401 90,951 138,693 299,252 708,853 3,405,735 50,088 Federal Tax Burden Percent of Total 1.5 6.9 8.5 8.6 8.0 18.2 13.0 17.9 7.9 2.5 7.2 100.0 After-Tax Income 4 Average (dollars) Percent of Total Average (dollars) 417 876 2,300 4,329 6,649 11,632 18,525 31,465 76,909 215,847 1,280,491 9,438 0.5 2.0 4.0 5.4 5.9 17.2 14.0 21.6 10.8 4.0 14.4 100.0 5,761 15,147 23,883 32,648 40,833 53,769 72,426 107,228 222,343 493,005 2,125,243 40,650 Percent of Total 1.7 8.0 9.6 9.4 8.4 18.4 12.7 17.1 7.2 2.1 5.6 100.0 Average Federal Tax Rate 5 6.7 5.5 8.8 11.7 14.0 17.8 20.4 22.7 25.7 30.5 37.6 18.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would: (a) enact a credit for second earners of up to $500; (b) expand the earned income tax credit (EITC) for childless workers; (c) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (d) expand the American Opportunity Tax Credit (AOTC); (e) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); and (f) enact an “auto-IRA” proposal. Although the education credit provisions provide a net tax increase for some tax units because of the repeal of the Lifetime Learning Credit, they are included in this table instead of the Tax Increase Provisions tables, T15-0007 and T15-0008. Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0009 President Obama's State of the Union Proposal: Major Tax Reduction Provisions Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2016 ¹ Detail Table - Married Tax Units Filing Jointly Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 14.8 17.2 18.2 21.0 26.1 36.1 51.0 66.5 35.7 6.9 5.0 44.8 0.0 0.0 0.1 0.7 1.1 1.6 2.3 1.9 * 0.0 0.0 1.3 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 1.1 0.7 0.4 0.3 0.3 0.3 0.3 0.3 0.1 0.0 0.0 0.2 0.3 1.3 1.9 2.1 2.5 9.6 14.7 58.7 7.7 0.6 0.3 100.0 Average Federal Tax Change Dollars -60 -111 -97 -100 -112 -164 -275 -407 -138 -89 -88 -246 Percent -67.1 -491.8 -17.5 -7.2 -4.1 -2.6 -2.3 -1.6 -0.2 0.0 0.0 -0.7 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.2 0.1 0.1 0.2 0.0 Under the Proposal 0.0 0.0 0.1 0.2 0.4 2.5 4.6 26.2 26.3 9.4 30.0 100.0 Average Federal Tax Rate5 Change (% Points) -1.1 -0.7 -0.4 -0.3 -0.2 -0.3 -0.3 -0.3 -0.1 0.0 0.0 -0.2 Under the Proposal 0.5 -0.5 1.7 3.5 5.4 9.2 12.9 17.1 22.1 28.1 35.0 21.2 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2016 ¹ Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Pre-Tax Income Number (thousands) Percent of Total Average (dollars) 793 1,809 3,022 3,252 3,501 9,022 8,297 22,351 8,625 1,018 571 62,924 1.3 2.9 4.8 5.2 5.6 14.3 13.2 35.5 13.7 1.6 0.9 100.0 5,399 16,592 26,749 37,230 47,869 65,781 92,667 148,912 299,844 713,846 3,269,774 163,166 Federal Tax Burden Percent of Total 0.0 0.3 0.8 1.2 1.6 5.8 7.5 32.4 25.2 7.1 18.2 100.0 After-Tax Income 4 Average (dollars) Percent of Total Average (dollars) 89 23 557 1,393 2,715 6,222 12,248 25,920 66,481 200,599 1,143,209 34,788 0.0 0.0 0.1 0.2 0.4 2.6 4.6 26.5 26.2 9.3 29.8 100.0 5,310 16,569 26,192 35,837 45,154 59,560 80,419 122,992 233,362 513,247 2,126,565 128,378 Percent of Total 0.1 0.4 1.0 1.4 2.0 6.7 8.3 34.0 24.9 6.5 15.0 100.0 Average Federal Tax Rate 5 1.7 0.1 2.1 3.7 5.7 9.5 13.2 17.4 22.2 28.1 35.0 21.3 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would: (a) enact a credit for second earners of up to $500; (b) expand the earned income tax credit (EITC) for childless workers; (c) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (d) expand the American Opportunity Tax Credit (AOTC); (e) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); and (f) enact an “auto-IRA” proposal. Although the education credit provisions provide a net tax increase for some tax units because of the repeal of the Lifetime Learning Credit, they are included in this table instead of the Tax Increase Provisions tables, T15-0007 and T15-0008. Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0009 President Obama's State of the Union Proposal: Major Tax Reduction Provisions Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2016 ¹ Detail Table - Head of Household Tax Units Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 15.7 18.5 17.6 25.3 27.9 31.9 29.9 22.2 10.8 8.6 6.9 24.0 0.0 0.0 0.1 0.5 0.4 1.3 0.5 * 0.0 0.0 0.0 0.4 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 1.3 0.7 0.3 0.3 0.3 0.4 0.4 0.2 0.1 0.0 0.0 0.3 2.5 12.3 9.8 10.3 9.5 26.5 17.8 10.6 0.5 0.1 0.0 100.0 Average Federal Tax Change Dollars -98 -121 -90 -108 -133 -224 -308 -243 -102 -85 -77 -158 Percent 12.5 7.7 7.2 -14.7 -4.5 -2.9 -2.2 -0.9 -0.1 0.0 0.0 -2.7 Share of Federal Taxes Change (% Points) -0.1 -0.5 -0.4 -0.2 -0.1 -0.1 0.1 0.6 0.3 0.1 0.3 0.0 Under the Proposal -0.6 -4.8 -4.0 1.6 5.6 24.2 22.0 31.5 10.4 3.2 10.8 100.0 Average Federal Tax Rate5 Change (% Points) -1.4 -0.8 -0.3 -0.3 -0.3 -0.4 -0.3 -0.2 0.0 0.0 0.0 -0.3 Under the Proposal -12.7 -10.4 -5.0 1.7 6.0 11.5 15.2 19.2 24.0 28.9 34.4 10.8 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2016 ¹ Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Pre-Tax Income Number (thousands) Percent of Total Average (dollars) 991 3,911 4,185 3,664 2,738 4,543 2,217 1,672 203 22 14 24,338 4.1 16.1 17.2 15.1 11.3 18.7 9.1 6.9 0.8 0.1 0.1 100.0 6,932 16,165 26,542 36,939 47,547 64,562 90,547 135,775 295,754 699,809 3,214,257 52,994 Federal Tax Burden Percent of Total 0.5 4.9 8.6 10.5 10.1 22.7 15.6 17.6 4.7 1.2 3.4 100.0 After-Tax Income 4 Average (dollars) Percent of Total Average (dollars) -785 -1,567 -1,243 731 2,981 7,621 14,072 26,369 71,059 202,428 1,107,169 5,864 -0.5 -4.3 -3.6 1.9 5.7 24.3 21.9 30.9 10.1 3.1 10.5 100.0 7,716 17,732 27,784 36,208 44,566 56,940 76,476 109,406 224,695 497,381 2,107,088 47,130 Percent of Total 0.7 6.1 10.1 11.6 10.6 22.6 14.8 16.0 4.0 1.0 2.5 100.0 Average Federal Tax Rate 5 -11.3 -9.7 -4.7 2.0 6.3 11.8 15.5 19.4 24.0 28.9 34.5 11.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would: (a) enact a credit for second earners of up to $500; (b) expand the earned income tax credit (EITC) for childless workers; (c) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (d) expand the American Opportunity Tax Credit (AOTC); (e) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); and (f) enact an “auto-IRA” proposal. Although the education credit provisions provide a net tax increase for some tax units because of the repeal of the Lifetime Learning Credit, they are included in this table instead of the Tax Increase Provisions tables, T15-0007 and T15-0008. Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0009 President Obama's State of the Union Proposal: Major Tax Reduction Provisions Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2016 ¹ Detail Table - Tax Units with Children Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 5.6 9.3 12.3 23.7 27.5 40.4 53.3 70.5 40.2 9.7 7.1 39.9 0.0 0.0 0.1 0.7 0.8 1.7 2.1 1.8 0.1 0.0 0.0 1.1 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 0.6 0.4 0.2 0.3 0.3 0.4 0.5 0.4 0.1 0.0 0.0 0.3 0.4 2.3 2.6 3.8 3.6 13.4 16.1 50.4 6.5 0.5 0.3 100.0 Average Federal Tax Change Dollars -46 -68 -69 -113 -130 -243 -385 -520 -182 -129 -125 -263 Percent 4.4 3.2 3.8 216.4 -6.1 -3.7 -3.1 -2.1 -0.3 -0.1 0.0 -1.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.3 0.2 0.1 0.3 0.0 Under the Proposal -0.1 -0.9 -0.8 -0.1 0.6 4.0 5.8 27.5 26.7 9.3 27.7 100.0 Average Federal Tax Rate5 Change (% Points) -0.7 -0.4 -0.3 -0.3 -0.3 -0.4 -0.4 -0.4 -0.1 0.0 0.0 -0.2 Under the Proposal -16.5 -13.7 -7.2 -0.5 4.2 9.7 13.2 16.6 21.7 27.8 35.0 18.7 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2016 ¹ Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Pre-Tax Income Number (thousands) Percent of Total Average (dollars) 1,314 4,482 5,071 4,588 3,767 7,470 5,676 13,148 4,834 554 294 51,650 2.5 8.7 9.8 8.9 7.3 14.5 11.0 25.5 9.4 1.1 0.6 100.0 6,606 16,300 26,480 36,926 47,623 65,340 92,064 148,626 299,909 711,773 3,175,190 122,065 Federal Tax Burden Percent of Total 0.1 1.2 2.1 2.7 2.9 7.7 8.3 31.0 23.0 6.3 14.8 100.0 After-Tax Income 4 Average (dollars) Percent of Total Average (dollars) -1,043 -2,157 -1,829 -52 2,130 6,550 12,489 25,232 65,360 197,781 1,111,551 23,105 -0.1 -0.8 -0.8 0.0 0.7 4.1 5.9 27.8 26.5 9.2 27.3 100.0 7,649 18,457 28,309 36,978 45,494 58,790 79,574 123,393 234,549 513,992 2,063,639 98,959 Percent of Total 0.2 1.6 2.8 3.3 3.4 8.6 8.8 31.7 22.2 5.6 11.9 100.0 Average Federal Tax Rate 5 -15.8 -13.2 -6.9 -0.1 4.5 10.0 13.6 17.0 21.8 27.8 35.0 18.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would: (a) enact a credit for second earners of up to $500; (b) expand the earned income tax credit (EITC) for childless workers; (c) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (d) expand the American Opportunity Tax Credit (AOTC); (e) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); and (f) enact an “auto-IRA” proposal. Although the education credit provisions provide a net tax increase for some tax units because of the repeal of the Lifetime Learning Credit, they are included in this table instead of the Tax Increase Provisions tables, T15-0007 and T15-0008. Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income. 28-Jan-15 VERY PRELIMINARY: SUBJECT TO REVISION http://www.taxpolicycenter.org Table T15-0009 President Obama's State of the Union Proposal: Major Tax Reduction Provisions Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2016 ¹ Detail Table - Elderly Tax Units Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 5.1 4.8 7.6 8.5 7.7 8.7 12.1 18.6 7.7 0.6 0.4 9.2 0.0 0.0 0.1 0.5 0.6 0.2 0.3 0.7 0.0 0.0 0.0 0.3 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 0.5 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.1 2.8 13.4 17.4 12.8 7.6 13.8 10.2 19.8 1.7 0.0 0.1 100.0 Average Federal Tax Change Dollars -32 -34 -56 -53 -37 -38 -45 -65 -18 -3 -6 -44 Percent -48.8 -33.2 -9.5 -3.4 -1.3 -0.6 -0.4 -0.3 0.0 0.0 0.0 -0.3 Share of Federal Taxes Change (% Points) 0.0 0.0 -0.1 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.1 0.0 Under the Proposal 0.0 0.1 0.5 1.1 1.7 6.5 8.0 21.4 20.0 8.5 32.0 100.0 Average Federal Tax Rate5 Change (% Points) -0.5 -0.2 -0.2 -0.1 -0.1 -0.1 -0.1 -0.1 0.0 0.0 0.0 -0.1 Under the Proposal 0.5 0.4 2.0 4.1 5.9 9.1 12.6 16.3 22.8 29.3 35.5 17.4 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2016 ¹ Expanded Cash Income Level (thousands of 2013 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Pre-Tax Income Number (thousands) Percent of Total Average (dollars) 1,457 6,526 5,200 4,042 3,424 6,060 3,810 5,100 1,597 222 149 37,787 3.9 17.3 13.8 10.7 9.1 16.0 10.1 13.5 4.2 0.6 0.4 100.0 6,339 16,345 26,113 37,177 47,594 64,902 91,972 141,706 302,486 716,118 3,337,465 83,961 Federal Tax Burden Percent of Total 0.3 3.4 4.3 4.7 5.1 12.4 11.1 22.8 15.2 5.0 15.7 100.0 After-Tax Income 4 Average (dollars) Percent of Total Average (dollars) 65 104 590 1,581 2,826 5,953 11,639 23,129 68,857 209,788 1,185,167 14,622 0.0 0.1 0.6 1.2 1.8 6.5 8.0 21.4 19.9 8.4 31.9 100.0 6,274 16,242 25,523 35,596 44,767 58,949 80,334 118,577 233,628 506,330 2,152,298 69,339 Percent of Total 0.4 4.1 5.1 5.5 5.9 13.6 11.7 23.1 14.2 4.3 12.2 100.0 Average Federal Tax Rate 5 1.0 0.6 2.3 4.3 5.9 9.2 12.7 16.3 22.8 29.3 35.5 17.4 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0613-5). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would: (a) enact a credit for second earners of up to $500; (b) expand the earned income tax credit (EITC) for childless workers; (c) expand the child and dependent care tax credit (table does not include effects of repeal of dependent care flexible spending accounts); (d) expand the American Opportunity Tax Credit (AOTC); (e) repeal the Lifetime Learning Tax Credit (table does not include the effect of provisions related to student loan forgiveness or Section 529 education savings plans); and (f) enact an “auto-IRA” proposal. Although the education credit provisions provide a net tax increase for some tax units because of the repeal of the Lifetime Learning Credit, they are included in this table instead of the Tax Increase Provisions tables, T15-0007 and T15-0008. Estimates in the table are based on descriptions of these proposals provided by the Administration in its fact sheet: http://www.whitehouse.gov/the-press-office/2015/01/17/fact-sheet-simpler-fairer-tax-code-responsibly-invests-middle-class-fami For a description of TPC's current law baseline, see: http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average expanded cash income.