12-Mar-07 PRELIMINARY RESULTS Less than 10 10-20

advertisement

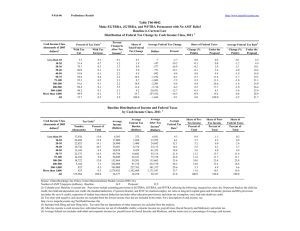

12-Mar-07 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T07-0103 One Percentage Point Individual Income Tax Surcharge 1 Distribution of Federal Tax Change by Cash Income Class, 2007 Cash Income Class (thousands of 2006 dollars)2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units3 With Tax Cut With Tax Increase 0.0 2.8 2.8 2.0 0.9 0.4 0.9 0.4 0.3 0.1 0.1 1.3 2.0 29.2 62.5 79.6 89.8 96.7 98.0 98.9 99.1 99.1 99.5 66.4 Percent Change in After-Tax Income4 0.0 -0.1 -0.3 -0.4 -0.6 -0.7 -0.7 -0.7 -1.0 -1.1 -1.2 -0.7 Share of Total Federal Tax Change 0.0 0.7 2.4 3.7 4.7 12.8 11.0 22.9 16.7 7.6 17.6 100.0 Average Federal Tax Change Dollars 0 14 65 135 212 333 465 761 2,061 5,575 24,560 371 Percent 0.0 2.1 2.7 2.7 2.8 2.9 2.6 2.4 2.6 2.9 2.5 2.6 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.1 0.0 0.0 0.0 0.0 Under the Proposal 0.2 0.8 2.3 3.5 4.3 11.6 11.0 24.9 16.3 6.7 18.3 100.0 Average Federal Tax Rate5 Change (% Under the Points) Proposal 0.0 0.1 0.3 0.4 0.5 0.5 0.5 0.6 0.7 0.8 0.8 0.6 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Class, 2007 Cash Income Class (thousands of 2006 dollars)2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units3 Number (thousands) 18,608 25,761 20,224 15,244 12,157 21,294 13,139 16,685 4,475 756 396 149,332 Percent of Total 12.5 17.3 13.5 10.2 8.1 14.3 8.8 11.2 3.0 0.5 0.3 100.0 Average Income (Dollars) 5,699 15,189 25,240 35,555 45,638 62,764 88,142 137,212 293,234 692,259 3,113,319 66,439 Average Federal Tax Burden (Dollars) 231 660 2,429 4,952 7,529 11,703 17,963 32,136 78,133 189,965 995,145 14,401 Average After-Tax Income4 (Dollars) 5,468 14,529 22,812 30,603 38,109 51,062 70,179 105,076 215,101 502,294 2,118,173 52,039 Average Federal Tax Rate5 Share of PreTax Income Percent of Total 4.1 4.4 9.6 13.9 16.5 18.7 20.4 23.4 26.7 27.4 32.0 21.7 1.1 3.9 5.1 5.5 5.6 13.5 11.7 23.1 13.2 5.3 12.4 100.0 Share of Share of PostFederal Taxes Tax Income Percent of Percent of Total Total 1.3 4.8 5.9 6.0 6.0 14.0 11.9 22.6 12.4 4.9 10.8 100.0 0.2 0.8 2.3 3.5 4.3 11.6 11.0 24.9 16.3 6.7 18.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 1006-1). Number of AMT Taxpayers (millions). Baseline: 23.4 Proposal: 21.6 (1) Calendar year. Baseline is current law. Proposal would increase individual income tax rates from 10, 15, 25, 28, 33, and 35 percent to 11, 16, 26, 29, 34, and 36 percent. Alternative minimum tax rates would increase from 26 and 28 percent to 27 and 29 percent. Rates on long-term capital gains and qualifying dividends would increase from 15 to 16 percent (from 5 percent to 6 percent for lower-income taxpayers). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 4.1 4.4 9.9 14.3 17.0 19.2 20.9 24.0 27.4 28.3 32.8 22.2