3-Feb-06 Preliminary Results Less than 10 10-20

advertisement

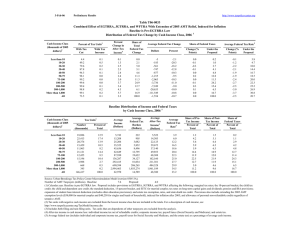

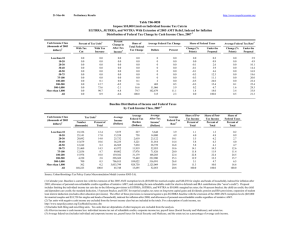

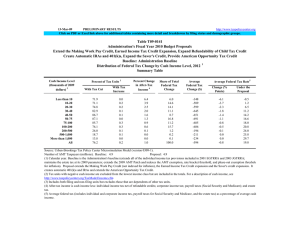

3-Feb-06 Preliminary Results http://www.taxpolicycenter.org Table T06-0035 Combined Effect of EGTRRA, JGTRRA, and WFTRA With Extension of 2005 AMT Relief, Indexed for Inflation Baseline is Pre-EGTRRA Law Distribution of Federal Tax Change by Cash Income Class, 2007 1 Cash Income Class (thousands of 2005 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All 3 Percent of Tax Units With Tax Cut With Tax Increase 4.4 50.3 79.6 87.6 94.2 98.1 99.2 99.5 99.5 98.8 99.1 74.3 0.1 0.5 0.3 0.1 0.1 0.0 0.0 0.0 0.1 0.2 0.2 0.2 Percent Change in After-Tax 4 Income 0.1 1.3 2.5 2.5 2.3 2.4 3.0 3.7 3.5 4.3 5.7 3.2 Share of Total Federal Tax Change 0.0 2.0 4.8 4.9 4.5 11.0 11.3 25.3 13.0 6.1 17.1 100.0 Average Federal Tax Change Dollars -5 -190 -558 -751 -877 -1,240 -2,118 -3,827 -7,447 -21,209 -114,172 -1,630 Percent -2.2 -20.3 -17.7 -12.6 -10.1 -9.4 -10.5 -10.9 -9.0 -10.1 -11.0 -10.6 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.2 -0.1 0.0 0.2 0.0 -0.1 0.3 0.0 -0.1 0.0 Under the Proposal 0.2 0.9 2.6 4.0 4.7 12.6 11.4 24.6 15.7 6.5 16.6 100.0 Average Federal Tax Rate 5 Change (% Points) -0.1 -1.2 -2.2 -2.1 -1.9 -1.9 -2.4 -2.8 -2.5 -3.0 -3.7 -2.5 Under the Proposal 3.9 4.8 10.1 14.4 16.8 18.6 20.0 22.4 25.3 26.8 30.4 20.8 Baseline Distribution of Income and Federal Taxes by Cash Income Class, 2007 1 Cash Income Class (thousands of 2005 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units3 Number (thousands) 18,336 25,141 20,692 15,679 12,242 21,460 12,836 15,976 4,220 700 362 148,223 Percent of Total 12.4 17.0 14.0 10.6 8.3 14.5 8.7 10.8 2.9 0.5 0.2 100.0 Average Income (Dollars) 5,875 15,558 25,732 36,235 46,569 63,972 89,802 139,382 298,369 706,013 3,053,799 65,748 Average Federal Tax Burden (Dollars) 231 934 3,145 5,950 8,685 13,144 20,093 35,006 82,915 210,230 1,042,900 15,313 Average After-Tax 4 Income (Dollars) 5,644 14,624 22,587 30,285 37,883 50,828 69,709 104,376 215,454 495,783 2,010,898 50,435 Average Federal Tax 5 Rate Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total 3.9 6.0 12.2 16.4 18.7 20.6 22.4 25.1 27.8 29.8 34.2 23.3 1.1 4.0 5.5 5.8 5.9 14.1 11.8 22.9 12.9 5.1 11.3 100.0 1.4 4.9 6.3 6.4 6.2 14.6 12.0 22.3 12.2 4.6 9.7 100.0 Share of Federal Taxes Percent of Total 0.2 1.0 2.9 4.1 4.7 12.4 11.4 24.6 15.4 6.5 16.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0305-3A). Number of AMT Taxpayers (millions). Baseline: 9.0 Proposal: 4.4 (1) Calendar year. Baseline is pre-EGTRRA law. Proposal includes provisions in EGTRRA, JGTRRA, and WFTRA affecting the following: marginal tax rates; the 10-percent bracket; the child tax credit; the child and dependent care credit; the standard deduction, 15-percent bracket, and EITC for married couples; tax rates on long-term capital gains and dividends; pension and IRA provisions; expansion of student loan interest deduction (excludes other education provisions); and estate tax exemption, rates, and state death tax credit. Provisions also include extending the 2005 AMT exemption levels ($58,000 for married couples and $40,250 for singles and heads of household), indexed for inflation after 2005; allowance of personal non-refundable credits regardless of tentative AMT; and extending the non-refundable credit for elective deferrals and IRA contributions (the "saver's credit"). (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units. Tax units that are dependents of other taxpayers are excluded from the analysis. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.