14-Dec-05 Preliminary Results Less than 10 10-20

advertisement

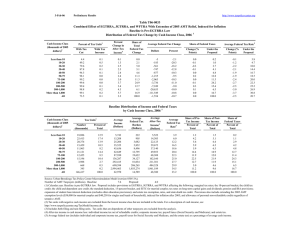

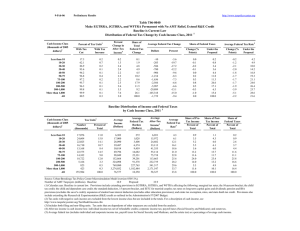

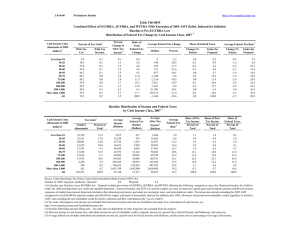

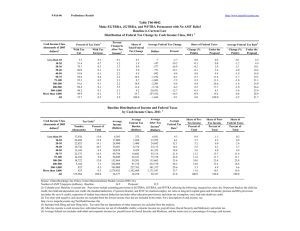

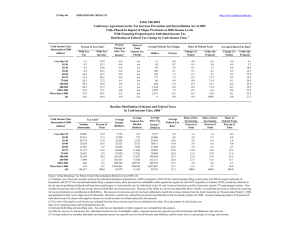

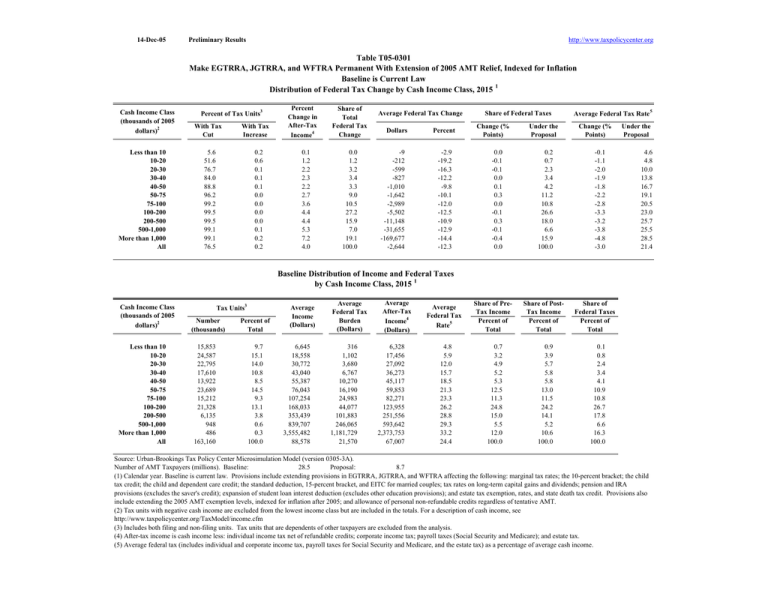

14-Dec-05 Preliminary Results http://www.taxpolicycenter.org Table T05-0301 Make EGTRRA, JGTRRA, and WFTRA Permanent With Extension of 2005 AMT Relief, Indexed for Inflation Baseline is Current Law Distribution of Federal Tax Change by Cash Income Class, 2015 1 Cash Income Class (thousands of 2005 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All 3 Percent of Tax Units With Tax Cut With Tax Increase 5.6 51.6 76.7 84.0 88.8 96.2 99.2 99.5 99.5 99.1 99.1 76.5 0.2 0.6 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.1 0.2 0.2 Percent Change in After-Tax 4 Income 0.1 1.2 2.2 2.3 2.2 2.7 3.6 4.4 4.4 5.3 7.2 4.0 Share of Total Federal Tax Change 0.0 1.2 3.2 3.4 3.3 9.0 10.5 27.2 15.9 7.0 19.1 100.0 Average Federal Tax Change Dollars -9 -212 -599 -827 -1,010 -1,642 -2,989 -5,502 -11,148 -31,655 -169,677 -2,644 Percent -2.9 -19.2 -16.3 -12.2 -9.8 -10.1 -12.0 -12.5 -10.9 -12.9 -14.4 -12.3 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 0.0 0.1 0.3 0.0 -0.1 0.3 -0.1 -0.4 0.0 Under the Proposal 0.2 0.7 2.3 3.4 4.2 11.2 10.8 26.6 18.0 6.6 15.9 100.0 Average Federal Tax Rate 5 Change (% Points) -0.1 -1.1 -2.0 -1.9 -1.8 -2.2 -2.8 -3.3 -3.2 -3.8 -4.8 -3.0 Under the Proposal 4.6 4.8 10.0 13.8 16.7 19.1 20.5 23.0 25.7 25.5 28.5 21.4 Baseline Distribution of Income and Federal Taxes by Cash Income Class, 2015 1 Cash Income Class (thousands of 2005 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units3 Number (thousands) 15,853 24,587 22,795 17,610 13,922 23,689 15,212 21,328 6,135 948 486 163,160 Percent of Total 9.7 15.1 14.0 10.8 8.5 14.5 9.3 13.1 3.8 0.6 0.3 100.0 Average Income (Dollars) 6,645 18,558 30,772 43,040 55,387 76,043 107,254 168,033 353,439 839,707 3,555,482 88,578 Average Federal Tax Burden (Dollars) 316 1,102 3,680 6,767 10,270 16,190 24,983 44,077 101,883 246,065 1,181,729 21,570 Average After-Tax 4 Income (Dollars) 6,328 17,456 27,092 36,273 45,117 59,853 82,271 123,955 251,556 593,642 2,373,753 67,007 Average Federal Tax 5 Rate Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total 4.8 5.9 12.0 15.7 18.5 21.3 23.3 26.2 28.8 29.3 33.2 24.4 0.7 3.2 4.9 5.2 5.3 12.5 11.3 24.8 15.0 5.5 12.0 100.0 0.9 3.9 5.7 5.8 5.8 13.0 11.5 24.2 14.1 5.2 10.6 100.0 Share of Federal Taxes Percent of Total 0.1 0.8 2.4 3.4 4.1 10.9 10.8 26.7 17.8 6.6 16.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0305-3A). Number of AMT Taxpayers (millions). Baseline: 28.5 Proposal: 8.7 (1) Calendar year. Baseline is current law. Provisions include extending provisions in EGTRRA, JGTRRA, and WFTRA affecting the following: marginal tax rates; the 10-percent bracket; the child tax credit; the child and dependent care credit; the standard deduction, 15-percent bracket, and EITC for married couples; tax rates on long-term capital gains and dividends; pension and IRA provisions (excludes the saver's credit); expansion of student loan interest deduction (excludes other education provisions); and estate tax exemption, rates, and state death tax credit. Provisions also include extending the 2005 AMT exemption levels, indexed for inflation after 2005; and allowance of personal non-refundable credits regardless of tentative AMT. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units. Tax units that are dependents of other taxpayers are excluded from the analysis. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.