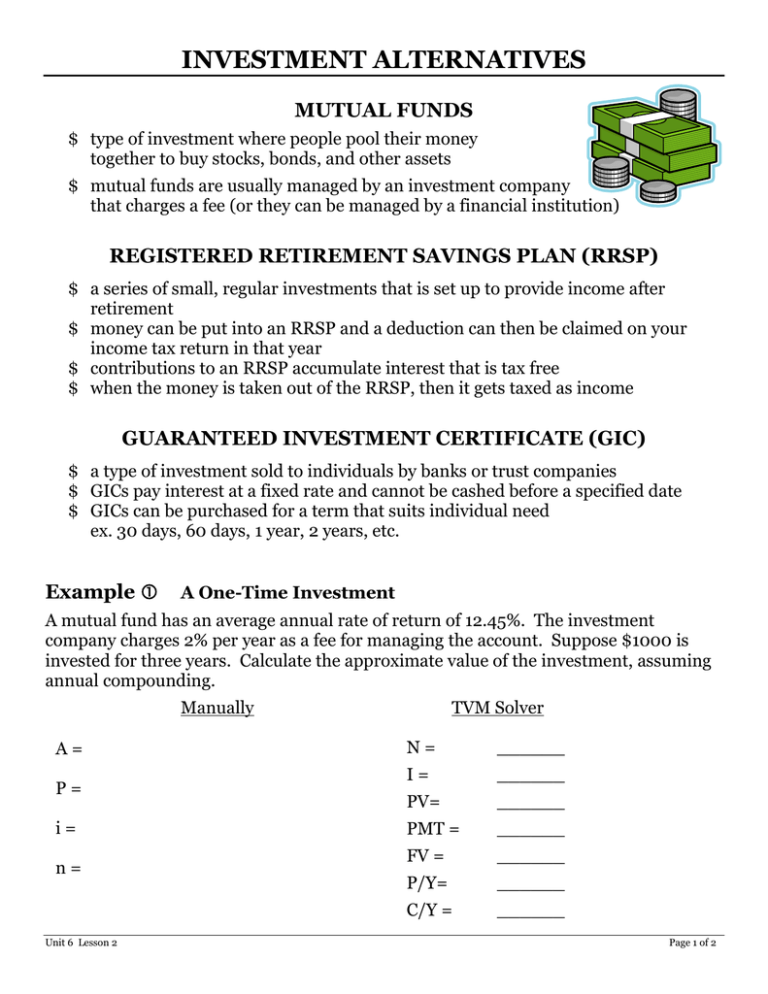

INVESTMENT ALTERNATIVES MUTUAL FUNDS

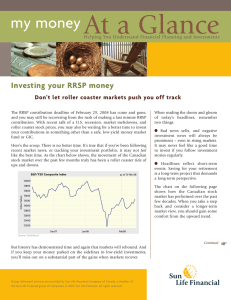

advertisement

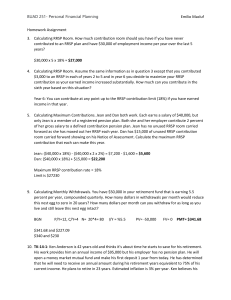

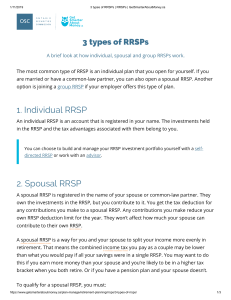

INVESTMENT ALTERNATIVES MUTUAL FUNDS $ type of investment where people pool their money together to buy stocks, bonds, and other assets $ mutual funds are usually managed by an investment company that charges a fee (or they can be managed by a financial institution) REGISTERED RETIREMENT SAVINGS PLAN (RRSP) $ a series of small, regular investments that is set up to provide income after retirement $ money can be put into an RRSP and a deduction can then be claimed on your income tax return in that year $ contributions to an RRSP accumulate interest that is tax free $ when the money is taken out of the RRSP, then it gets taxed as income GUARANTEED INVESTMENT CERTIFICATE (GIC) $ a type of investment sold to individuals by banks or trust companies $ GICs pay interest at a fixed rate and cannot be cashed before a specified date $ GICs can be purchased for a term that suits individual need ex. 30 days, 60 days, 1 year, 2 years, etc. Example A One-Time Investment A mutual fund has an average annual rate of return of 12.45%. The investment company charges 2% per year as a fee for managing the account. Suppose $1000 is invested for three years. Calculate the approximate value of the investment, assuming annual compounding. Manually A= P= i= n= Unit 6 Lesson 2 TVM Solver N= ______ I= ______ PV= ______ PMT = ______ FV = ______ P/Y= ______ C/Y = ______ Page 1 of 2 Example An Investment that Decreases in Value Investing often carries an element of risk. Some investments increase in value while others decrease in value. A mutual fund has an average annual rate of return of –5.29%. If the investment company’s fees for managing the account are 2% per year, calculate the approximate value of a $1000 investment after two years, assuming annual compounding. Manually A= P= i= n= Example TVM Solver N= ______ I= ______ PV= ______ PMT = ______ FV = ______ P/Y= ______ C/Y = ______ Regular Investment (Annuity) Barney started an RRSP by investing $200 per month from age 16 until his retirement at age 65. If the investment averaged a 7% annual rate of return, compounded monthly, determine the amount of money Barney received upon retirement. TVM Solver These must be in the same unit of time!! N= number of payments _______ I = interest (percent) _______ PV= starting value of investment _______ PMT= value of each payment _______ FV= future value of investment _______ P/Y = number of payments per year _______ C/Y= number of compounding periods _______ CONCLUSIONS: All investments carry some level of risk. Generally, the greater the risk, the greater the potential return (or loss). Some investments increase in value while others lose value. One way to accumulate wealth is to invest regularly over a long period Of time. This takes advantage of the power of compound interest! Unit 6 Lesson 2 Page 2 of 2