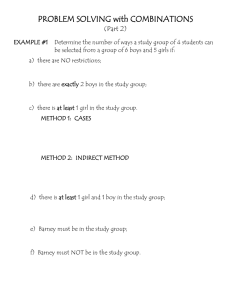

EFFECTS OF CHANGING THE CONDITIONS ON INVESTMENTS AND LOANS INVESTIGATION

advertisement

EFFECTS OF CHANGING THE CONDITIONS ON INVESTMENTS AND LOANS INVESTIGATION Barney deposited $500 into an investment fund that earned 11.3% per year, compounded annually. He intends to leave the money in the fund for at least four years. 1. a) Determine the value of Barney’s investment in four years. N= __________ I= __________ PV = __________ PMT = __________ FV = __________ P/Y = __________ C/Y = __________ b) Predict the value of Barney’s investment in four years if the rate of return is doubled. c) Verify your prediction using technology. Describe the results. d) Unit 5 Lesson 6 N= __________ I= __________ PV = __________ PMT = __________ FV = __________ P/Y = __________ C/Y = __________ Describe how doubling the interest rate affects the value of an investment. Does the amount of the total interest paid double? Explain. Page 1 of 2 2. a) Predict the value of the investment if Barney doubles the amount of time he keeps his money in the fund. b) Verify your prediction using technology. Describe the results. c) 3. N= __________ I= __________ PV = __________ PMT = __________ FV = __________ P/Y = __________ C/Y = __________ Describe how doubling the amount of time money is invested affects the value of an investment. Does the amount of the total interest paid double? Explain. Matthew has $2000 available to invest at 12% per year, compounded annually. He will need the money in six to eight years to finance his children’s education. a) Using a graphing calculator, graph A = 2000(1.12)n. b) Use the CALC feature to determine the value of A for: i) n=6 A= c) ii) n=7 A= iii) n=8 A= Describe the shape of the graph in part a). What happens when you change the total length of time the money is invested? CONCLUSIONS When changing any condition of an investment/loan, the amount will also change. Doubling an interest rate or term more than doubles the total interest. This is due to the effects of compounding. The more frequent the compounding period, the greater the effects of any changes. Unit 5 Lesson 6 Page 2 of 2