At a Glance my money Investing your RRSP money

advertisement

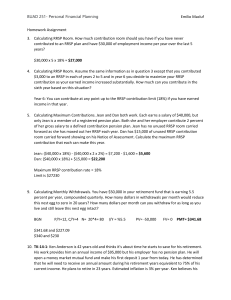

my money At a Glance Helping You Understand Financial Planning and Investments Investing your RRSP money Don’t let roller coaster markets push you off track The RRSP contribution deadline of February 29, 2008 has come and gone, and you may still be recovering from the rush of making a last minute RRSP contribution. With recent talk of a U.S. recession, market meltdowns, and roller coaster stock prices, you may also be waiting for a better time to invest your contributions in something other than a safe, low-yield money market fund or GIC. Here’s the scoop. There is no better time. It’s true that if you’ve been following recent market news, or tracking your investment portfolio, it may not feel like the best time. As the chart below shows, the movement of the Canadian stock market over the past few months truly has been a roller coaster ride of ups and downs. When reading the doom and gloom of today’s headlines, remember two things: G Bad news sells, and negative investment news will always be prominent – even in rising markets. It may never feel like a good time to invest if you follow investment stories regularly. G Headlines reflect short-term events. Saving for your retirement is a long-term project that demands a long-term perspective. The chart on the following page shows how the Canadian stock market has performed over the past few decades. When you take a step back and consider a longer-term market view, you should gain some comfort from the upward trend. Source: GlobeFund Continued But history has demonstrated time and again that markets will rebound. And if you keep your money parked on the sidelines in low-yield investments, you’ll miss out on a substantial part of the gains when markets recover. Group retirement services are provided by Sun Life Assurance Company of Canada, a member of the Sun Life Financial group of companies. © 2007, Sun Life Financial. All rights reserved. (cont’d) Boost RRSP contributions if you can If you still have unused RRSP contribution room, there are two ways that you can take further advantage of the recent market decline: Source: GlobeFund That’s why it’s important to continue investing your RRSP money according to your long-term plan. While holding cash and cash equivalents can be useful for saving for short-term goals, their relatively low returns combined with the effects of inflation make this a poor long-term strategy. If you have an investment horizon of more than five years, you should ensure that your RRSP contribution is working towards meeting your longterm financial goals. And for most people, that means maintaining a diversified portfolio that contains at least some longer-term growth investments. With so many world stock markets slumping, this is a great time to follow one of the oldest pieces of investment advice – buy low and sell high. If you invested your recent RRSP contributions in short-term investments, take advantage of the opportunity that lower prices present today, to invest in funds with a longer-term growth potential. Understand the investment mix that’s right for you While a diversified portfolio of stock, bond, and cash investments is ideal for spreading the investment risk over many types of investments, the allocation that you give to each type of investment will depend on your personal situation and will include the length of time you have to invest and your tolerance for the ups and downs of the investment market. You may have already determined the investment strategy that’s right for you, but if you haven’t done so, or it has been a few years since you last looked at your investment strategy, Sun Life Financial’s Investment risk profiler is a great place to start with a portfolio reassessment. To access the Investment risk profiler, just sign in to www.sunlife.ca/member and on the Home page, under my financial future, select my info Café for your applicable account. Then: G Under the Resource Centre drop-down menu, select my money tools. G Under the Asset allocation tool, select Continue to proceed to I Top-up your RRSP. If you have the ability to make a lump sum contribution, this is an excellent time to boost the amount you can invest at today’s lower prices. Contributing a lump sum amount also gives you a head-start on your 2008 RRSP contributions and ensures you place a priority on your retirement savings before you spend the money on something else. And don’t forget, every dollar you contribute will be deductible on next year’s tax return, so a contribution today may provide you with extra cash at your disposal in 2009. I Increase amount of ongoing RRSP contributions. If you make regular contributions to a group RRSP by payroll deduction, consider increasing your contribution amount, subject to your personal RRSP contribution limits. You’ll have more money invested and working for you earlier in the year, and you may be surprised at how little you miss the additional money that you are now investing. i If you have a general question or suggestion about this newsletter, please send an e-mail to can_pencontrol@sunlife.com or write to my money At a Glance Newsletter, Group Retirement Services Marketing, Sun Life Financial, 225 King Street West, Toronto, ON M5V 3C5. This bulletin has been created exclusively for you. It addresses issues to help you with your financial planning and investments, and cannot be reproduced in whole or in part without the express permission of Sun Life Financial. the Investment risk profiler. 03/08-st-eo