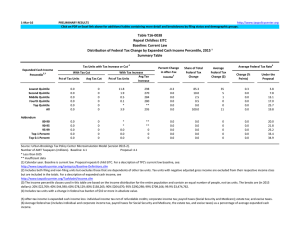

Table T08-0009 Tax Benefits of Select Tax Expenditures for Economic Mobility

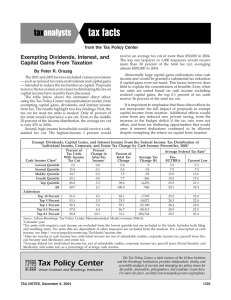

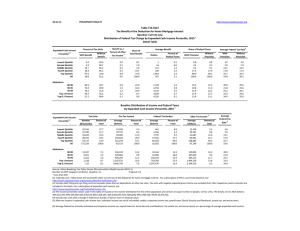

advertisement

15-Jan-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0009 Tax Benefits of Select Tax Expenditures for Economic Mobility Distribution of Federal Tax Change by Cash Income Percentile, 2006 1 Summary Table Cash Income Level (thousands of 2006 dollars) 2 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent of Tax Units 3 With Benefit Without Benefit Benefit as Percent of After-Tax Income4 Share of Total Benefits Average Benefit Average Federal Tax Rate 5 With Benefits Without Benefits 34.9 61.3 71.8 83.1 95.8 69.3 65.1 38.7 28.2 16.9 4.2 30.7 5.6 5.3 3.0 2.9 5.6 4.8 3.4 8.0 7.7 12.3 68.6 100.0 417 961 925 1,471 8,223 2,398 3.4 7.2 14.3 18.6 25.3 21.3 8.8 12.1 16.9 20.9 29.5 25.0 93.8 97.3 98.3 98.7 99.2 6.2 2.7 1.7 1.3 0.8 3.9 5.1 5.7 7.5 9.8 12.7 11.6 17.4 27.0 16.1 3,039 5,539 10,428 64,651 386,028 20.8 22.7 24.9 30.7 33.3 23.8 26.6 29.2 35.9 39.8 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 1006-2). Number of AMT Taxpayers (millions). Baseline: 3.6 Proposal: 2.9 (1) Calendar year. Baseline is current law. Alternative repeals the Hope and Lifetime Learning credits, the student loan interest deduction, the home mortgage interest deduction, the state and local property tax deduction, the self-employed health insurance deduction, the earned income tax credit, the child and dependent care credit, the preferential rates on capital gains and dividends, the partial exclusion for Social Security benefits, and the exclusions and deductions for IRAs, Keogh plans, and defined contribution retirement savings plans. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile breaks used in this table are (in 2006 dollars): 20% $13,640, 40% $26,417, 60% $46,362, 80% $82,316, 90% $121,201, 95% $170,900, 99% $418,664, 99.5% $655,488, and 99.9% 1,907,342. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 15-Jan-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T08-0009 Tax Benefits of Select Tax Expenditures for Economic Mobility Distribution of Federal Tax Change by Cash Income Percentile, 2006 Detail Table Cash Income Class (thousands of 2006 dollars)2 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Percent of Tax Units 3 With Benefit Without Benefit Benefit as Percent of After-Tax Income 4 Share of Total Benefits Average Benefit 1 Share of Federal Taxes Dollars As Percent of Tax With Benefits Without Benefits Average Federal Tax Rate5 With Benefits Without Benefits 34.9 61.3 71.8 83.1 95.8 69.3 65.1 38.7 28.2 16.9 4.2 30.7 5.6 5.3 3.0 2.9 5.6 4.8 3.4 8.0 7.7 12.3 68.6 100.0 417 961 925 1,471 8,223 2,398 157.3 67.6 18.2 12.7 16.6 17.6 0.4 2.1 7.5 17.0 72.8 100.0 0.8 3.0 7.5 16.3 72.2 100.0 3.4 7.2 14.3 18.6 25.3 21.3 8.8 12.1 16.9 20.9 29.5 25.0 93.8 97.3 98.3 98.7 99.2 6.2 2.7 1.7 1.3 0.8 3.9 5.1 5.7 7.5 9.8 12.7 11.6 17.4 27.0 16.1 3,039 5,539 10,428 64,651 386,028 14.8 17.2 17.4 16.8 19.7 15.1 11.8 17.7 28.2 14.4 14.8 11.8 17.6 28.0 14.7 20.8 22.7 24.9 30.7 33.3 23.8 26.6 29.2 35.9 39.8 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Baseline Distribution of Income and Federal Taxes by Cash Income Percentile, 2006 1 Cash Income Percentile 2,3 Lowest Quintile Second Quintile Middle Quintile Fourth Quintile Top Quintile All Tax Units4 Number (thousands) Percent of Total Average Income (Dollars) Average Federal Tax Burden (Dollars) Average After5 Tax Income (Dollars) Average Federal Tax Rate6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 28,860 29,449 29,448 29,448 29,447 147,237 19.6 20.0 20.0 20.0 20.0 100.0 7,727 19,690 35,657 62,346 195,755 63,974 265 1,421 5,092 11,569 49,539 13,603 7,462 18,269 30,565 50,777 146,215 50,371 3.4 7.2 14.3 18.6 25.3 21.3 2.4 6.2 11.2 19.5 61.2 100.0 2.9 7.3 12.1 20.2 58.1 100.0 0.4 2.1 7.5 17.0 72.8 100.0 14,724 7,362 5,889 1,472 147 10.0 5.0 4.0 1.0 0.1 99,138 141,716 241,655 1,248,587 5,889,414 20,585 32,133 60,113 383,838 1,959,921 78,553 109,582 181,542 864,749 3,929,493 20.8 22.7 24.9 30.7 33.3 15.5 11.1 15.1 19.5 9.2 15.6 10.9 14.4 17.2 7.8 15.1 11.8 17.7 28.2 14.4 Addendum 80-90 90-95 95-99 Top 1 Percent Top 0.1 Percent Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 1006-2). Number of AMT Taxpayers (millions). Baseline: 3.6 Proposal: 2.9 (1) Calendar year. Baseline is current law. Alternative repeals the Hope and Lifetime Learning credits, the student loan interest deduction, the home mortgage interest deduction, the state and local property tax deduction, the self-employed health insurance deduction, the earned income tax credit, the child and dependent care credit, the preferential rates on capital gains and dividends, the partial exclusion for Social Security benefits, and the exclusions and deductions for IRAs, Keogh plans, and defined contribution retirement savings plans. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) The cash income percentile breaks used in this table are (in 2006 dollars): 20% $13,640, 40% $26,417, 60% $46,362, 80% $82,316, 90% $121,201, 95% $170,900, 99% $418,664, 99.5% $655,488, and 99.9% 1,907,342. (4) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (5) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (6) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.